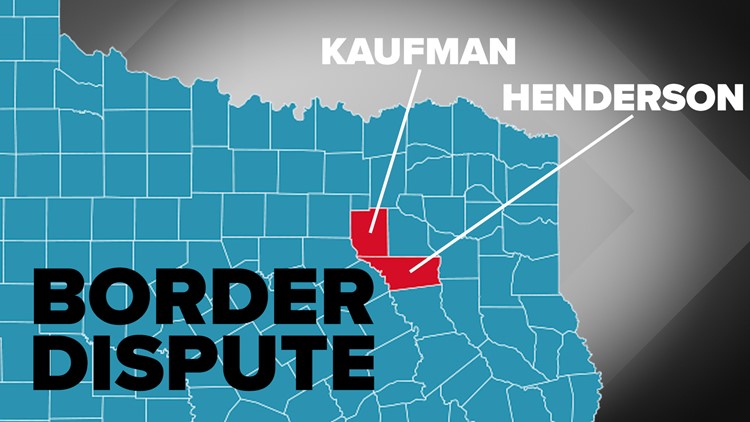

KAUFMAN COUNTY, Texas — There are more than 180 properties in an approximately six-mile-long path between two North Texas counties currently being disputed.

There is a 1,200 foot-wide area along the Kaufman County and Henderson County line that remains in limbo until the Van Zandt County District Court attends to the case filed between the two counties. The argument revolves around which county this stretch of land belongs to.

Decades ago, a northern area of Henderson County suddenly became considered part of Kaufman County without an explanation, according to Kaufman County Judge Hal Richards.

Now that this error has become known, Richards says residents are wondering who to pay their property taxes to while the litigation continues.

In July 2021, a letter from the State of Texas General Land Office explained that the area in question is a part of Henderson County and not Kaufman County. The correct boundary line is shown on the General Land Office 1942 map of record, according to Richards.

“We appreciated the clarification from the General Land Office about this issue and we notified residents in that area, that their properties are, in fact, inside Henderson County,” Richards said. “The problem now is that Henderson County has not yet added the properties into the Henderson County tax rolls. Of course, Kaufman County cannot collect taxes on Henderson County properties. So, owners of these properties should expect to pay taxes to the Henderson County Tax Office. It should be good news to those taxpayers that Henderson County tax rates are lower than Kaufman County rates.”

In Texas, county lines are straight lines, East–West and North-South unless the line is defined by a natural geological feature.

The only way a county line can be moved is by an act of the Texas Legislature. No legislation exists that changes the Henderson County and Kaufman County straight boundary, Richards said.

In an effort to communicate with the owners of the approximately 180 properties, Kaufman County has asked the Van Zandt County District Court to provide a statement to those residents letting them know what to do about paying their property taxes while litigation is pending.

According to articles 3307 & 3308 of the Texas Property Tax Code, a property owner cannot be penalized if a tax bill has never been sent. It says that even if a property owner gets a tax bill, there might be a small late fee, but there will be no attorney’s fees for at least six months.

It is advised that these property owners seek their own legal advice on how to move forward during the pending litigation, Richards said.

Other services rendered by the county are also in limbo including permits, vehicle registrations and voter registration. The 9-1-1 emergency services within this area, however, have not been disrupted and their addresses will be listed as Henderson County addresses.

“Not only are the residents unsure about how to proceed,” said Judge Richards, “but we as a county, are unsure what to tell them. We hope the Van Zandt County District Court will provide these residents some direction regarding how to pay their taxes.”