IRVING, Texas — This story was originally published by our content partners at the Dallas Business Journal. You can read the original version here.

Arctos Partners LP has found the end zone with its latest investment.

Dallas-based Arctos and nine individuals will gain non-controlling, minority interests in the Buffalo Bills after receiving approval Dec. 11 from NFL owners at a league meeting in Las Colinas. Once the transactions closes, it will mark the completion of Arctos' first NFL investment and one of the first-ever private equity investments in an NFL franchise. League owners also approved a private equity deal for the Miami Dolphins.

The deals involving the Bills are expected to close within the next few weeks, according to Sports Business Journal, a sister publication of Dallas Business Journal. Bills majority owner Terry Pegula agreed to sell 20.6% of the franchise, with Arctos getting a 10% stake, SBJ reported. This represents the first time in Bills history that the franchise has added minority owners.

Arctos is one of only a handful of firms allowed to take minority stakes in NFL franchises under rules approved in August by the league's owners. The new ownership rules allow private equity investors to own as much as 10% of a team. In addition to Arctos, other groups that received provisional approval included Ares Management, Sixth Street and a consortium led by former NFL star Curtis Martin comprised of Blackstone, Carlyle, CVC Capital Partners, Dynasty Equity and Ludis.

New investors in the Bills alongside Arctos include former NBA stars and Hall of Famers Vince Carter and Tracy McGrady, as well as Jozy Altidore, a former member of the U.S. men's national soccer team. Carter and McGrady both played across the border in Canada for the Toronto Raptors, while Altidore played part of his MLS career at Toronto FC.

Other limited partners included:

- Rob Palumbo, co-managing partner of Accel-KKR, a technology-focused private equity firm

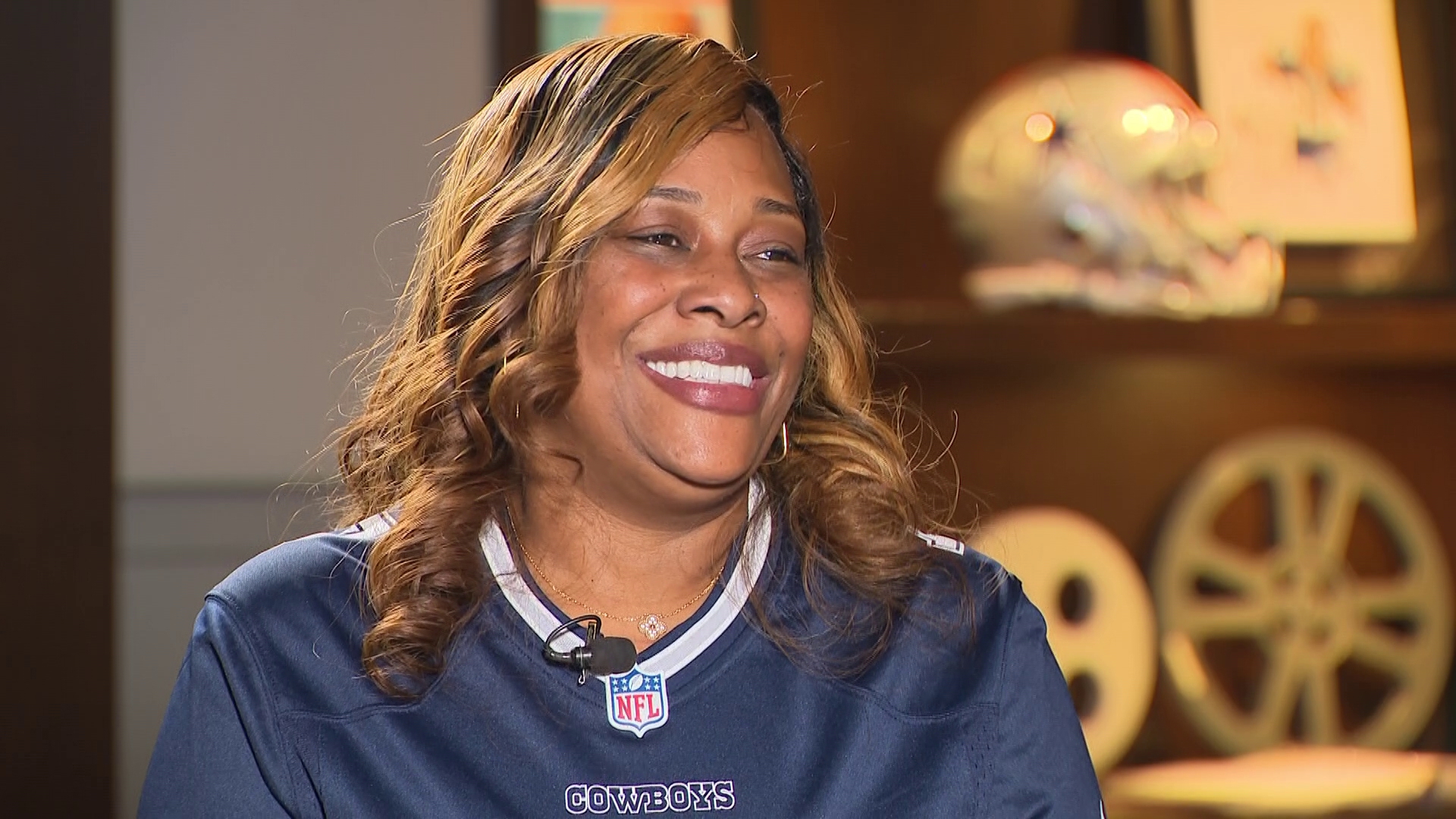

- Sue McCollum, CEO and owner of beverage distribution companies Eagle Brand Sales and Double Eagle Distributing

- Theresia Gouw, co-founder and managing partner of the venture capital firm Acrew Capital

- Rob Ward, co-founder, general partner of venture capital firm Meritech Capital

- Mike Joo, chief operating officer of global corporate and investment banking and head of North America corporate and investment banking at Bank of America

- Tom Burger, co-founder and managing partner of investment firm Gridiron Capital

Among the NFL's 32 teams, the Bills rank No. 30 with a $4.2 billion valuation, according to the most recent Forbes rankings. The Dallas Cowboys top the list with a valuation of more than $10 billion. The average valuation across the NFL is $5.7 billion, up 11% from the prior year as the NFL continues to rake in revenue from media rights deals with CBS, ESPN/ABC, Fox, NBC, YouTube and Amazon.

Terms of the deal with Arctos were not disclosed, but the Forbes valuation would make a 10% stake worth $420 million.

The Bills have been one of the most successful teams in the NFL in recent years. The team recently clinched its fifth consecutive AFC East division title and its seventh playoff berth since 2017. In the early 1990s the Bills made four consecutive appearances in the Super Bowl but lost all of them, including back-to-back losses to the Cowboys.

David "Doc" O'Connor, a managing partner at Arctos, said the Bills have an "established global brand with one of the most passionate fan bases across the entire league."

"Through our investment, Arctos will leverage its strategic expertise, data science-backed insights and other resources to support the team's commercial growth off the field," O'Connor said in a statement.

Founded in 2019 by Ian Charles of Dallas and O’Connor and Jordan Solomon of New York, Arctos specializes in sports team investments. The firm has previously taken minority stakes in teams such as the Golden State Warriors and the Sacramento Kings of the NBA. In April, the firm announced the close of a $4.1 billion fund.

Arctos says it's the only firm approved to invest in equity across each of the five major North American sports leagues and currently has investments in professional sports across in the NBA, NHL, MLB, MLS, NASCAR, the English Premier League, Italian Serie A and Formula One.

In a statement, Pegula described Arctos as a "reputable private equity partner" with an "extensive track record of success with professional sports franchises."

All of the investors have achieved "high levels of success," Pegula said. They also have a "personal attachment" to the Bills and Western New York or Ontario, Canada, which Pegula said was a "very important factor" in his decision on who to sell to.