IRVING, Texas — This story originally appeared in the Dallas Business Journal, a WFAA news partner.

Wells Fargo Bank is officially building a new campus in Irving.

After years of speculation and a handful of recent happenings, Texas Gov. Gregg Abbott's office confirmed the construction of what will be a multi-tower regional corporate office campus in Dallas-Fort Worth.

“Texas has a long history of leadership in financial services, attracting major operations for the world’s largest financial services companies, as well as the most innovative startups in the field,” said Abbott in a prepared statement. “Already home to the largest workforce in the financial services sector, and as the new frontier for financial technology, data centers, and more, Texas offers opportunities for Fortune 500 operations to grow, and I thank Wells Fargo for their continuing investment in the great state of Texas and the best workforce in America.”

Wells Fargo Bank – which holds Wells Fargo & Co. (NYSE: WFC) as its parent organization – is expected to create 650 new jobs and make a capital investment of $455 million in the new campus. The San Francisco banking giant has been offered a Texas Enterprise Fund grant of just over $5 million as part of the new corporate office push.

The new campus is expected to open by the end of 2025.

“Currently, most of our 3,000 employees are located in several offices across the Metroplex," said Tanya Sanders, Wells Fargo head of Auto, said in a statement. “We are thrilled to have a new state-of-the-art campus where we can bring the majority of our local workforce together for an even better employee experience, which prioritizes wellness and sustainability."

Yesterday, the Business Journal reported that Wells Fargo acquired the land long-rumored to be the site of the bank's new Irving hub.

In early August, Irving City Council approved incentives totaling $31 million for a forthcoming office development that is now slated to become a new regional campus.

For years, sources have said that Wells Fargo was targeting hundreds of thousands of square feet of office space to house thousands of workers, eventually selecting a build-to-suit option in Irving.

The majority of Dallas area employees will relocate to the new offices, Wells Fargo said in a news release Tuesday.

The plans for the site, which will be developed by Dallas-based KDC, include two 400,000-square-foot buildings with the potential to hold 4,000 workers that are expected to be set within a broader mixed-use development.

The two office buildings are expected to sit within a larger mixed-use development featuring multifamily space with restaurants and retail. Wells Fargo’s ground-up project is expected to function as an anchor within a denser, mini-CBD surrounded by other notable companies, sources have said.

Wells Fargo stated that its new campus will include well-being rooms and gyms with remotely-led classes with wellness and outdoor recreation front-of-mind for employees. Other wellness amenities involve nearby walking and bicycle trails, stand-up paddle board rentals, a cycling studio, and four golf courses.

The Irving development is slated to serve as Wells Fargo’s first net positive campus, meaning it is expected to generate more energy than it consumes.

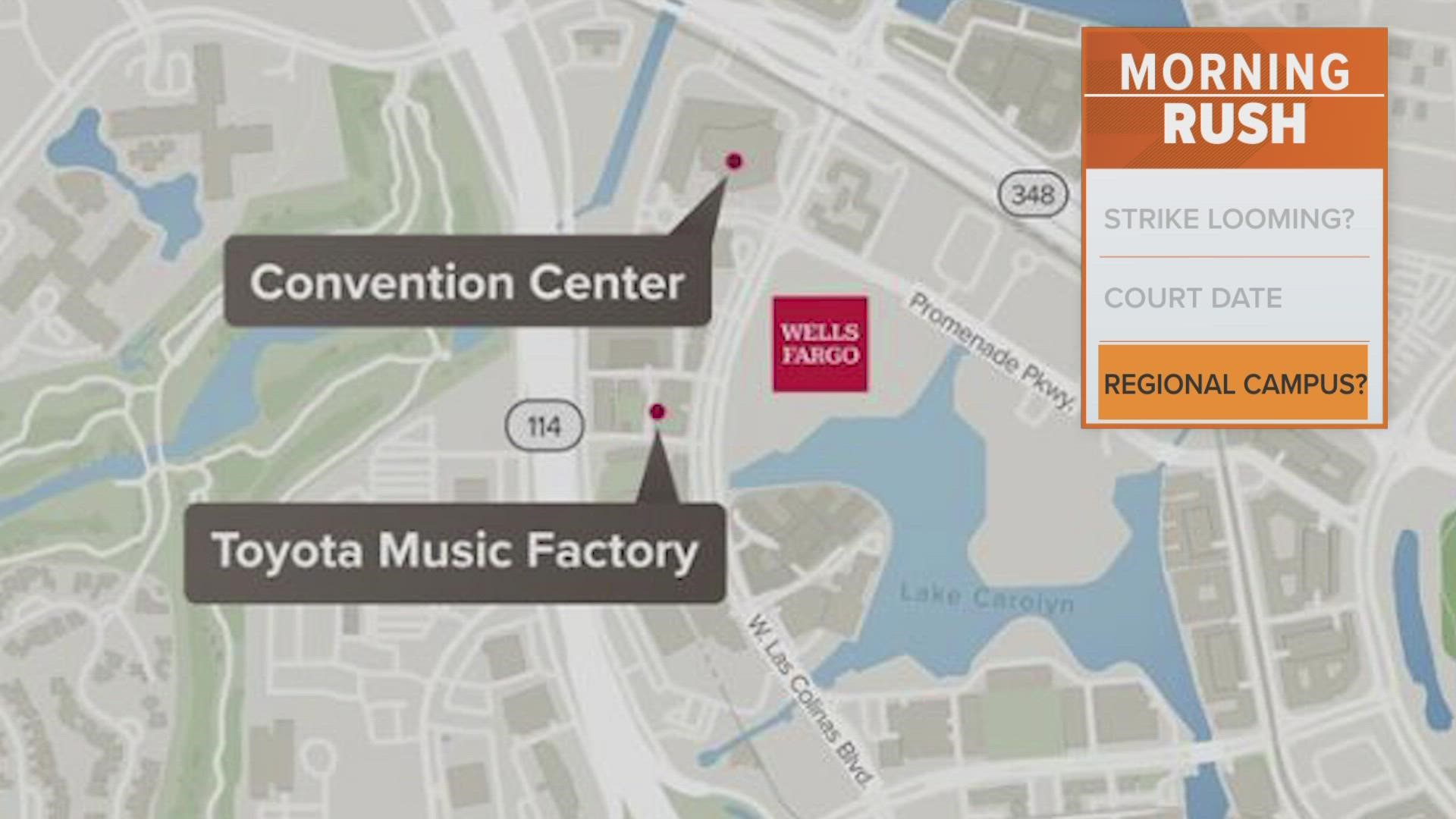

The office project will be constructed near the Irving Convention Center and Toyota Music Factory at the corner of West Las Colinas Boulevard and Promenade Parkway – one of the last and largest vacant sites in the area.

Some sources have concluded that an office development of this size could result in an eventual headquarters relocation for Wells Fargo, though a spokesperson for the institution said in June it has "no plans" to move its headquarters.

North Texas has cemented a diverse business ecosystem over the past 30 years that ventures well beyond arcane notions of a region reliant on the ebbs and flows of crude and cows.

Buoyed by technology, aviation, health care and defense, Dallas-Fort Worth is sustained by an especial emphasis on financial services with a skilled employee base to stoke its continued growth.

Beyond homegrown private equity, banking and wealth management firms with substantive clout – from TPG to Texas Capital Bank – the region has added significant financial services heavyweights over the past several years.

Those victories include wooing the headquarters for Charles Schwab in tandem with its TD Ameritrade merger, along with key expansions from JPMorgan Chase, Goldman Sachs and Vanguard.

Goldman Sachs, for its part, is expected to be part of a near half-billion-dollar development that should shepherd thousands of new jobs within the CBD.

Teachers Insurance and Annuity Association, one of the country's largest pension funds and financial advisors, announced in April plans to build a 15-story tower that will bring 2,000 additional jobs to the region by the end of 2029 to the headquarters of the Dallas Cowboys in Frisco, The Star.

Texas Capital Bank has launched an investment banking arm, looking to grow corporate advisory, merger and acquisition services, underwriting and sales and trading. That effort includes a trading floor in the heart of North Texas.

Since 2018, eight Fortune 500 companies have relocated their headquarters to Texas, with five landing in Dallas-Fort Worth.

Irving scored McKesson's move from San Francisco and Caterpillar's recently announced pilgrimage from Chicago. Dallas is now the home of CBRE and AECOM, both of which left Los Angeles, while Charles Schwab set up camp in Westlake a few years ago.

Texas now boasts 54 Fortune 500 headquarters – the most of any state in the nation.