DALLAS — For years, home and auto insurers have made the pitch to customers that it may be beneficial for them to ‘bundle’ their different coverages, most commonly for home and auto insurance. And in some cases, it might be cost-effective to bundle your home and auto policies with the same insurer, since they commonly offer a bundling discount.

Conversely, in some cases, bundling might not be the best option. A customer may find a better auto insurance rate with one carrier and a better home insurance rate with another.

But consumers who choose that second option of doing business with two different insurers may face a more complicated (and potentially more expensive) dynamic now. That traditional suggestion that they bundle may become more of an ultimatum.

“Home Insurance Notice of Non-Renewal”

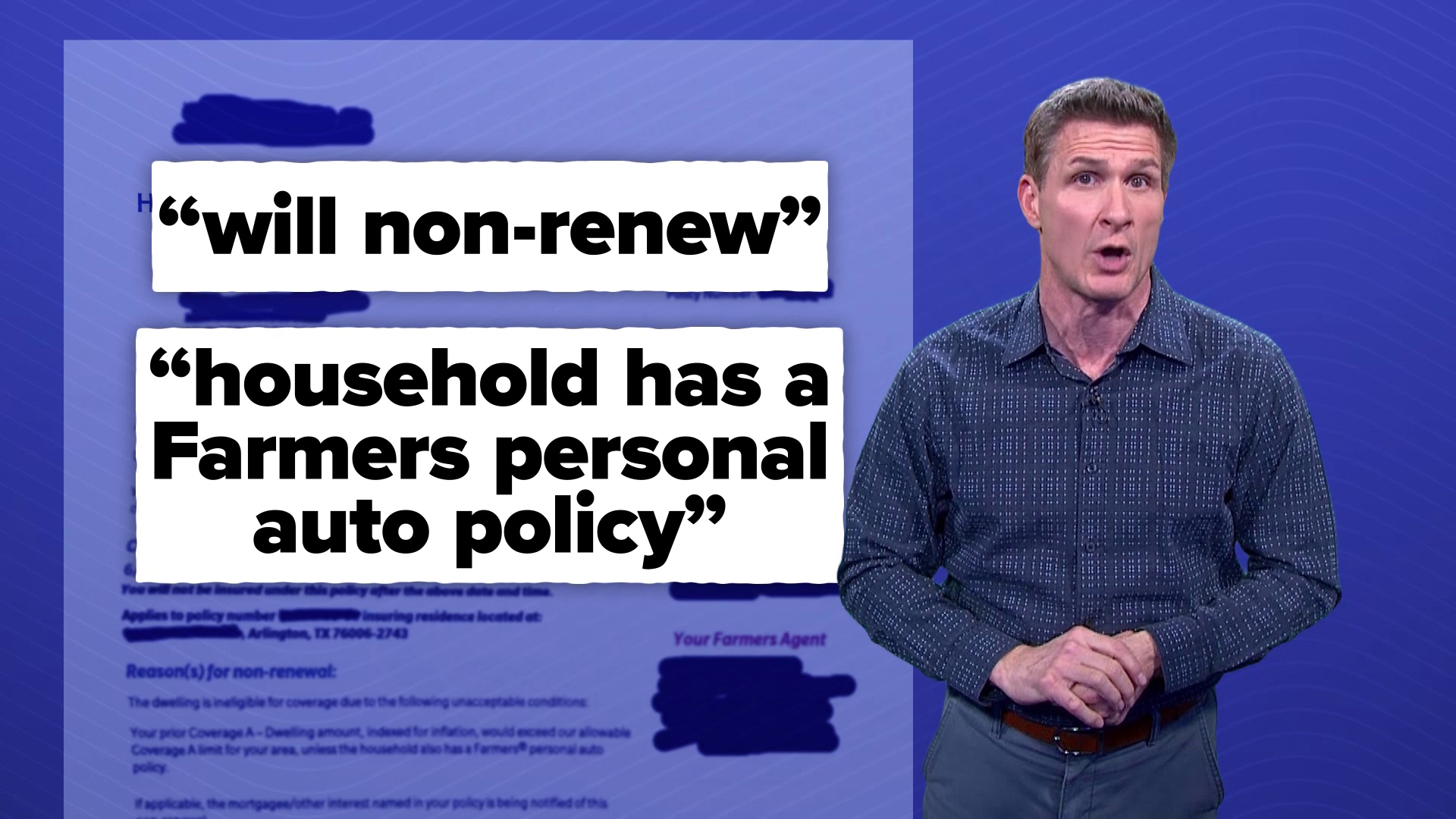

In April, one of my colleagues received a “Home Insurance Notice of Non-Renewal”. Their home insurer, Farmers Insurance, alerted them their policy was in jeopardy of not being renewed when it expires in June.

The letter the homeowner received explained: “The dwelling is ineligible for coverage due to the following unacceptable conditions: Your prior Coverage A - Dwelling amount, indexed for inflation, would exceed our allowable Coverage A limit for your area, unless the household also has a Farmers personal auto policy.” The customer’s homeowners insurance policy will end unless they choose Farmers to insure their auto as well.

The customer tells me they periodically shop around for insurance, which can help customers find valuable savings. They say they have been with Farmers for home insurance for four of the past five years. In that time, they say they had a single claim on their homeowners policy, which was due to a weather event, so the lack of claims was a mark in their favor, but it wasn’t enough to warrant a renewal of their farmers policy.

Important reminder: Insurers in Texas are prohibited from canceling or charging more for a homeowners policy because of weather-related claims.

An explanation from the insurer’s perspective

I reached out to Farmers about the bundle ultimatum, and they explained, “We continuously monitor the changing market environment and make adjustments, as necessary. In order to effectively address the frequency of catastrophe events, increased reconstruction costs and persistent inflationary pressures, we initiated targeted underwriting actions to better manage our risk exposure in the state.”

They continued, “As a result, we will be unable to continue offering homeowners insurance coverage to a portion of Farmers customers that no longer meet our underwriting guidelines. Importantly, affected customers are being given at least 60 days advanced notice, providing them the opportunity to discuss alternate coverage options with their agent.”

This could be especially significant, since Farmers is the fourth largest home insurer in Texas. Other insurers may also be sending notices like this, but I had not previously seen this.

What regulators had to say

I asked the Texas Department of Insurance about this. TDI says it is, “Looking into this issue and researching applicable provisions of law”. The office, which regulates insurance in Texas, asked me to share the notice of non-renewal with them, which I did. So far, nothing further to report there.

My own home insurer just asked me to take a bunch of specific pictures inside and outside my house to determine if they would renew my policy. I have owned several homes and have never been asked to do that.

Homeowners insurance rates are rising in Texas

Sometimes insurance customers can get frustrated with these interactions with insurers. And customers can get even more incensed when they see headlines like this one. And this one. And this one. But the fact is that companies covering home perils in Texas have also been contending with some perilous math in recent years.

S&P Global Market Intelligence does a great job keeping up with insurance rate changes. They report that Texas homeowners insurance rates surged a staggering 23.3% in 2023, the most of any state. And they note that, since 2018, Texas home insurance rates have risen 59.9%, also the highest in the U.S.

Home insurers in Texas experiencing ups and downs. Mostly downs

Before you cuss the insurers, consider these profit and loss reports by insurers to the Texas Department of Insurance: In 2020, insurers’ collective net underwriting profit for homeowners policies in this state was $1,490,440,220.

In 2021, Winter Storm Uri and the substantial damage caused by sweeping, enduring power blackouts led to insurance losses that were more than twice what their profit was for the prior year. For 2021, home insurers reported a collective loss in Texas of $3,809,805,701.

In 2022, they were back in the money again, with a collective net underwriting profit of $1,135,547,997 for Texas homeowner policies. But in 2023, they fell back in the red, losing $699,668,960 on home policies. And those numbers include some of the insurance rate increases.

If trends keep up, we can probably expect more increases. Again…shop around! I recently did and there were wildly different quotes for the same house and same amount of coverage.

Filing an insurance complaint

The Texas Department of Insurance says, “If you have concerns about whether an insurance company is treating you fairly or legally, you can file a complaint with TDI”.