IRVING, Texas — Read this story and other North Texas business news from our content partners at the Dallas Business Journal

On Thursday night, Irving City Council approved incentives totaling $31 million for a forthcoming office development that is expected to be home to a new Wells Fargo regional campus.

For years, sources have said that Wells Fargo (NYSE: WFC) was targeting hundreds of thousands of square feet of office space to house thousands of workers, eventually settling on a build-to-suit option in the Dallas suburb of Irving after scouring North Texas.

The banking giant has settled on two 400,000-square-foot buildings with the potential to hold 4,000 workers that are expected to be set within a broader mixed-use development.

A spokesperson for the San Francisco-based Wells Fargo declined to comment again on Monday when asked about the office development which was directly tied to the bank for the first time by this week’s city council agenda.

Is DFW becoming the nation’s new finance hub?

While North Texas has a deep history of homegrown firms focused on private equity, banking and wealth management, the region has added to that might with the addition of several financial heavyweights over the past several years.

That includes snagging headquarters for Charles Schwab in tandem with its TD Ameritrade merger, in addition to expansions from JPMorgan Chase and Goldman Sachs, among others.

A more recent victory for the region includes the approval of a half-billion-dollar, Goldman Sachs-anchored tower in Dallas developed by Hunt Realty.

With $18 million in incentives tied to the project, the investment banking giant is expected to retain or create a minimum of 5,000 full-time jobs by the end of 2028, in addition to occupying 800,000 square feet with a 15-year lease term.

Dallas Director of Economic Development Robyn Bentley said in June that Goldman was considering "the full spectrum of headquarters services," not focused on a specific facet of the business, when it comes to the jobs that would be housed in the new office. Those roles could range from accounting to finance, and from tech to corporate jobs such as human resources and legal roles, she said.

Since 2018, eight Fortune 500 companies have relocated their headquarters to Texas with five of those landing in North Texas. Irving scored McKesson’s move from San Francisco and Catepillar’s recently announced pilgrimage from Chicago. Dallas is now the home of CBRE and AECOM, both of which migrated from Los Angeles, while Charles Schwab headed to Westlake.

Some sources believe that a Wells Fargo regional campus of this size meant for this many employees could mean an eventual headquarters move, as well. A spokesperson said in June that the firm had ‘no plans’ to move its headquarters.

What will Wells Fargo’s future regional campus look like?

Two separate incentive agreements passed on Thursday night,: consisting of $19 million tied to improvements in a Tax Increment Reinvestment Zone through the Financial Services and Economic Development Departments and $12 million to aid in the construction of the regional campus through the Office of Economic Development. The latter was approved unanimously.

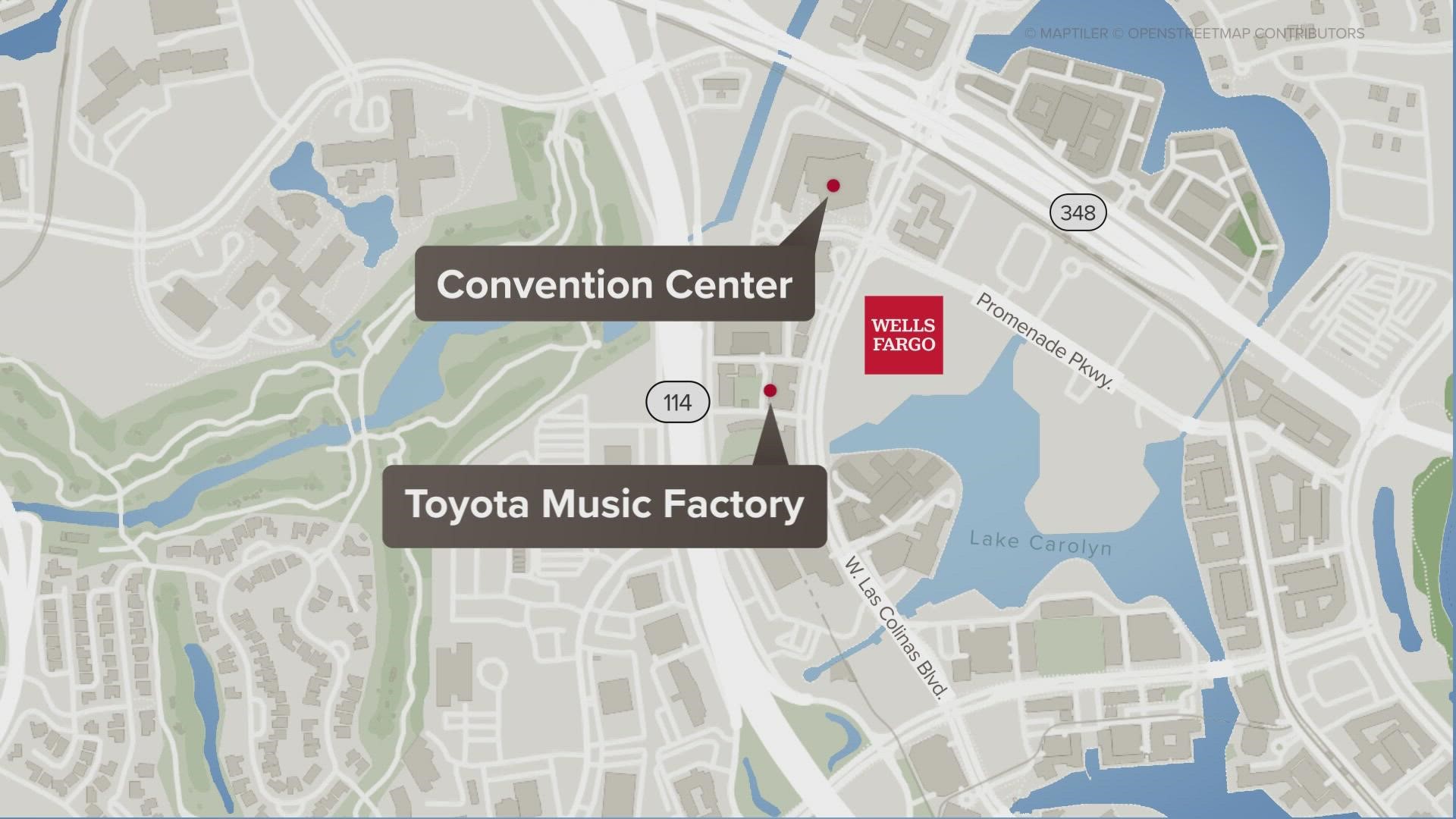

In order to receive the agreed-upon incentives, Wells Fargo or company affiliates must purchase 22 acres near Las Colinas Blvd. and Promenade Parkway by the end of the year; construct and occupy two office buildings that are a minimum of 400,000 square feet that are at least 10 stories by December 31, 2026; and construct a parking garage housing at least 4,000 spaces; among other requirements.

Wells Fargo must occupy the office space for 10 years and is required to increase the real property value by a minimum of $200 million by Jan. 1, 2027, with the development.

The forthcoming office development will sit along Irving-Las Colinas’ Lake Carolyn across from Williams Square. Situated along West Las Colinas Boulevard and Promenade Parkway, Dallas' KDC will develop the office project.

The two office buildings are expected to sit within a larger mixed-use development featuring multifamily space with restaurants and retail.

Wells Fargo’s potential ground-up project is expected to function as an anchor within a denser, mini-CBD surrounded by other notable companies, sources have said.