DALLAS — Strong storms that sparked a tornado warning swept through North Texas Tuesday, leaving damage and thousands without power.

As North Texas works to recover from the storm, here are some tips from the Texas Department of Insurance about what to do after storm damage:

- Call your insurance company to report damage.

- Take pictures and video of the damage. Don’t throw anything away until your insurance adjuster tells you.

- Make temporary repairs to prevent more damage. Remove standing water. Cover broken windows and holes to keep rain out.

- Keep a list of the repairs and save receipts. Don’t make permanent repairs before the insurance adjuster sees the damage.

Filing a claim

Call your insurance agent or company as soon as possible to report property damage.

For company phone numbers, use the Texas Department of Insurance's Company Lookup or call 1-800-252-3439.

- Keep a record of everyone you talked to with your company.

- Be ready to answer questions about the damage.

- Ask about an advance payment if you need help quickly.

- Ask about living expenses. Most policies will cover some of the costs you have if you are unable to live in your home because of damage that is covered by your insurance. Keep your receipts for these costs.

- If you need shelter or emergency food or water, contact the Red Cross at 800-733-2767.

Repairing your home

- Make sure your adjuster and company have your current phone number.

- Make sure your address is visible from the street. You may need to post a sign with your address in the yard.

- Try to be there when the adjuster visits and point out all the damage.

- Get multiple bids from contractors and compare them with the adjuster’s report before settling the claim.

For more information from the Texas Department of Insurance, visit their website.

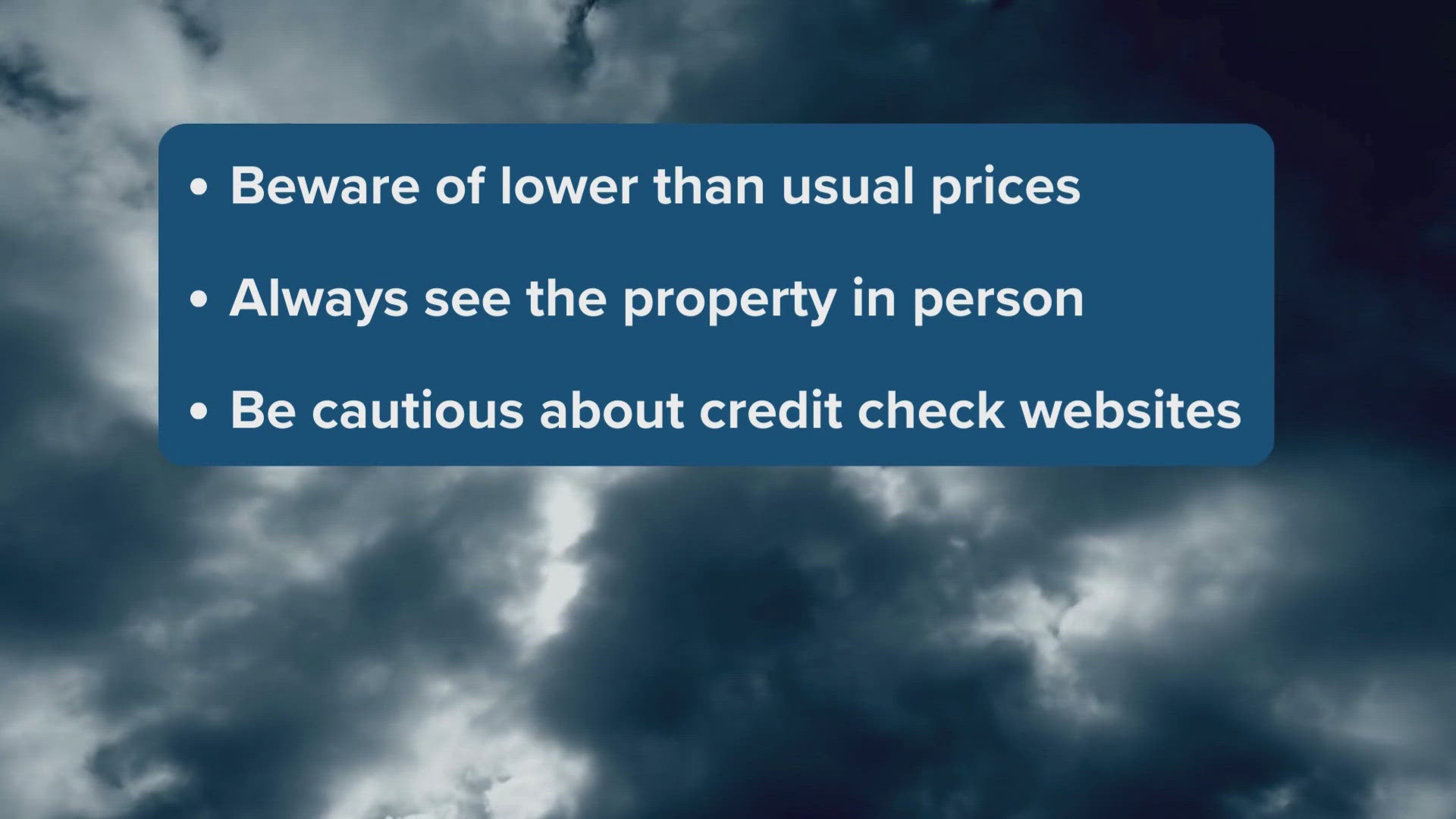

Here are some tips from the Better Business Bureau about storm recovery and how to avoid scams in the process:

- Contact your insurance company. Ask your insurance company about your policy coverage and filing requirements. Save all receipts, including for food, temporary lodging and other things that may be covered under your insurance policy. Your insurance company also may have recommended contractors.

- Beware of contracts claiming to waive deductibles. Claiming to waive insurance deductibles without the insurer’s consent is illegal in the state of Texas, per House Bill 2102. If you speak with a contractor who offers to waive your deductible, reach out to your insurance company to check whether they were authorized to make that claim.

- Research. Check the BBB’s website for trusted businesses, and your local city government agency responsible for registering or licensing contractors. Get references from friends and neighbors.

- Be careful of door-to-door contractors. Many municipalities require a solicitation permit if salespeople go door-to-door. Ask for identification, check their vehicle for their business name, phone number, and license plate number for your state.

- Don’t sign over insurance checks to contractors. Instead, get an invoice from the contractor and pay them directly (preferably with a credit card, which offers additional fraud protection over other forms of payment). Don’t sign any documents that give the contractor any rights to your insurance claims. For questions, contact your insurance company or agent.

- Be wary regarding places you can’t see. Most contractors abide by the law but be careful allowing people you don’t know to inspect your roof or other areas of your house. Unethical contractors may actually create damage to get work.

For more information, visit the Better Business Bueau’s website.