ARLINGTON, Texas — Whether it's from burst pipes, downed trees or hail, weather-related damages can lead to major expenses and insurance headaches.

Here are five things you need to know to ease those weather worries, according to the Texas Department of Insurance.

1. If your insurance company denies your claim.

You can file a complaint with the Texas Department of Insurance. They can launch an investigation to see what you’re entitled to and what the company should be paying.

2. If your insurance isn’t paying enough.

Consider hiring an independent public adjuster to negotiate more money for you. If your case is solid, it might actually pay for itself

“It’ll either be a flat fee or it’ll be a percentage of the additional money that the public adjuster gets for you,” said Markus Wilcox of the Texas Department of Insurance.

3. If you can’t afford your deductible.

Dial 211 from any phone or check your city and county websites to find financial assistance in your area. Most local governments have funds or resources to assist residents in exactly this situation.

4. If you aren’t covered at all.

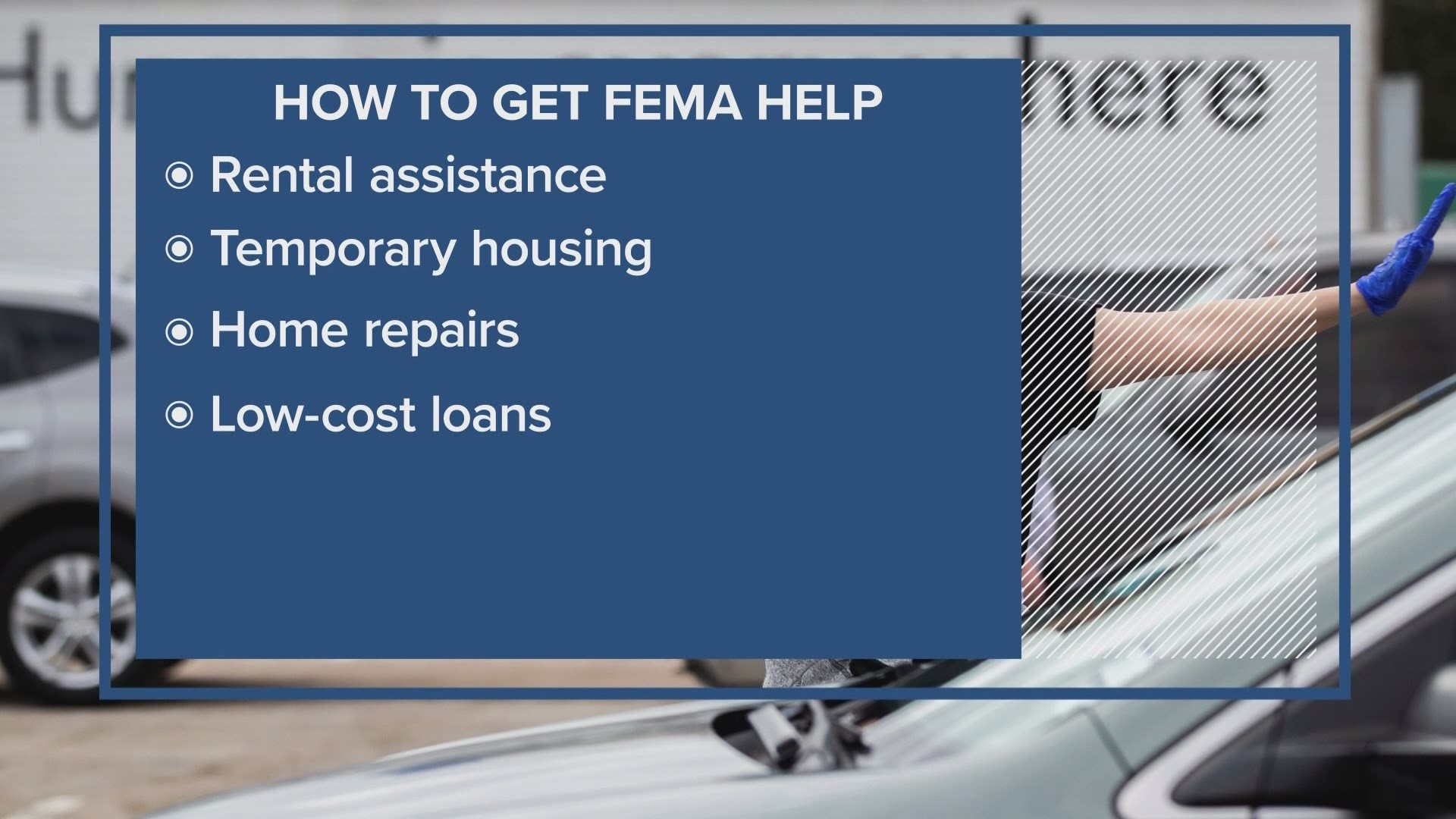

FEMA offers financial assistance to uninsured and under-insured residents to help pay for things like temporary lodging, home repairs and low-interest loans to cover uninsured property losses.

5. Prepare for the next storm now.

If you avoided damages from the winter storm or the first round of spring weather, the TDI says you shouldn’t push your luck. Review your policy now. Make sure you can cover the cost of a deductible and have adequate coverage.

“Hopefully you don’t need your insurance but if you do, you want to make sure that you have the coverages that you need to have,” Wilcox said.

Click here to learn more about the Texas Department of Insurance.