FORT WORTH — Sara Karashin loves her home in Fort Worth's Fairmount neighborhood. But even she is quick to admit it needs some work.

"We'll kind of laugh and say, 'Yeah, we need a new paint job,'" she said. "We haven’t done much with the house; we had two kids right off the bat."

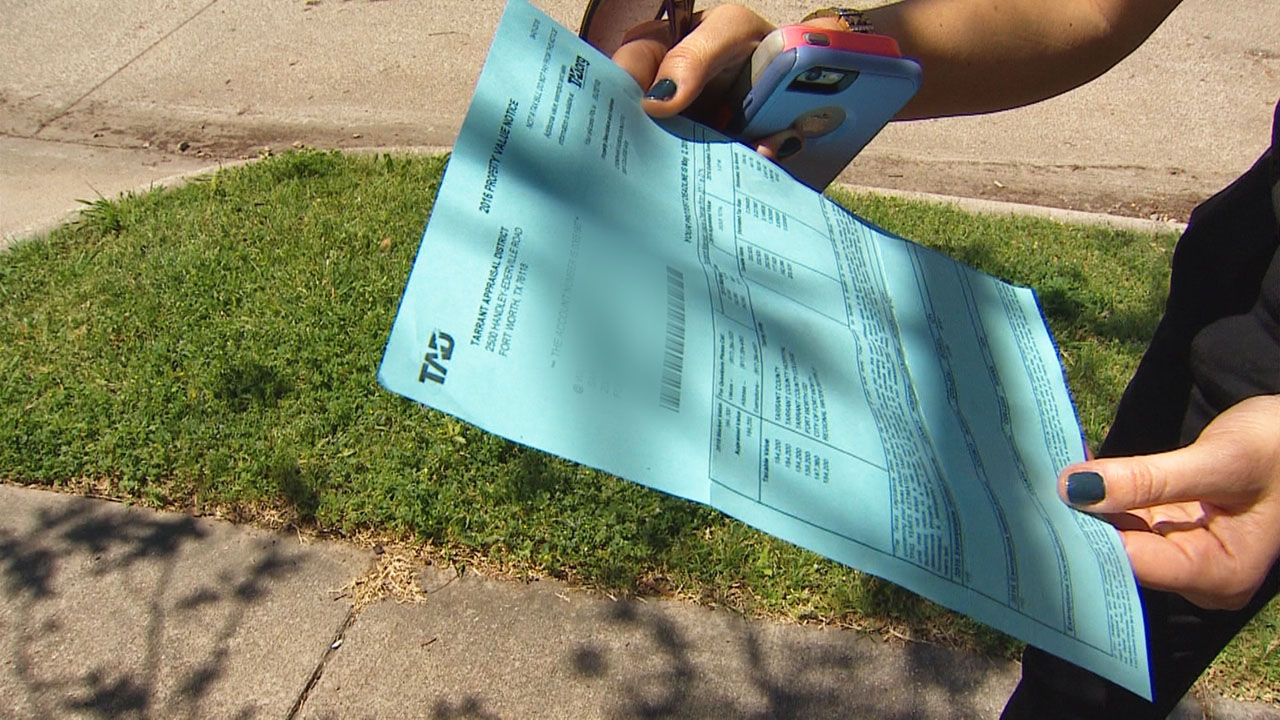

That's why Karashin was dumbfounded this week when she opened her annual notice from the Tarrant Appraisal District and saw that her home's market value had jumped from $184,200 last year to $242,060 this year.

That's an increase of nearly $60,000.

Karashin said she bought the home in 2012 for $168,000.

"What am I going to do about it? I'm going to protest it," she pledged.

And she is apparently in good company. On Tuesday, the appraisal district office was buzzing with puzzled property owners, all wanting to know why their home values soared this year.

"The law requires us to appraise property at 100 percent of market value," explained chief appraiser Jeff Law.

And because the Tarrant County market is currently low on homes for sale... and high on demand... Law said market values have jumped, on average, 14 to 16 percent this year. That's up from a 5 percent increase in the previous 12 months.

"Right now, Tarrant County is a very hot real estate market," he said. "In recent history, yes. This is unusual."

The problem? Those values could lead to higher taxes, though not automatically, Law explained. In fact, some people who qualify for certain exemptions may not notice changes to their taxes at all.

However, Law said he is anticipating plenty of taxpayers will protest before the appraisal review board, which is in your right.

"What I recommend taxpayers do is bring in some type of proof... some type of evidence the data we have might be incorrect," he said.

"We know that it’s a hot market right now, and we completely understand that," Sara Karashin said. But she's now worried she could get priced out of her own home before she's even had the time to fix it up.