DALLAS — New York’s iconic charging bull might need to move over.

A red Pegasus appears poised to take flight as the symbol of a city that’s a global financial center.

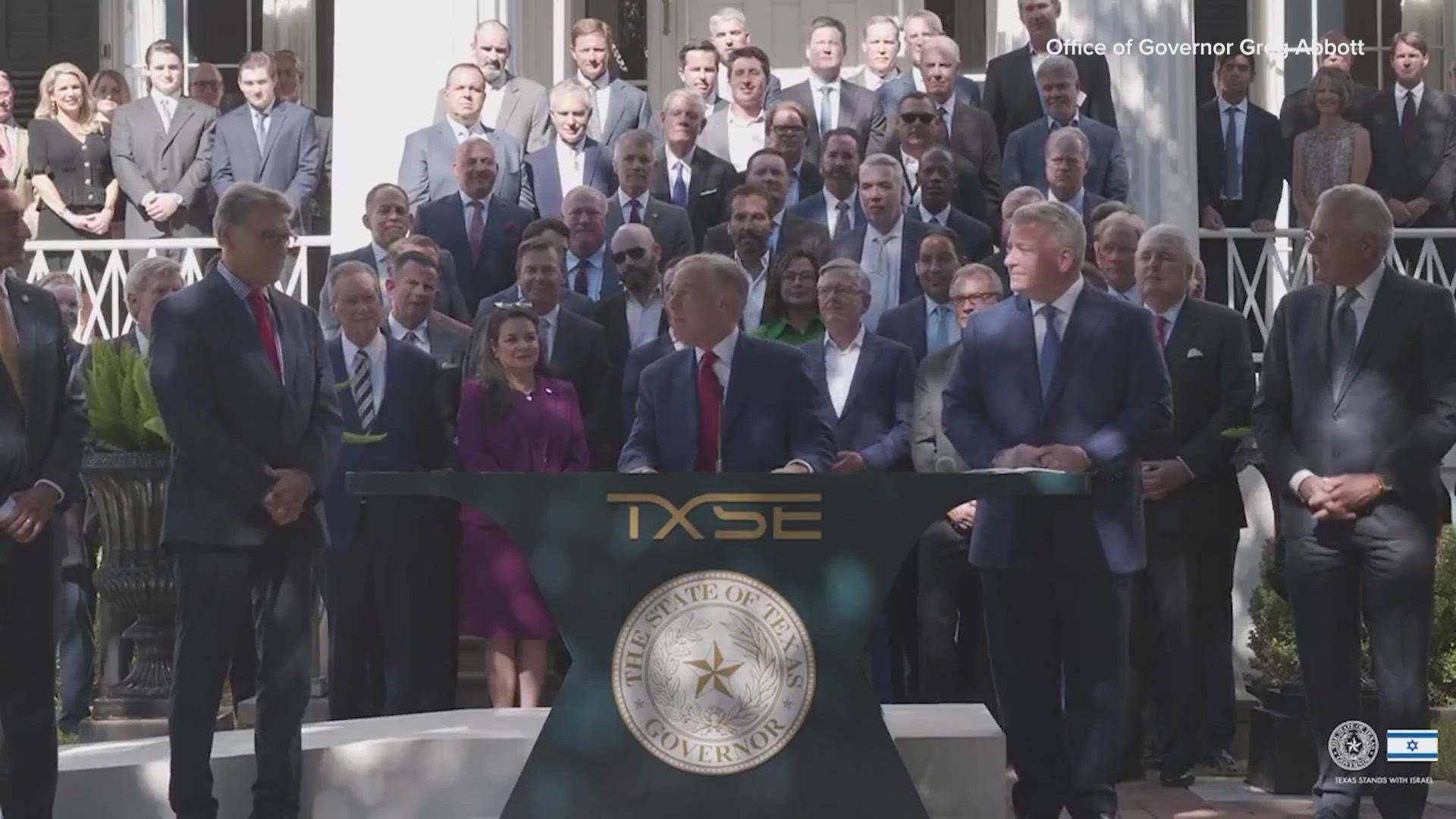

The Texas Stock Exchange leadership team appeared with Gov. Greg Abbott in Austin Monday, announcing they are firmly on their way to making a decades-long dream a reality.

“Our next step is to submit a registration with the SEC which we will do in the coming months,” said James Lee, founder, chairman and CEO of the TXSE. “Pending approval, we will execute our first trades at the end of next year and launch listings in early 2026.”

The Texas Stock Exchange will be somewhere in “the heart of Dallas,” according to its website, at a headquarters they will call it Texas Market Center.

It will house executive offices, a conference center, a bell-ringing venue and a broadcast center.

“Dallas will become a new hub for capital markets in the United States,” Lee said.

They expect the TXSE to compete with the New York Stock Exchange and NASDAQ.

Founders have raised more than $135 million, which Lee said makes them “the most well-capitalized national securities exchange applicant to ever file a registration with the SEC.”

The TXSE board includes former Texas Gov. Rick Perry, who was also U.S. Energy Secretary, and leaders from Blackrock and Citadel Securities.

“This is another step that expands the financial might of Texas in the United States and cements our economic power on the global stage,” Abbott said, adding that a stock exchange had long been a vision of his.

The TXSE can only elevate a city and state that already boast a global reputation for finance, said Ray Perryman, an economist with The Perryman Group.

“In the last few years, Dallas has had much faster growth in the financial sector than New York or just about any other place,” Perryman said. “New York is going to be the place we think of as a financial center for a long time, but I think Dallas can definitely make some significant inroads there.”

The stock exchange itself won’t create a large number of jobs, but its presence could attract new companies and encourage existing ones to expand.

Growth in finance jobs in North Texas has already been “unbelievable,” said Don Shelly, a professor of finance in practice at SMU in Dallas.

“It just continues to be a magnet for companies and investors,” he said. “I always tell our students this is the best job market in the United States. I think it will continue to be that way certainly for the next couple of decades.”

Shelly said with the dominant presence of U.S. equity markets, there’s enough room for competition for the TXSE to succeed and backing from Citadel and Blackrock lend it credibility.

“I think it is going to be interesting to see how many companies decide to at least co-list on the exchange and I suspect there will be a lot of them,” he said. “I think there’s a lot of momentum.”