DALLAS — The night he was re-elected in November 2022, Texas Gov. Greg Abbott said one reason he ran was for “homeowners who are burdened with skyrocketing property taxes.”

Then in February 2023, during his State of the State address he minced no words.

“Property taxes are suffocating Texans,” Abbott said.

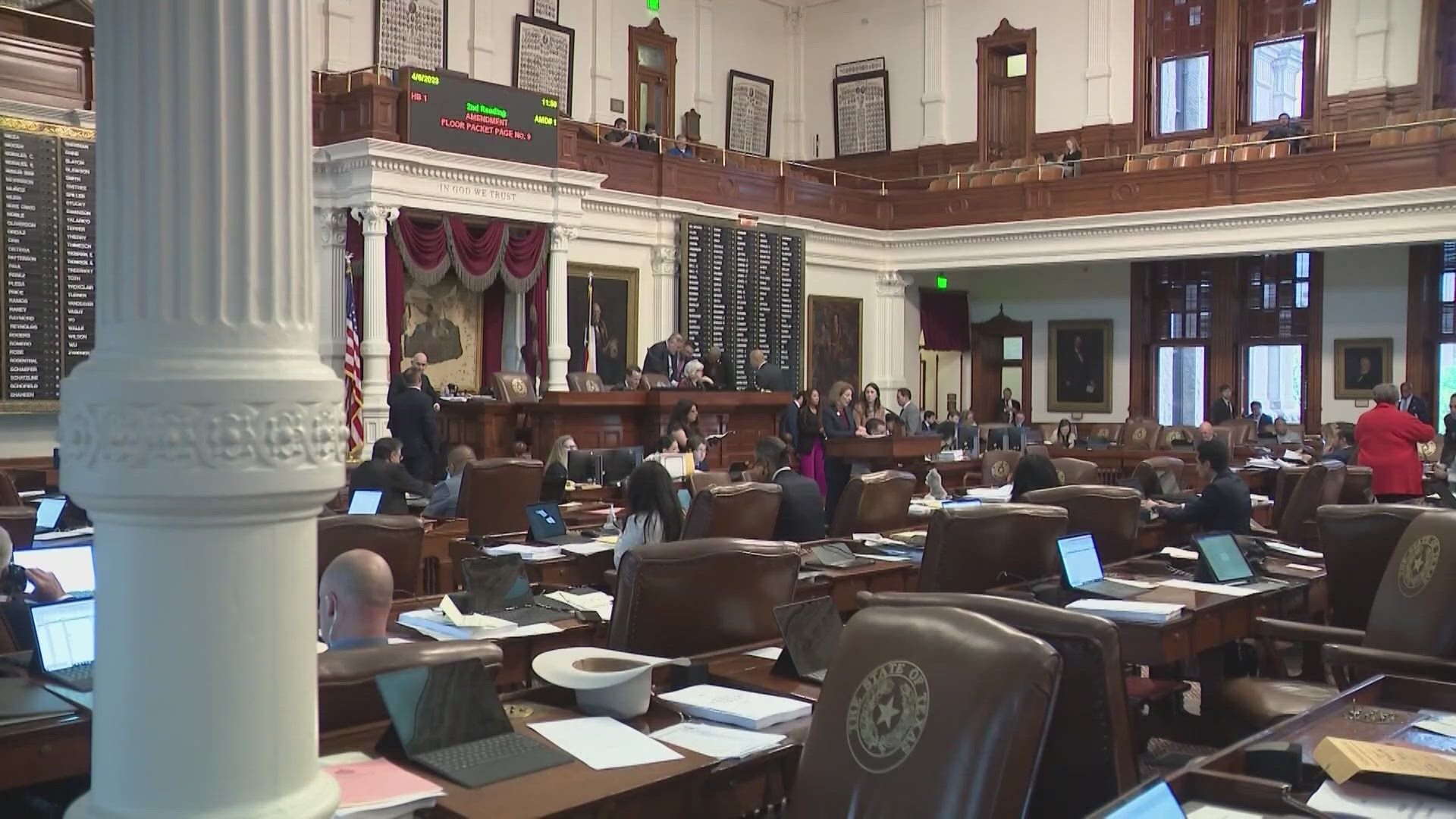

The regular legislative session started in January and ended in May.

A special session started in May and ends Tuesday.

That means lawmakers have had six months to debate, and property taxes are still not cut.

“If you’re a Republican elected official right now, your main concern is that you have promised your core base voters a lot of property tax relief and you’ve delivered nothing so far,” said Jim Henson, director of the Texas Politics Project at UT Austin.

Henson and his team surveyed Texas voters after the regular session ended to see how they felt the legislature handled key issues.

“Property taxes was basically tied for the lowest level of approval,” he said.

“It’s a very curious turn of events for leadership in the state,” he added.

The House and Senate both passed their own plans for property tax relief during the special session.

The House version, which seems to have Abbott’s support, would send $12 billion directly to school districts to lower property taxes.

The Senate plan includes raising the homestead exemption – the portion of a home exempt from taxes – from $40,000 to $100,000. It also raises the franchise tax exemption on businesses.

"You just can’t seem to get agreement and alignment between what we call the big three – the governor, lieutenant governor, and speaker of the House," Henson said.

"Democrats are taking votes but they’re not central to the negotiation process. That makes it that much more awkward for Republicans who own state government, have made these promises, and can’t seem to get it done," he said.

Some House caucuses are telling members to prepare to be called back for a second special session as early as Wednesday.