DALLAS — Editor's note: The video above is from an earlier story.

Banks lend relatively little money to the Black and Hispanic community that lives south of I-30 in Dallas. It’s a story WFAA has been reporting on in our Banking Below 30 investigative series.

In response to our stories, the US House Financial Services Committee, which oversees banking regulation, is taking testimony about the scope of the problem in Dallas and how it severely impacts real people.

Dallas Congresswoman Eddie Bernice Johnson (D) organized the session and committee Chairwoman Rep. Maxine Waters (D) are expected to participate.

WFAA's reporting has focused on poor enforcement of the Community Reinvestment Act (CRA), a law that encourages a bank to lend money to the entire community it serves, particularly the minority communities that banks have long ignored. The hearing is seen as an important step to elevating the issue of CRA reform in Congress.

You can watch the proceedings below:

Our investigative work exposes the systemic racism entrenched in the banking industry and how it fuels the racial wealth gap. Through failed policies and weak oversight of the Community Reinvestment Act, we found the federal government is complicit in allowing banks to turn their backs on disenfranchised communities in Dallas and around the country.

Here are some highlights of the what our investigative findings:

- Modern redlining in minority neighborhoods where banks still refuse to lend.

- Bank branches in minority zip codes that take deposits but won’t make loans.

- Bank-financing of the predatory lending industry that preys on minority neighborhoods.

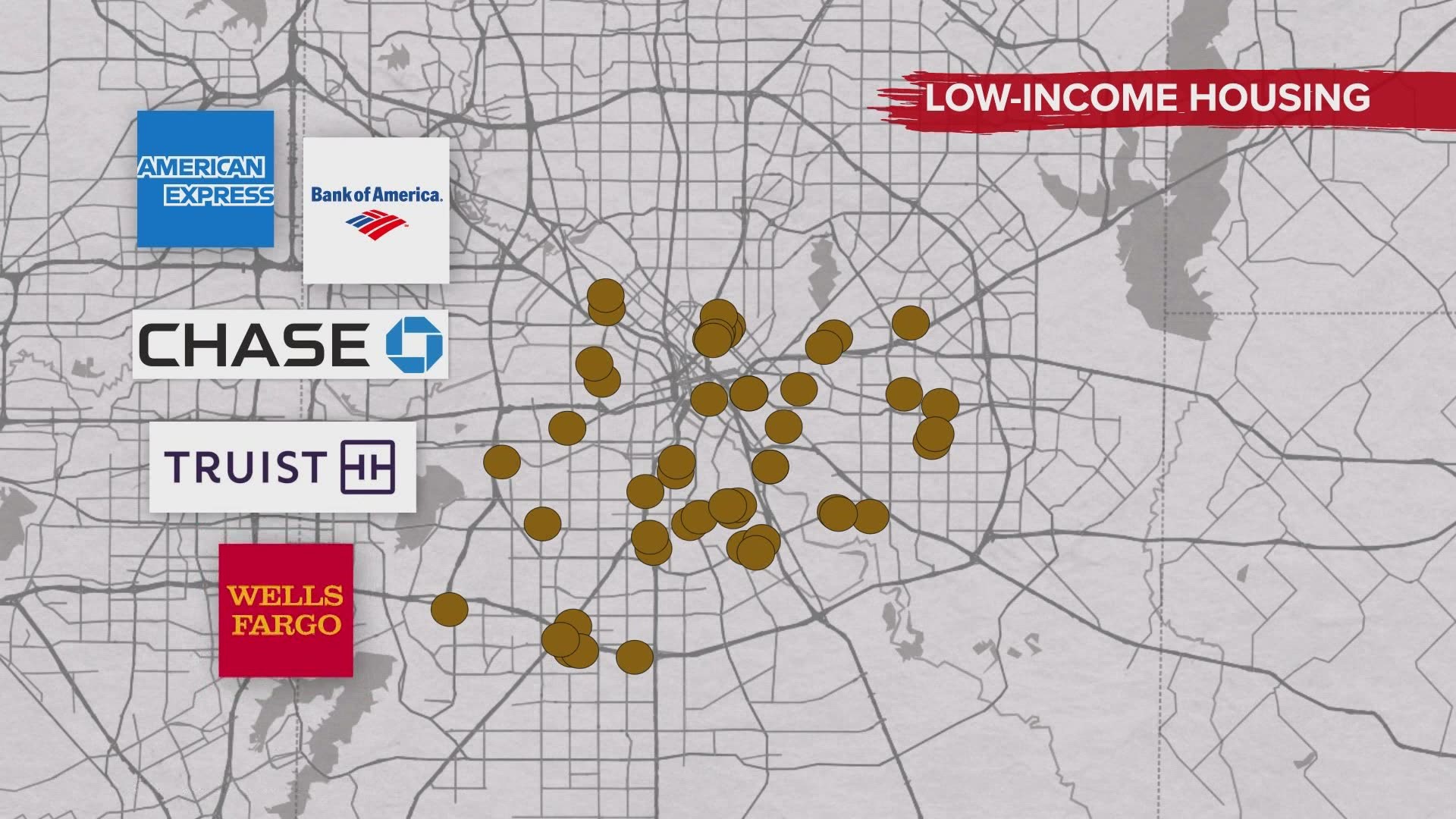

- Bank ownership of low-income housing in high-crime neighborhoods.

In addition to today’s Congressional session, here are some results of Banking Below 30 series:

- Local governments, with billions deposited at local banks, are drafting ordinances to hold their depository banks accountable to equitable lending standards.

- Two banks entered binding, community agreements to substantially increase lending in minority neighborhoods.

- The Office of the Comptroller of the Currency is considering a proposal to end incentives that reward banks for owning low-income housing in high-crime neighborhoods.

- A bill to expand oversight of how well banks in Texas lend to minority borrowers was introduced this legislative session.