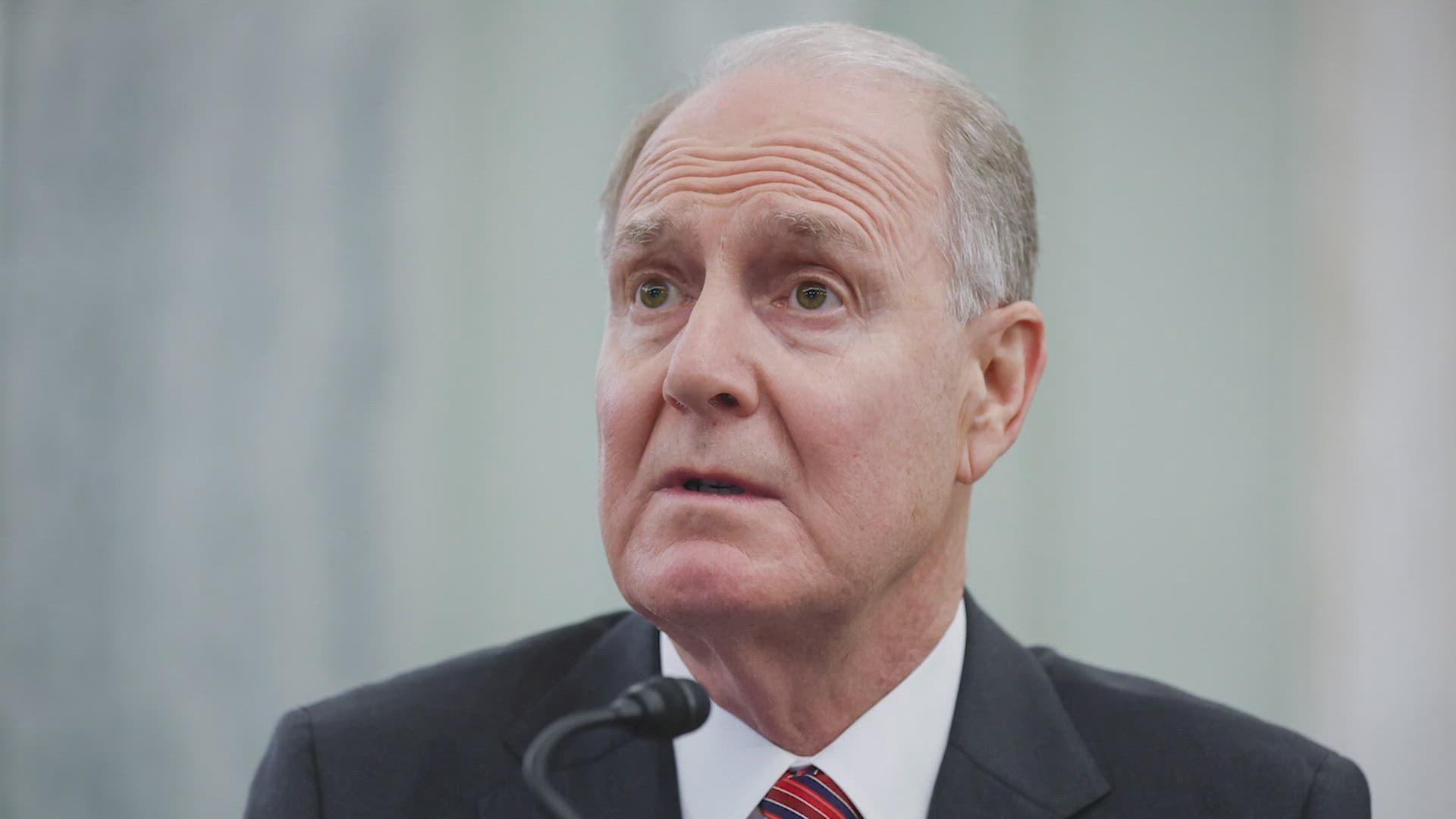

DALLAS — Dallas-based Southwest Airlines on Thursday announced that executive chairman Gary Kelly, the airline's former CEO, will "accelerate his retirement" and step down next week.

The company also announced the appointment of six new board directors in what Kelly described as a "collaborative resolution" with Elliott Management, the activist investor that has pushed for major changes in the company in recent months.

Kelly was previously expected to retire sometime next year. Instead, Kelly's retirement will be effective Nov. 1.

Southwest CEO Bob Jordan, who also has faced pressure from Elliott, remains in his role leading the company.

Elliott earlier this year surpassed the 10% ownership threshold, giving them more say in how the company and its board are run.

Kelly on Thursday called the moves a "collaborative resolution with Elliott, continuing our Board refreshment with the addition of new directors who bring complementary skills and experience."

Elliott Partner John Pike and Portfolio Manager Bobby Xu said in a joint statement: "We are pleased to have come to an agreement with Southwest on the addition of six new directors that will enhance and revitalize its Board. They are all highly qualified and will bring diverse skills and backgrounds to the task of overseeing Southwest under the leadership of a new Board Chairman."

The new board directors are:

- Pierre Barber: Former vice president at chief financial officer at Chevron

- David Cush: Former CEO of Virgin America

- Sarah Feinberg: Former administrator at the Federal Railroad Administration

- Dave Grissen: Former group president of Marriott International

- Gregg Saretsky: Former CEO of Westjet

- Patricia Watson: Chief information and technology officer at NCR Atleos

The moves were announced as part of Southwest's third-quarter earnings report.

Southwest's third-quarter revenue rose to a record high but profit fell nearly two-thirds, to $67 million, on higher costs for labor and other expenses.

The airline, which is under pressure from Elliott to boost profit, said Thursday that adjusted earnings beat Wall Street expectations.

Southwest also said it would speed up the repurchase of $250 million worth of its stock, under a $2.5 billion share-buyback plan it announced last month.

Jordan said the profit — although down from $193 million a year earlier — shows that the airline's turnaround plan is starting to work. Southwest limited cost increases by offering voluntary time off and limiting hiring to deal with what it considers overstaffing.