FORT WORTH, Texas — Property tax relief is notoriously hard to deliver in a housing market like DFW.

But last year, Fort Worth's biggest taxing entities did it, possibly saving the average Fort Worth resident hundreds of dollars on their annual property tax bill.

This year, taxing entities could not accomplish the same level of cuts.

A Fort Worth resident who owns a home with the average market value and is eligible for a homestead exemption will pay $3,735 in property taxes -- about $6 more than last year. It's a very slight increase compared with last year's major cut of $643, which was brought about by changes in state and local policies.

Several taxing entities levy a tax rate that makes up resident's final tax bill. The final amount residents pay depends on the taxable value of their home and any exemptions that apply, the most common of which is a homestead exemption.

Tax relief can be particularly hard to deliver in Texas, which is one of seven states that do not have an income tax. That means taxing entities have to rely solely on property and sales tax to keep the government running. In a housing market like Fort Worth, as property values rise precipitously so do property taxes, even as taxing entities cut rates.

Last year, homeowners benefited from higher homestead exemptions mandated by the state and approved by local taxing entities. Plus, a commitment from local officials who promised to lower rates enough to achieve real tax relief.

This year, those exemptions still apply. Some taxing entities, such as the city of Fort Worth, went further to provide additional tax relief to elderly and disabled homeowners. Plus, the Tarrant Appraisal District voted to freeze residential property values until 2026 and then conduct appraisals every other year.

The policy change has prompted concern from several Tarrant County School districts who say the pause will effectively "defund" public schools.

"If the defunding of public schools were truly unintentional, then the TAD board had ample opportunity to correct its mistake," nine superintendents wrote in a letter to the TAD board. "Instead, they chose to intentionally harm the funding of public schools in Tarrant County."

However, several conservative politicians lauded the change after they previously called on the Tarrant Appraisal District to provide more transparency and fairness in the appraisal process. Republican County Judge Tim O'Hare publically supported the police change after it was finalized.

"These monumental changes will ensure a more fair and transparent appraisal process for Tarrant County property owners," O'Hare wrote on X.

The average taxable value of residential property has more than tripled since 2015, while average household income has remained fairly static.

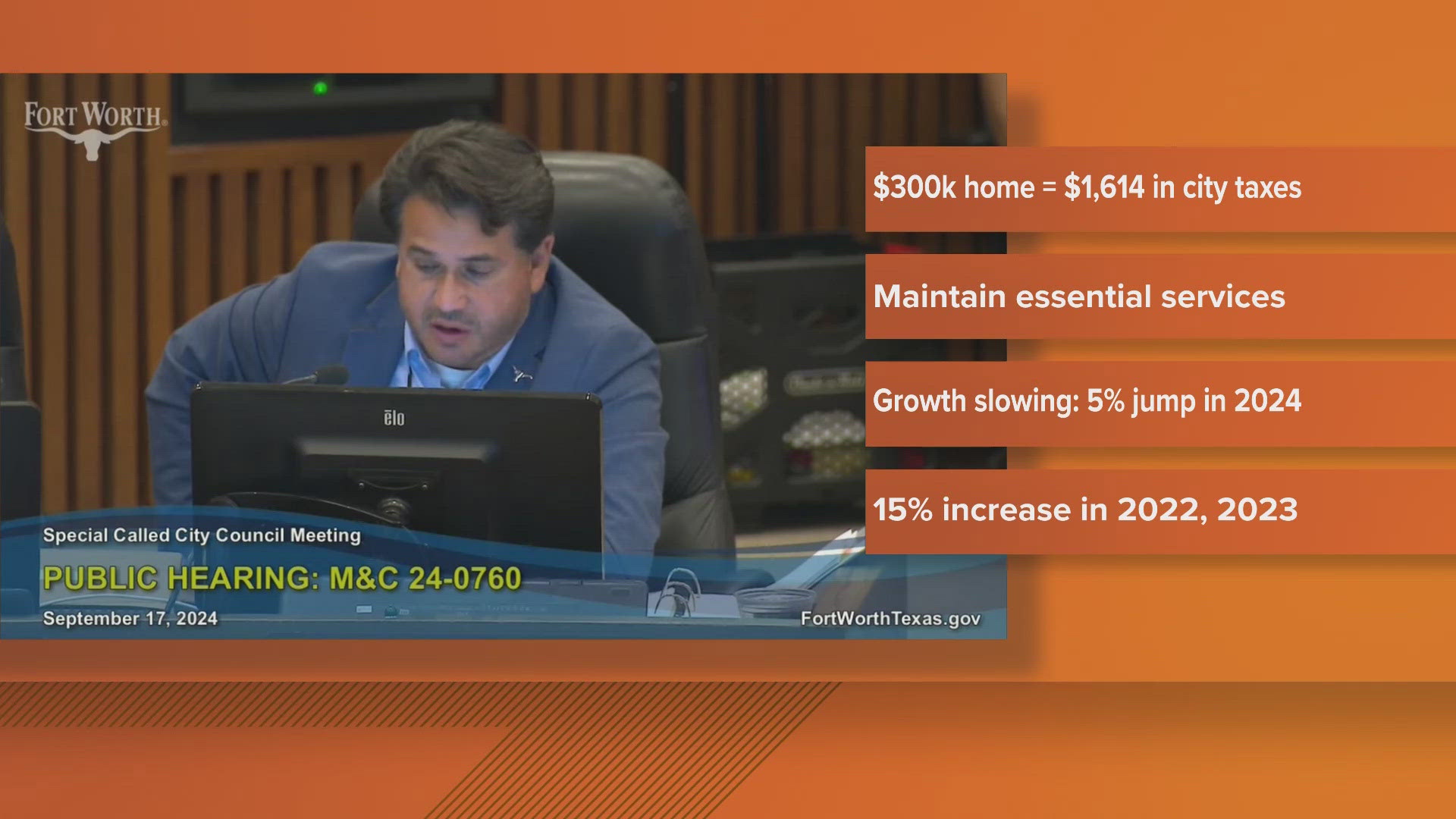

Fort Worth finalized its 2025 budget this week. Amid an unexpected drop in projected property tax income, City Manager David Cooke initially proposed raising the city's tax rate for the first time since the 1990s. However, city council members sent a joint letter to the city manager requesting that he reduce the budget to ensure the tax rate stays below the no-new-revenue rate.

"With growing concerns about property tax burdens and housing affordability, we must remain committed to lowering the property tax rate while also maintaining superior city services," Parker said in a social media post to X.

To accomplish the cut, while preserving funding for police and fire, the city reduced funding for its neighborhood improvement program which provides dedicated funding for infrastructure in underprivileged neighborhoods.

Other highlights from the 2025 budget include increasing the minimum wage for city employees to $18 per hour, investing $10 million in street maintenance and spending $3.5 million on a new EMS system.

Every other taxing entity in Tarrant County joined Fort Worth in keeping their tax rate fairly consistent this year compared to last.