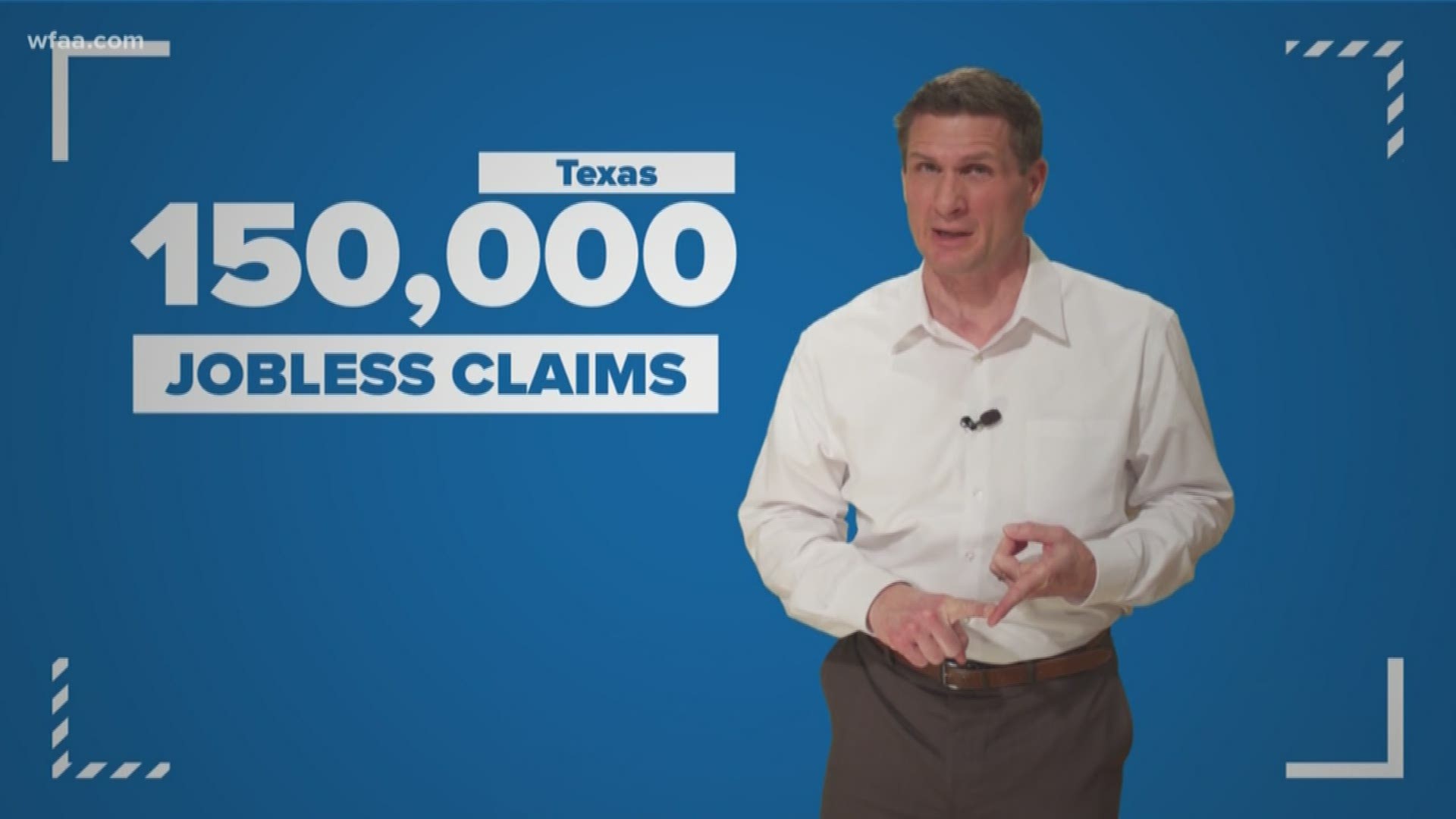

Well, we knew it was going to be a big number. Jobless claims last week hit nearly 3.3 million--that’s four times the previous record. In Texas, we know at least 150,000 people lost their jobs last week.

To apply for unemployment benefits in Texas, know these things:

- Your last employer’s business name, address and phone number

- First and last dates (month, day and year) you worked for your last employer. If you worked for your last employer on more than one occasion, provide the most recent employment dates.

- Number of hours worked and pay rate if you worked the week you apply for benefits (Sunday through Saturday)

- Information about the normal wage for the job you are seeking

- Alien Registration number (if not a U.S. citizen)

Then you can call 800-939-6631 or you can file online here.

The Texas Workforce Commission is adding call capacity and computer servers to meet an overwhelming demand. Still, if you call in to file — and you actually get through — you may want to put them on speaker while you’re doing something else. You will likely be waiting a while.

If you’ve tried to file online, you may have noticed the system crashing. A suggestion: Since the website is up 24 hours a day, you may want to get on early in the morning or late at night, perhaps even at an hour like 3 a.m. With fewer people online, you’re more likely to be able to avoid a website crash.

Mortgage rates are falling

On to mortgages. Mortgage rates are heading back down to near historic lows…and could still go down further from here. Rates actually jumped last week. That’s because some lenders reportedly temporarily raised rates to keep up with the number of people trying to refinance.

One firm that tracks rates says almost 13 million homeowners could save money with refinance rates where they are now. But a Bankrate survey last month showed 27% of homeowners don’t know their current mortgage rate.

You can’t go to the gym, or the movies, or a restaurant right now...and you may be working from home. Make it your homework to know your rate. From there, you may want to start considering a refinance.

More on WFAA:

- Right on the Money: Coronavirus and the airline industry

- Right on the Money: Why a door knock is more effective than a phone call for political campaigns

- Right on the Money: Jobs, taxes and food

- Right on the Money: Millennial home owners, temp jobs and Monday Night Football viewer numbers

- Right on the Money: Health insurance, retirement savings and cow health