DALLAS — There have been a lot of headlines lately about legal settlements that are changing the way homes are bought and sold. Probably the most talked about settlement was the $418 million one entered into by the National Association of Realtors earlier this year. That agreement, and the changes it brought about, just went into effect nationwide this month.

The big change

The major change is this: It used to be that on the database real estate agents use to list properties for sale, called the multiple listing service (MLS), an agent representing a home seller could alert agents representing buyers that the seller is willing to pay a commission of a certain percentage and that the commission could be split between the agents representing the buyer and the seller. Now, because of the settlement, no talk about the commission is allowed anymore in the MLS.

So, buyers beware: You have to negotiate and be responsible now for paying your agent. Whether it’s a percentage, flat fee or an hourly rate, if the agent uses the MLS, your payment agreement with them must be specific and agreed upon before you are escorted through a tour of any properties.

Justin Landon, the CEO of MetroTex Association of Realtors explains, “That consumer will have to sign a written agreement outlining the services that that agent is providing that day, that week, that month, that year for a group of properties or just single property, and what they'll be paid for that service”.

So, buyers, you may want to shop around more than you did before to determine who is going to be showing you houses because Landon says the agent fees you’re responsible for now can vary widely. “We expect is that the fee identified in those early written showing agreements or written touring agreements will range from zero (dollars) to whatever," Landon said.

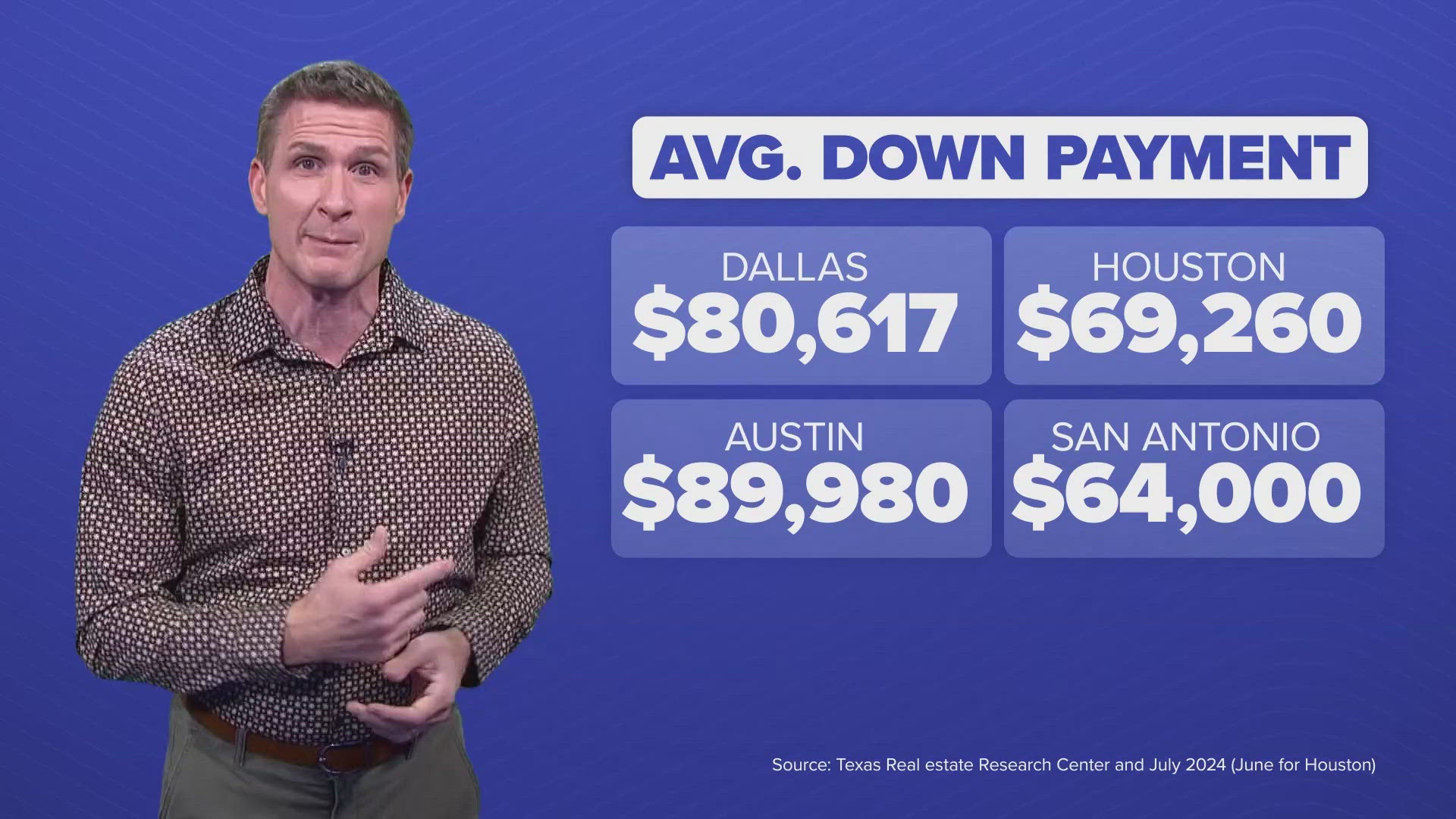

Potential buyers might be feeling overwhelmed by this, since declining -- but still high --mortgage rates are costing them extra, and because in major Texas markets, these would be the 20% down payment thresholds for a median home according to June and July data from the Texas Real Estate Research Center: DFW: $80,617, Houston: $69,260, Austin: $89,980 and San Antonio: $64,000.

And on top of all that, now you’re supposed to come up with possibly many thousands more to pay an agent who often used to be paid by the seller? Before buyers get too worked up, they should remember what has not changed: That everything in real estate is negotiable.

Negotiations go on...

Buyers can still ask sellers if they will contribute to the commission for the buyer’s agent and sellers can still offer to pay the buyer’s agent. It is important to reiterate that such an offer can no longer be listed on the MLS.

But a seller’s agent can relay that offer of compensation in lots of other ways, says MetroTex Association of Realtors President Ashley Gentry, “This is where the professionals communicate with one another. And so, there's a lot more active dialogue preemptively, which I think is great. You can put it on a sign, you can do marketing flyers, you can have a QR code on your sign, you can put it on social media.”

Might we see some buyers decide to represent themselves in complex negotiations opposite a seller who is represented by a professional expert? Gentry says, “I think we're going to see it. It has not happened exponentially.” Landon adds, “We believe many of those people after trying it once, will immediately seek out a professional to help them next time.”

More likely, Gentry thinks we will see buyers shopping for a menu of services from their agents, and that their compensation may be adjusted depending on how narrow or broad that representation is on behalf of the buyer.

Some buyers might contemplate instructing their agent to only look for properties where the seller advertises that they will help compensate the buyer’s agent. Landon cautions: “I think some consumers are saying this, right? ‘Only show me properties where I know I'm not going to have to pay my agent out of my pocket.' Buyers have been shopping for homes and there have been all kinds of things they didn't know about that home before they saw it. I would challenge buyers and buyers’ agents to say go find your client the best house for them and then let's find out if it's the right house and meets all of their needs financially.”

In other words, Landon is arguing that there may be unknown benefits that are revealed even in cases where the seller isn’t offering upfront to pay your agent. Ultimately, Landon believes, “It is still highly probable that the buyer will be able to identify a property that meets their needs that will be willing to help them offset the cost of their representation.”

Sellers have another decision to make

Sellers, you may wonder why you would offer to help compensate a buyer’s agent anymore. One reason could be that not offering such compensation could cause you to rethink the price at which you are listing your home.

Since that buyer’s agent compensation has been paid by so many sellers over the years, it is thought that some of that contribution is baked into the price of the home.

Now, Gentry says some sellers will be confronted with what he might best describe as the deli meat principle of home prices. “If you’ve got five houses all on the same street and they're all relatively the same condition, but some are willing to offer compensation, well now you’ve got to look at that ‘price per pound’ a little differently and now say ‘hey, I might have to market myself a little bit more like bologna (and have a relatively lower asking price) while my neighbors are roast beef (with higher asking prices)'," Gentry said.

As you think about the big changes, don't forget to think about insurance!

This new landscape for home buying and selling is not the only big gyration for the real estate market. While Fall is not usually a busy buying season, many potential buyers have waited several years for the fall of home prices and/or mortgage rates.

It’s widely expected that The Federal Reserve will finally start cutting interest rates in September, which could cause mortgage rates to come down more. And that could create a buying frenzy in a usually slower season. Nerdwallet says 15% of Americans plan to home shop when rates drop. Not to drop a chilly autumn rain on that parade of potential buyers, but they may want to shop with insurance in mind more than usual.

As I told you recently, homeowner premiums went up in Texas more than in any other state in the last five years. Gentry says, “We're actually seeing sellers having to sell their homes because of insurance premiums or deductibles."

She says some homes have risen in value so much that their owners can’t afford a 2% deductible if they need to file a claim, so they’re selling. Also, insurance companies in Texas have been doing some unusual things. As I recently reported, my insurer wanted pics of everything. They saw the date on my water heater and demanded that it be replaced with a new one in order to renew the policy.

Buyers, look closely at the details around a home for sale as you shop because you will have to insure what you buy. Gentry points out a few things to watch for: “Are there a lot of mature trees around the property? Do you still have cast iron plumbing? Do you have an old electrical panel because your house was built in 1962? All of those things are affecting their insurance premiums."

Might new changes mean fewer real estate agents?

With all that is going on, there has been talk that some agents will simply leave the business rather than ride out the major changes, especially because they come as many real estate markets have seen slowing home sales because of higher prices and higher mortgage rates.

Landon says, “Every real estate practitioner...all 27,000 of our members, all 50,000 in North Texas, all 150,000 in Texas and all 1.5 million across the country…every single one of them is having to look at their internal business practices and they have to change a little bit. Any time there's a big change in the industry--when the MLS books went away when listings went online--every time we change our purchase contract or change the MLS software platform, that leads to some agents making a decision to hang it up and say, you know what, now is now's my time to get out.”

Do you have a claim for some of the real estate settlement money?

Finally, if you have sold a home in recent years, you could be eligible to make a claim for a payout from the hundreds of millions of dollars that have been set aside in the real estate settlements.

You can click here for more information on the major settlements. Be aware that there are deadlines. You can check for more specifics on the FAQ page, which also includes a phone number to call for further assistance.