DALLAS — The pandemic left many Americans in need of as much financial assistance they could find, and the federal government tried to get it to them with a variety of different stimulus programs.

But multiple emails from WFAA viewers asked to verify claims made by several posts they saw online about a mortgage relief program.

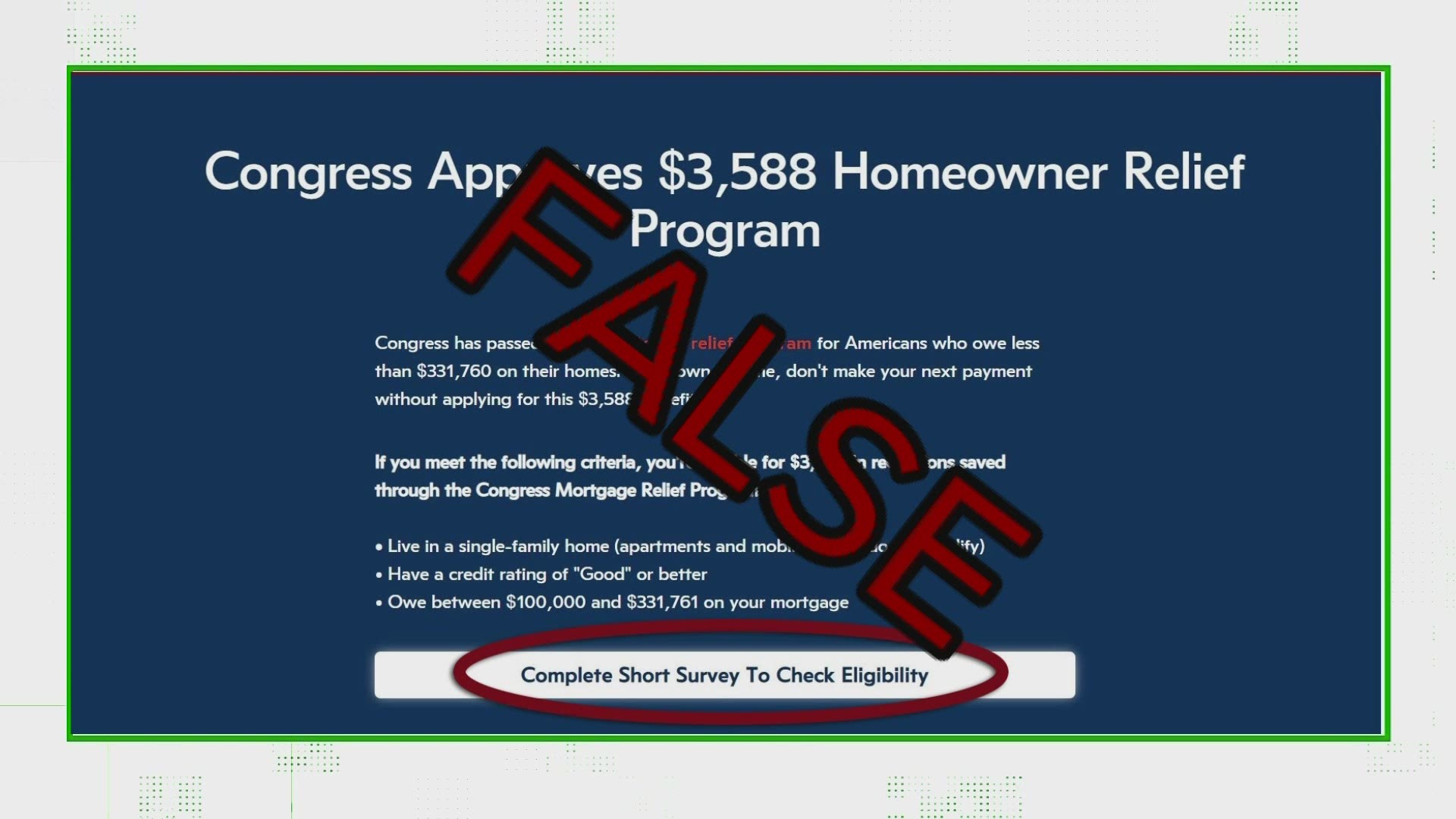

We found one such post online saying homeowners owing less than $331,760 on their mortgage could receive a $3,588 benefit.

THE QUESTION

Is there a Congress-approved homeowner relief program for mortgage payments?

THE SOURCE

- Brandy Whitmire, a Dallas-based mortgage loan originator

THE ANSWER

FALSE

Calling possible opportunities to save on mortgage payments a “Congress-approved homeowner relief program” is a highly misleading label and a combination of multiple half-truths.

WHAT WE FOUND

Simply put, the posts you see boasting mortgage benefits and the opportunity to save are cleverly disguised advertisements.

“It is complete clickbait, basically,” said Whitmire.

Sites such as LowerMyBills.com use the ads in hopes of luring you onto their site to fill out an application and then connect you to a lender who may or may not be able to save you money.

Depending on how much you owe on your mortgage and your current interest rate, you may stand to save money by refinancing. Therein lies one of the “half-truths” in the advertising.

Another half-truth is calling it a “Congress-approved program.” Fannie Mae and Freddie Mac are mortgage companies that do received government funding, but any savings one might find is not the result of a congressional action in the general sense of a new bill or legislation.

“It does not mean (saving) is not possible,” said Whitmire, “But this is not something everyone will get. No, not at all.”