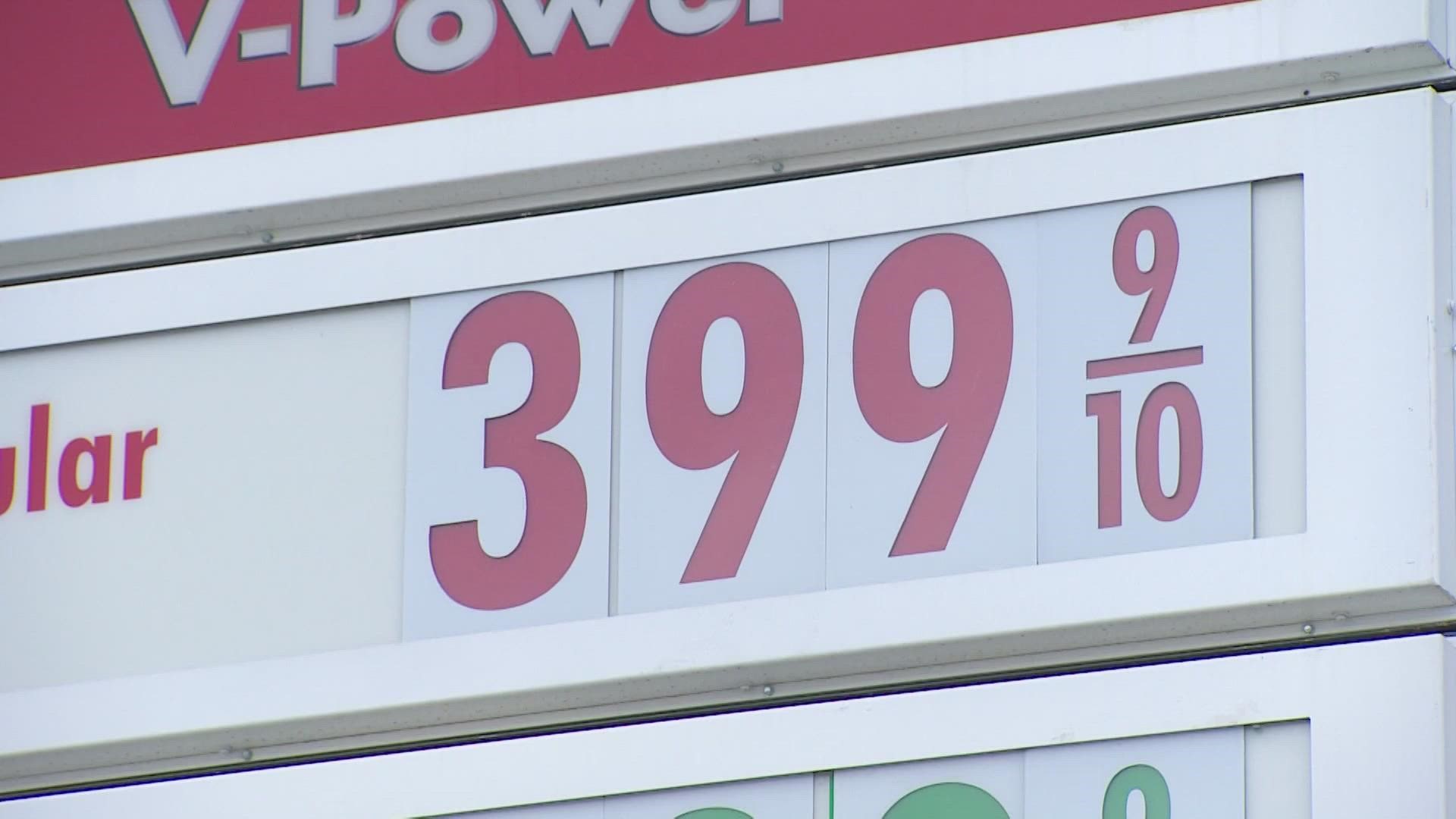

DALLAS — As gas prices continue to soar across the country, including in North Texas, many people are wondering why.

President Joe Biden announced a ban Russian imports this week, Russian imports only make up a small portion of America's oil supply.

James Coleman, a law professor who specializes in energy law and policy at Southern Methodist University, said the biggest reason for the current spike in oil prices is uncertainty.

“The oil markets are very afraid that we’re soon going to have a shortage of oil because of sanctions on Russia or an embargo that Russia would impose on the west," Coleman said.

While the U.S. only receives a small portion of its oil from Russia, other countries in Europe, that have not banned Russian imports, import a lot more.

Coleman said some companies are already opting to not purchase oil, and if there were to be a disruption of the oil supply chain, it would impact the global supply of oil. The increased demand on a more limited supply would, in turn, lead to an even higher spike in the price of oil, which directly impacts gas prices.

“If Russia’s exports were to disappear from the market tomorrow, you would see catastrophic rise in oil prices around the world," Coleman said. “A lot of what’s happening today is just the anticipation that we may have more shortages in the weeks and months to come.”

An increase in oil prices doesn't just impact gasoline. It also means higher prices for diesel, which impacts costs to operate trucks and trains. That will impact shipping costs. There's also jet fuel, which could impact the price of airline tickets.

“It will, and it already has" Coleman said. "We’re already seeing a run-up in prices. That goes right along with a run-up in jet fuel prices. That’s absolutely the case, and the reality is that most of our economy runs in oil gas and so when you have sort of catastrophic run up in those prices…two things happen. One, everything gets more expensive and two, we have supply chains just entirely break down."

Southwest Airlines confirmed it hedges fuel, which means it buys a chunk of the fuel it anticipates it will need for the year in advance at a set price. The purpose of doing that is so the airline won't be as impacted by fluctuating fuel prices.

American Airlines said it does not hedge fuel and is not considering it at this time.

Coleman said hedging fuel doesn't guarantee that airlines won't increase prices for customers. Neither airline commented on whether fuel supplies will impact ticket prices.