DALLAS — A program that lets Dallas police officers and firefighters stay on the job and grow a tidy retirement nest egg has put the Dallas Police and Fire Pension System on the road to financial disaster.

The pension fund has lost $325 million on its deferred retirement option program (DROP). The option lets police officers and firefighters remain employed while the pension checks they would have received if they had retired go into a special account.

The problem: The $3.3 billion fund guarantees an interest rate return of eight to 10 percent — no matter what. So even when the overall pension fund lost money or saw only average returns, the fund was still on the hook to pay high interest rates to DROP accounts.

Those losses are only expected to grow following a recent ruling that prevented the pension system from making changes to reduce the interest rates which would stopped the hemorrhaging for a fund that covers nearly 10,000 current and former police officers and firefighters.

![Pension fund seeks to rescind interest rate promises[ID=21727629] ID=21727629](http://wfaa-download.edgesuite.net/video/21727629/21727629_Still.jpg) "It's almost a [Bernie] Madoff interest rate," said Dallas City Council member Scott Griggs, referring to the financier who was convicted of operating a Ponzi scheme that defrauded thousands of investors out of billions of dollars. "It's not sustainable. If you don't find a solution, you have to raise contributions or you have to cut benefits." Griggs is on the board of trustees for the pension fund.

"It's almost a [Bernie] Madoff interest rate," said Dallas City Council member Scott Griggs, referring to the financier who was convicted of operating a Ponzi scheme that defrauded thousands of investors out of billions of dollars. "It's not sustainable. If you don't find a solution, you have to raise contributions or you have to cut benefits." Griggs is on the board of trustees for the pension fund.

Police officer representatives to the board sought to quell fears among the rank and file at a question-and-answer session at Dallas Police Association headquarters. But it was readily apparent that their concerns were not abated.

Many are angry at the former and current police officers who filed the lawsuit which resulted in the ruling that prevented the pension board from lowering the interest rates paid to the DROP accounts.

"It's a cancer that's slowly killing this pension," Ernest Sherman, a Dallas police officer, told News 8 in an interview.

ATTEMPTS TO STEM HEMORRHAGING

The pension board voted last Thursday to appeal the judge's ruling, a process that will likely take years. Board members also voted to seek a legislative fix want to block further enrollment in the DROP program after March 31.

"I'm flabbergasted that any fiduciary in his or her right mind could look at a guaranteed eight percent return and say, 'That's sustainable. That's in the best interest of this system," said City Council member Philip Kingston, who joined the pension board trustees last year.

Kingston likens the pension to a bucket with a spigot at the bottom.

"The spigot is where the benefits come out," Kingston explained. "Right now, the spigot is letting out more than we're able to put in the top of the bucket, and that's a severe problem. Any time you have that kind of situation, it's unsustainable."

HOW DID THIS HAPPEN?

In 1993, the pension fund created the DROP program to help retain veteran police and firefighters after they reached retirement age. The pension fund promised them an interest rate return of eight to 10 percent.

For the first 15 years, the program was cost-neutral. In fact, it resulted in a net gain of $26 million for the overall pension fund.

In 2008 — as the stock market crashed and the Great Recession rippled across the economy — the pension fund was not immune. It sustained a 22 percent loss, according to pension fund documents.

Still, the pension fund had to pay those high interest rates to the DROP accounts.

The pension fund "lost" more than $200 million in 2008 and another $100 million in 2011 when it "credited more in interest to DROP accounts than the investment return from the total assets in those DROP accounts," according to pension fund documents.

In effect, that meant the fund had to take dollars from assets for future benefit payments to credit interest to those DROP accounts. Those accounts now amount to about 40 percent of the fund's total assets.

A PLAN TO REDUCE INTEREST RATES

Last October, police and firefighters overwhelmingly voted to gradually drop the interest rate paid on those DROP accounts. The changes would have dropped the interest rate by one percent until it reached five percent in 2017. After that, the interest rate would be based on a sliding scale from zero to seven percent, depending on the pension's funded ratio.

"The proposed solution is designed to provide a DROP interest rate that will recover the more than $325 million loss from DROP and put DPFP in a position to withstand negative investment return years in the future," account to pension fund documents.

But three retired police officers and one current police officer sued to stop the changes from taking effect, calling it a benefit protected by the Texas Constitution. They cited a 2003 constitutional amendment that forbids any reduction or impairments of benefit.

In court filings, the plaintiffs cited pension handbooks which guaranteed an interest rate that "will not be less than eight percent or more than 10 percent."

They also cited the words of pension board chairman George Tomasavic from a flier distributed in 2011.

"We cannot lower the DROP interest rate below 8 percent based on the advice of nationally known and respected pension attorneys," the flier stated. "Doing so would be a breach of fiduciary duty and open the pension system to numerous lawsuits."

In court filings, the pension board's lawyers contended that the interest rate in and of itself was not a protected benefit. The filings also detailed the fund's dire situation, saying the guaranteed high interest jeopardizes "the future viability of the system" and endangers the "ability of the system to pay monthly pension, disability and death benefits"

On December 31, a Dallas County judge ruled against the pension fund. She concluded that the high interest rates are indeed protected and must be paid.

'BAD INVESTMENTS' BLAMED

Sherman insists the pension board and its former administrator, Richard Tettament, denied for too long that there was a problem. Tettament was ousted last fall as the pension's financial problems became impossible to ignore.

"They didn't do their fiduciary responsibility," Sherman said. "They didn't look out for the greater good."

Roman Kilgore, another Dallas police officer, was one of the four plaintiffs who filed the suit. The other three are retired. Kilgore said it's unfair to blame the DROP program for the pension system's woes.

"Really, it's their bad investments," Kilgore said.

He contends that the fund made a promise to the participants in DROP and those promises must be kept.

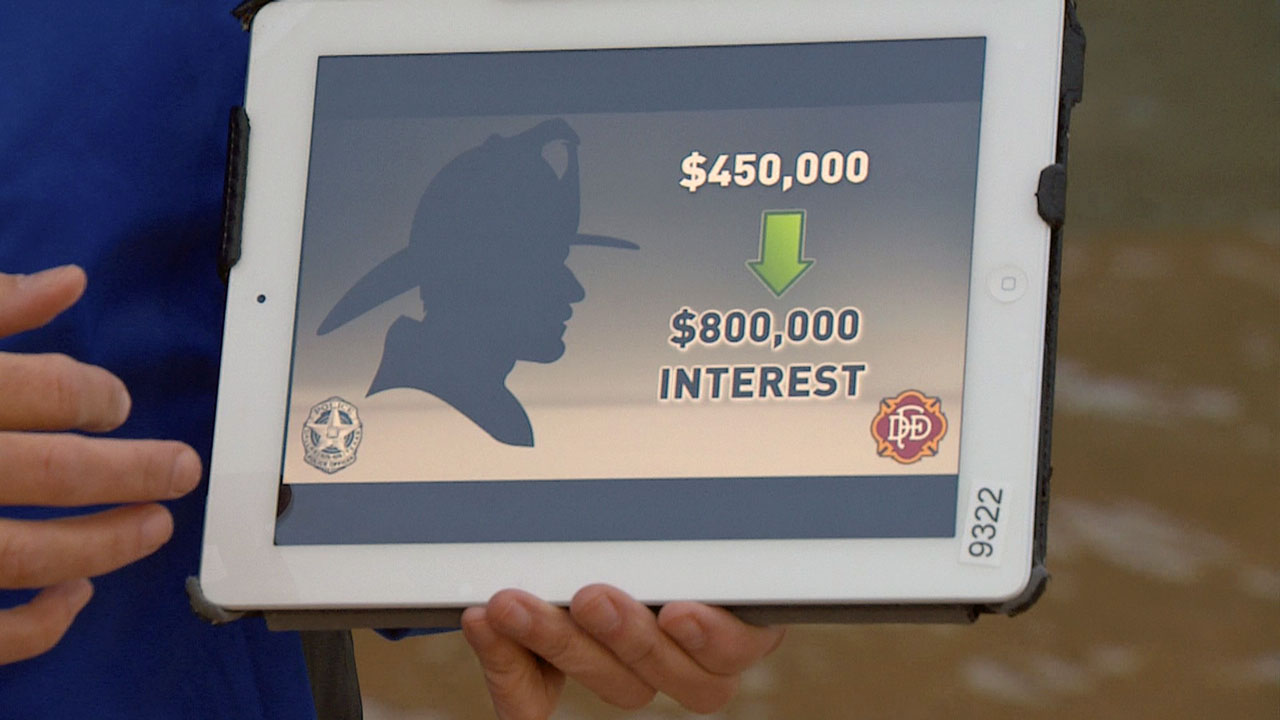

Court documents filed in the case show just show lucrative those accounts can be.

Larry Eddington, a former pension board chairman and retired police officer, was another of the plaintiffs. He put about $450,000 into DROP. He made about $800,000 in interest.

Multiply those dollar figures across hundreds of accounts and it's clear why DROP poses a danger to the future pension benefits of police officers and firefighters.

"It cannot support itself, and if you have something that cannot support itself but still pays money solely reliant on outside, that's the textbook definition of a Ponzi scheme," Sherman said.

Sherman and his wife, a Dallas firefighter, assumed their pension fund would be safe and secure. Now they aren't so sure.

"We don't know what our future holds," he said.

Sherman is not in the DROP program. He is eligible for DROP, but said he decided not to go enroll because he didn't want to be part of the problem.