DALLAS — When it comes to making home loans, the law says lenders are supposed to be colorblind.

Black, white, Hispanic - if you can pay the loan back, you can’t be treated differently.

But Jennifer Baker doesn’t believe that’s how it really works.

“I think when people think of this side of downtown Dallas - ‘that is low-income,’ or ‘people who don’t want to work, don’t want to pay their bills.’ That’s not the case.”

Baker is a homeowner south of Interstate 30, where the majority of the population is Black and Hispanic.

She’s also a nurse, and has been a customer with the same bank since 1999. But over the years, Baker says her bank has made it hard or impossible to get credit, so she had to go elsewhere when she needed an $89,000 loan.

"I can’t walk into my bank and ask them for money,” she said. “Not ‘give it to me,’ ‘loan it to me-- I'll pay you back.’ I pay everyone else back, no problem. But they are the only one that do not seem to trust me.”

As we’ve reported - over and over - in our “Banking Below 30” investigation, banks in Dallas make relatively few loans in lower-income and minority neighborhoods south of I-30.

Some people say that's just smart business. On social media, people have responded to our series of reports like this: “Why should banks be required to loan money to people that cannot pay them back?” “Banks only lend to people who qualify.” “Banks will loan to green Martians if likely to be paid back.”

But the reality is, lending is more than just business. It's also about race. We've been crunching new numbers, and we're finding Black and Hispanic people are denied home loans at much higher rates than white people - even when they have a similar ability to repay.

Denial rates

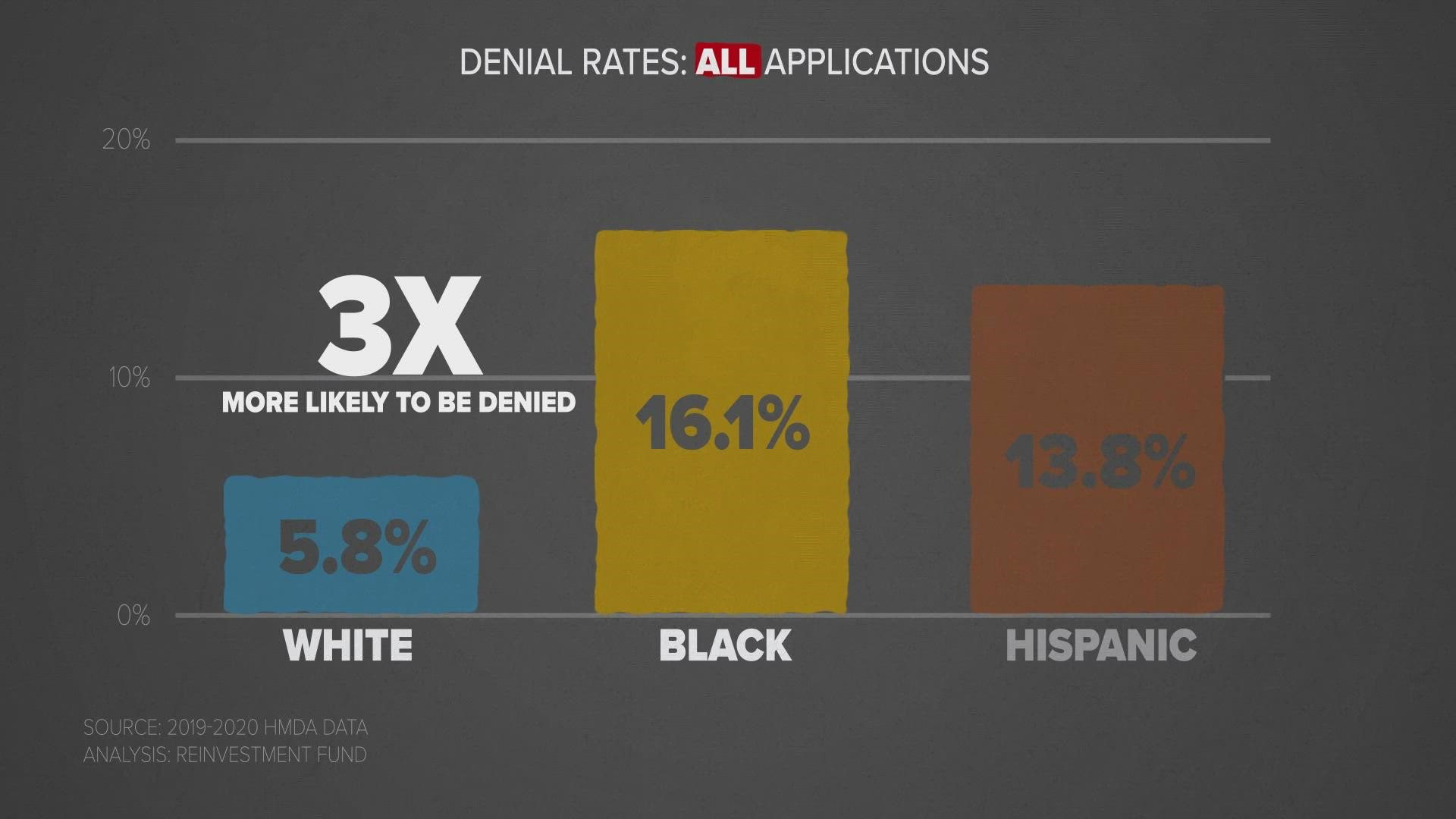

To analyze denial rates in mortgage lending from banks and mortgage companies, we collaborated with the nonprofit Reinvestment Fund, which focuses on advancing economic justice.

We started by looking at denial rates for all applicants in Dallas in 2019 and 2020. While this kind of public data doesn't include all the factors a lender considers, we found white people are denied loans for mortgages 5.8% of the time, Black people 16.1%, and Hispanic people 13.8%.

That means in Dallas, if you’re Black, it's three times more likely you'll get denied for a loan.

"It's an insult to the hardworking American people who get up and go to work,” Baker said.

So, what happens if we run the numbers again, but this time, instead of looking at everyone in Dallas, we just look at applicants who have enough savings for a down payment of 10% or more - and enough income to pay their debts with 57% or more of their paycheck left over.

Of these more qualified applicants, we found white people are denied loans 4.3% of the time, Black people 12.1% and Hispanic people 5.8%. So, even when they're more qualified, Black people are still three times as likely to get denied as white people.

And here's an even more interesting finding: the denial rate of less financially qualified white people is 12.2%. So, if you're more qualified and Black, you'll be treated the same as someone who is less qualified and white.

Others have reached a similar conclusion looking at mortgage lending nationwide. On Aug. 25, an analysis by investigative journalists at The Markup found that - looking at similarly qualified borrowers - lenders were 80% more likely to reject Black applicants, 40% more likely to reject Latino applicants, 50% more likely to reject Asian/Pacific Islanders, and 70% more likely to reject Native Americans.

Have questions about this story? Join reporter David Schechter on Twitter Sunday where he'll be answering them.

Credit scores

The thing that's missing in this picture is the credit score. That data is not public, so we can't factor it into what we're doing. But critics say it's what's holding back otherwise qualified Black borrowers.

“The credit score has become, in many ways, a proxy for race,” said Jeremie Greer, co-founder of the nonprofit group Liberation in a Generation. He recently testified in Congress for credit score reform.

“What research shows with Black households is, the higher the income, the more debt you have,” he said. “And a real driver of that debt for middle-income Black people is student loan debt.”

Student debt is not the only credit score driver, but Greer says it's a critical one. Here’s what he’s talking about.

Research from Brookings shows, on average, four years after graduation, Black graduates are in debt $53,000, while white students have $28,000 in debt.

Lots of debt drags down a credit score. So, are Black students better off for racking up student loans?

An analysis by the Urban Institute shows the rate of homeownership for a Black college graduate is 30%, which is significantly less than white college graduates, and even a little bit less than white high school drop-outs.

So, you've got a student loan gap, a homeownership gap - and what about a credit score gap? There's that, too.

The Urban Institute analyzed federal data and found one-third of Black people don't even have a credit score - also known as a FICO score - because of a lack of credit history. Another third has a credit score that's below 620, in the "poor" to "fair” range. Fourteen percent have a score that's fair to good. And 20% have a score that's "Good" or better (at least 700) compared to 50% of white people.

Looking at it in a different way, in Dallas, FICO scores in white neighborhoods are, on average, 156 points higher than in Black ones.

“Credit scores are reflective of current economic circumstances, but do not cause them,” said Francis Creighton, president and CEO of the Consumer Data Industry Association, which represents the major credit reporting companies.

“People of color confront a wealth gap every time they try to access financial services,” he said. “After generations of financial and other discrimination, many families of color have not been given the opportunity to build the kinds of inter-generational wealth that many white families have.

“Our industry is committed to financial, employment, and housing inclusion,” he said.

Bias in lending

Greer said credit scores are “inherently biased” because “they give more credit to things that are readily available to many white households.”

“If you have a home mortgage, you're likely to have a better credit score,” he said. “If you have high student loans - which a lot of Black and brown communities have - you're going to have a lower credit score. So, there are things that stack against Black or brown communities that make the system in which they determine the credit score inherently biased against Black and brown people.”

Credit scores are not the only predictor of default risk, but, it has historically been the key measure, said Ben Strube, who runs an independent mortgage business in Dallas.

Strube opened Mortgage on a Mission after quitting his job at a big bank. He was disillusioned about the emphasis on catering to people with healthy credit scores and overlooking borrowers with lower credit scores who might still qualify for a loan, but were less profitable and more time-consuming.

“Bigger banks [are] cherry-picking high net-worth clients,” he said. “The big banks offer wealth management services. They offer CD accounts, checking, savings. They want you for the life of your loan. So, if you have a 620 FICO score, do you have money to invest with them? Probably not.”

What do the banks say?

“Banks fulfill their obligation to treat all applicants equitably by ensuring that they apply underwriting criteria neutrally to each applicant regardless of their race,” the American Bankers Association said in a statement to WFAA. “…Many banks offer programs such as down payment assistance, grants to subsidize closing costs, and interest rate adjustments for low-income families.”

The ABA also pointed out it has successfully lobbied for ways to lower barriers to minority homeownership, like the removal of strict caps on how much income an applicant uses to pay off debt. It also supports credit score reforms.

Credit score reforms

Currently, rent and utility information is only reported to credit bureaus when you miss a payment. But these are major expenses for many families, and Greer says they should also be getting credit when they pay those bills on time.

"Homeowners are consistently getting their on-time payments reported to credit bureaus, while renters - who are disproportionately low income - do not,” Greer said.

The idea is getting traction.

On Aug. 11, the Federal National Mortgage Association, known as Fannie Mae, announced that it would begin using on-time rental payments to score potential borrowers seeking government-backed home loans.

That’s just a first step, experts say.

A more expansive fix is the The Credit Access and Inclusion Act, currently pending in Congress. It would expand what could be counted in a credit score to help an estimated 45 million low-income borrowers get more access to credit.

The major credit bureaus support the use of so-called “alternative data” in calculating credit scores to more accurately reflect more people’s creditworthiness - including many minorities with low traditional scores.

"On-time payments of rent, telephone and utility bills are indicators that a consumer is able to manage credit responsibly, even if the person is credit invisible or has a thin credit file,” said Creighton, head of the CDIA. “Our data has the power to lift people up. Racism and discrimination are against everything we stand for. It’s illegal, and it’s wrong. The use of credit reports in lending helps lead to a more equitable and fair lending system.”

Jennifer Baker, who has an excellent credit score and is currently working on her master’s degree, said she’s making all the right choices to get ahead. But she'll also graduate with $30,000 of student debt.

“We deserve equal opportunity,” she said. “Our money spends the same."