Cleveland — ATMs are so old school.

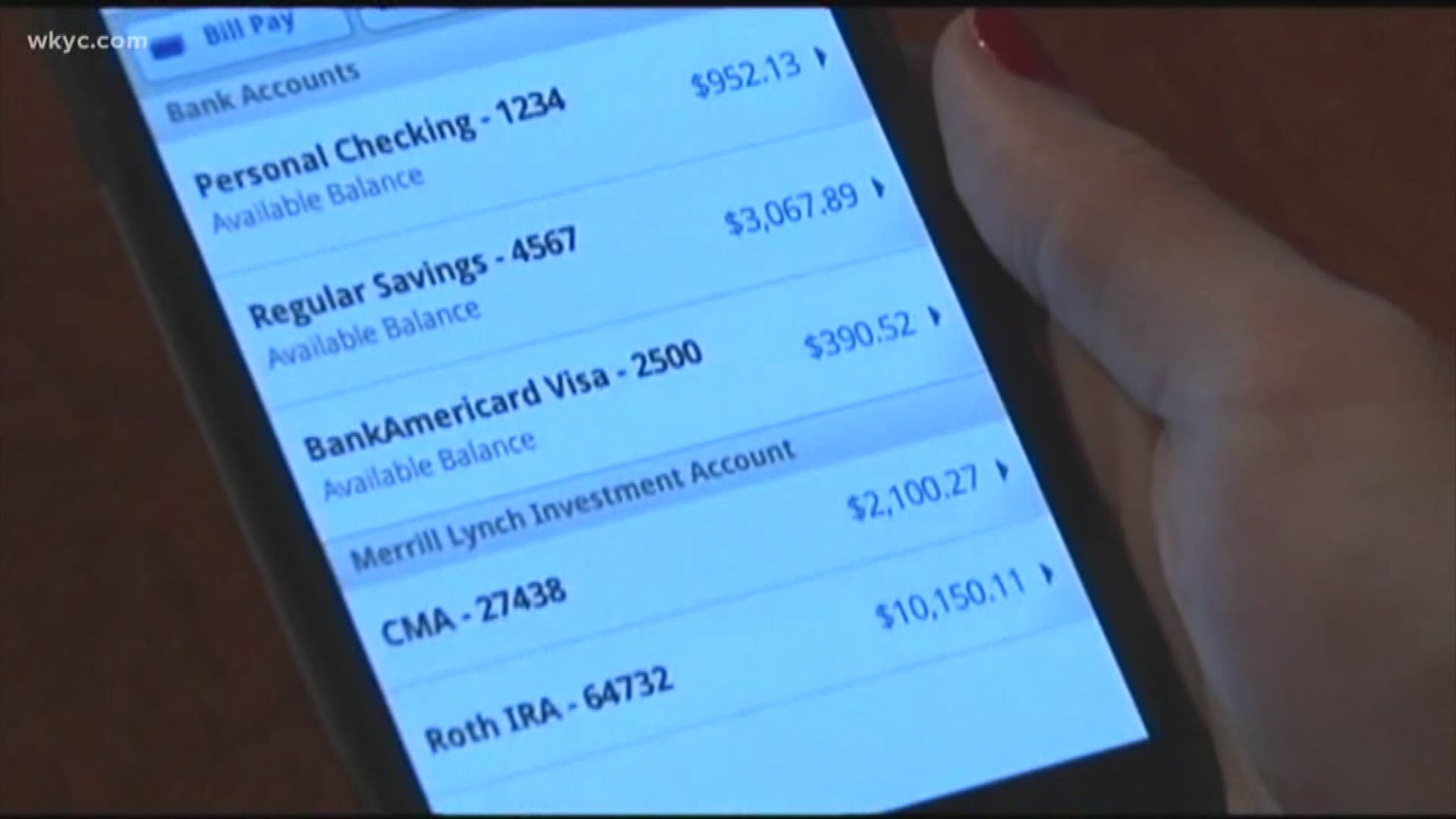

'Peer-to-Peer' mobile payment apps are where it's at when it comes to everything from buying goods, paying for services, and sending money to friends.

If you've never used one, there's a good chance you will. Transactions grew by 55% from 2016-2017. And they’re expected to continue to grow by double digits.

Problem is, they can be a cash cow for scammers.

"If you're opening your bank account up and allowing funds to be withdrawn, they may be able to take more than you think they are able to take,” says Ericka Dilworth of the Better Business Bureau.

In fact, we recently saw a Facebook post from a woman who claims a hacker took out $2,645 from her Cash App account. That’s a payment app used by 7 million customers.

She says neither Cash App nor her bank would refund the money.

And she's not the only one who said she was scammed.

You see, since users can only reach Cash App by email, thieves posted fake customer service numbers on Google.

When customers called one of the numbers, a thief would convince them to give over their account info, and there would go their money.

We called a customer service number we found on Google, and the person who answered hung up on us when we said we didn’t know how to get into our account.

Cash App issued a statement which reads:

"We are always working to protect our customers, which includes educating them about phishing scams. We remind customers that currently (1) the Cash App team generally communicates via email; (2) the email will come from a cash.app, square.com, or squareup.com address; and (3) the Cash App team will never solicit a customer’s PIN or sign in code outside of the app. For more information, we encourage customers to visit our website."

But no matter what payment app you may use, the Better Business Bureau says only link your account to a credit card. Credit cards will almost always reimburse for fraud. That is not always the case with a debit or bank card.

Also, since digital payments sometimes don't go through immediately, before you ship anything, log into your digital wallet account and check that you were actually paid.

And don't deal with strangers. According to Dilworth, "It’s called a peer to-peer app. That means it’s someone you know, somebody you're comfortable with. But if you’re transferring funds to a stranger you may not have the protections you think you have.”

Earlier this year, consumers complained to the BBB about emails from Cash App's parent company Square Up. The email told customers there were pending actions against their bank accounts. Turns out it was just a Phishing Scam.

If you have a problem with Cash App. you can contact them by clicking here or via direct message @CashSupport on Twitter.