DALLAS — Arnoldo Ortiz made his money stealing – at least 25 homes or other properties in Dallas County alone.

“I'm not going to lie, the money was good,” Ortiz told WFAA from the Dallas County jail.

Ortiz, 23, told WFAA it was easy to fabricate warranty deeds to illegitimately transfer the title of a property to himself or his companies.

"It shouldn't be like that, but that's how easy it was,” said Ortiz, who pleaded guilty to more than 25 counts of theft and received a 10-year prison sentence in early 2018.

In fact, it was so easy that Ortiz is now accused of doing the same scam from his prison cell. He now faces eight felonies accusing him of real estate fraud – new crimes he denies.

“They're saying I'm using money from my funds to commit crimes, but I ain't did that,” Ortiz told WFAA.

In fact, Ortiz claimed he’s now the victim of fraudulent deeds and claims his friend duped him into sending documents to the county clerk.

Ortiz is among a growing number of individuals convicted or under investigation for fraudulently deeding over properties, including family homes, to themselves or various companies they own, investigators told WFAA.

A WFAA investigation has found "dirty" property deeds filed with the Dallas County Clerk that have signatures of dead people, while other records have signatures of people who do not appear to even exist.

The scam has become so troublesome that a "Deed Fraud Task Force" of federal and local law enforcement is being formed to "hit back fast and hard," Dallas County Assistant District Attorney Phillip Clark told WFAA.

“A person’s home is their castle and their American dream," Clark said. "It’s shocking that someone would try to steal that away with nothing but a fake signature. But as quick and easy as it is for someone to commit this kind of crime, it costs victims months or even years of stress and expensive litigation to fix it – both for homeowners and unsuspecting buyers."

Clark told WFAA the scheme using fraudulent "dirty" deeds "affects properties of all values and residents from all walks of life" and costs "taxpayers enormous amounts of money and resources."

"Federal and local law enforcement agencies across the county will work together to investigate these cases more thoroughly and more quickly, stopping the damage earlier, cutting off these schemes, and hauling these criminals out into the daylight," Clark added.

"We will also identify solutions to make it harder to cheat the system, to protect future would-be victims,” Clark said.

So how is a property stolen?

WFAA has found that when property records are filed with the county clerk, no one checks to see if it's legitimate.

Dallas County Clerk John Warren told WFAA that with limited staff, it is impossible to check the veracity of each filed and notarized deed document.

“There’s no way for us... to determine if it’s a clean deed or a dirty deed,” Warren said.

If his clerks assumed that responsibility, Warren said, he would have to employ a lot more clerks. Otherwise, the clerk’s office would come to a near standstill.

For now, the system relies mainly on notaries verifying identifies. But as WFAA found, there are gaping holes in that process.

To perpetrate a fraud, all a scam artist needs to do is find a willing notary, be a notary themselves, or create a fake notary, WFAA found.

In May, a WFAA investigation uncovered more than a half-dozen properties that had been deeded over to companies owned by real estate investor William Baldridge under questionable circumstances.

In several cases, WFAA found signatures of dead people or people who do not appear to exist on deed records. Those documents then allowed Baldridge’s companies to gain ownership of homes in Dallas and Houston.

Baldridge later sold the homes, often for cash, buyers told WFAA.

In some cases, Baldridge notarized the documents himself.

Seizing laptops, paperwork and phones, police searched Baldridge's home earlier this year as part of an investigation into alleged real estate fraud involving a Mesquite home and “multiple other properties in Dallas County,” the search warrant said.

Baldridge has repeatedly declined to speak to WFAA.

'This guy's blind. He can't sign his name.'

In his prior convictions, Ortiz has confessed to some of the most brazen real estate fraud seen in North Texas.

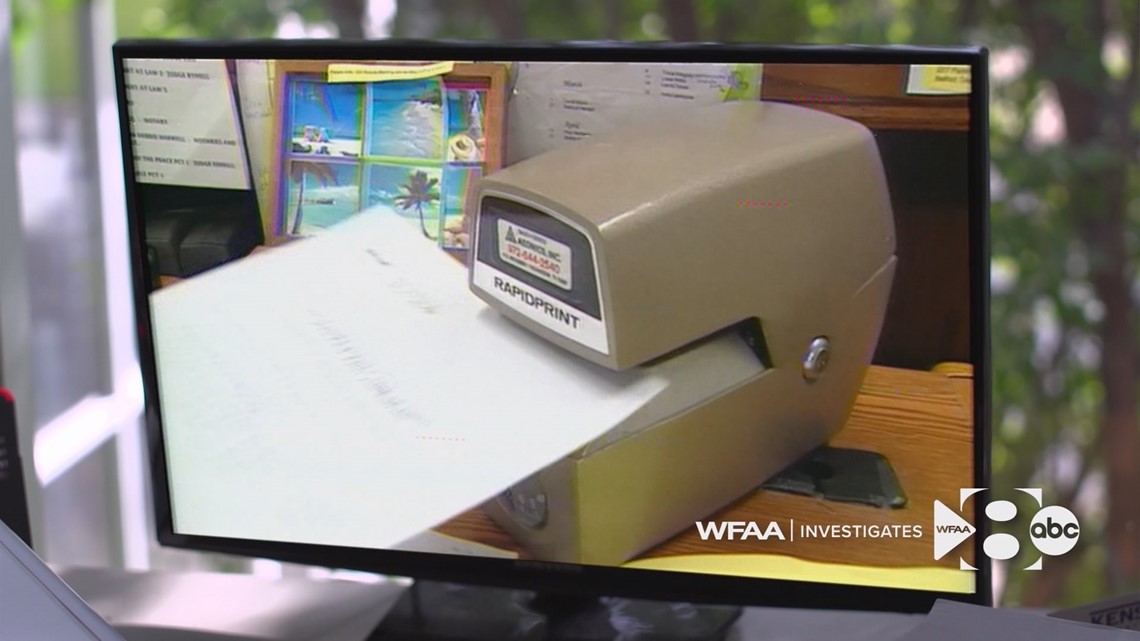

An investigation into his crimes began in 2015. Investigators found that Ortiz typically would get a legitimate document notarized, and then cut and paste the genuine notary stamp to a forged document in a scheme to gain ownership of the property.

Sometimes he would sell the homes to unsuspecting buyers. Other times, he would rent the homes.

Ortiz obtained loans to pay back taxes using the homes he’d fraudulently gotten control over as collateral, according to a 2016 search warrant affidavit.

Using forged deeds, Ortiz gained control of a $2 million retail strip and another worth $6 million, the records say. The rightful owners had to sue in both cases to get the property back.

Also using forged deeds, Ortiz transferred to his companies the following:

- A former Sam’s Club building.

- A building that once housed a Burger King.

When investigators interrogated him back in 2016, they confronted him about forging a signature. Ortiz denied it.

“Come on Arnoldo,” the investigator can be heard on a video telling Ortiz. “The owner, this guy's blind. He can't sign his name.”

Also, when they confronted him about signatures of dead people appearing on deeds, Ortiz can be seen making a face and not answering.

For Ortiz, even bank officials weren’t off-limits.

In one case, a forged signature of a vice president at CitiMortgage was used to transfer a house to one of Ortiz’s companies. That property was then sold to an investment company for $62,500.

The investment company sold the house to Lijuan Song for $100,000.

“We were doing real estate investment at that time so we were looking for a deal,” Song told WFAA.

But the real estate “deal” triggered a year-long legal battle over who rightfully owned the property.

“I rely on title company. That's why we pay them to run the title for us,” Song said.

While the legal battle was underway, she said she didn’t want to make any improvements to the house because she didn’t know what was going to happen.

She told WFAA she had “zero idea” that such scams were possible.

Song’s attorney, Mark Torabi, told WFAA that his client relied on the title companies, which in turn relied on the fraudulent deed records.

“Everybody was fooled,” Torabi said. “All you have to do is fake a signature on one of these [warranty deeds] and it gets recorded and once it gets recorded, as a matter of public record, you're the new owner.”

The title company ultimately paid to settle the case, and Song still owns the home.

Having title insurance was her saving grace.

Because she had purchased it, the title insurance company was on the hook for her $33,000 in insurance fees, as well as helping fund the settlement to pay off CitiMortgage’s lien, her attorney said. That title policy cost her about $700.

“Without title insurance, it would be difficult if not impossible for most people to afford to pay for this kind of litigation for an uncertain outcome, especially considering these kinds of cases will often drag on for a couple of years or more,” Torabi said.

Still, Song was shocked to learn that Ortiz had been charged with stealing properties from prison.

“I'm speechless,” Song told WFAA. “How could he do it again?”

'Dummy' corporations

WFAA has learned these real estate scams are not new, though possibly growing.

Back in 2010, WFAA reported on the case of Norris Fisher, of Fort Worth. He took control of more than 100 properties in Tarrant County.

“He was just churning them out," said retired federal agent Presley Darnell, who investigated Fisher, focusing on a five-year period.

Darnell said Fisher created fake notary stamps that were used to file false property records.

“It would appear from first glance, for all intents and purposes, that it was a true and accurate notary stamp that verified these signatures,” Darnell said.

Fisher also paid homeless people to sign the name of dead people, Darnell said. He then transferred the property to a series of “dummy” corporations.

“He probably had about 20 [dummy corporations],” Darnell said. “And so then, he would do a series of flips from one corporation to another to obfuscate the trail.”

Norris denied forging names and filing fraudulent deed records in interviews with WFAA. But he was later convicted and now serving a 20-year sentence in federal prison.

“He created a huge mess,” Darnell said. “Quite a few people lost. The true owners lost. The new owners lost. Not only is it straight out theft from the real owner, it’s causing both sides to spend thousands and thousands of dollars on civil litigation.”

As a result of Fisher’s fraud, both Tarrant and Dallas counties have enacted fraud alerts on the clerk’s website. The system will alert property owners any time there’s a specific document recorded regarding their property.

Fisher’s been in prison for nearly a decade and could not be reached for comment.

But since his conviction, few other safeguards have been enacted.

Various experts told WFAA that requiring those filing a deed to show photo identification may help. A further step would be to require a thumbprint when filing property records.

“Otherwise, anybody can make a name up and forge documents,” Darnell told WFAA.

More WFAA Investigates:

- 'Ghost surgery': Is the doctor you chose the one holding the scalpel? Maybe not

- 'This monster could have been stopped': DNA linked him to a rape, but he remained free. Then two women were killed.

- 'You will get nothing. You have to walk away': Governmental immunity blocks Texans from protection

- Texas judges may have overstepped by clearing violent criminal records

- Clearing The Air: We'll show you where kids are buying e-cigs, and how regulators missed their chance to stop an 'epidemic'