HONOLULU — Geographically, there is no other place in the United States more southwest than Hawaii.

Dallas-based Southwest Airlines flies to 121 destinations, but this one is likely the most culturally challenging of them all.

“Well, they call it the coconut wireless,” said Andrew Watterson, Southwest’s chief operating officer. “Basically, word of mouth is very strong in Hawaii. If you disrespect somebody, if you ill-serve somebody, they'll tell their friends, they'll tell their relatives or tell their cousins, and everybody will know. So, you must establish a brand and a reputation for delivering well.”

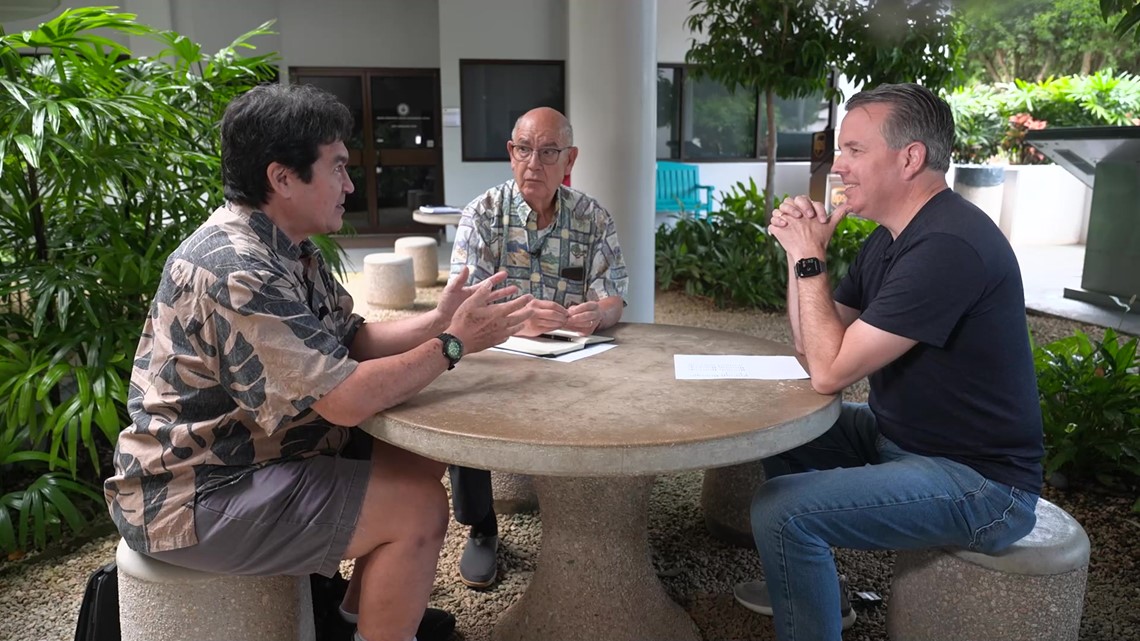

May marks four years since Southwest Airlines started flights to Hawaii and WFAA returned to the islands with top Southwest executives from Dallas.

Hawaiian Airlines, the hometown carrier, still has massive market share leading some to question what Southwest’s long-term goals are for the islands.

“Yes, our market share has gone up, but we're not trying to take away their customers. We're trying to bring customers, you know, off the couch, so to speak,” Watterson explained. “In Texas, it was ‘get them out of cars into the airplane.’ Well, here they can't drive. So, it’s getting them to go visit their friends and relatives they perhaps did a decade ago and so bring them an opportunity to go see a grandma, to go see their high school team play the rival in a different island.”

In 2019, Southwest started with four flights to Hawaii. Today, the airline has 90 flights there and two-thirds of them aren’t flying across the Pacific. They’re flying between islands.

“They don't have an interstate. You can’t drive between the islands. So, if you need health care, you have to fly,” Watterson explained. “Really our purpose is connecting people and being able to offer flights between the island really feels our purpose.”

Watterson said Southwest was approached by Hawaii to launch interisland flights to break Hawaiian Airlines’ monopoly and reduce ticket prices for locals.

“Oh, yes, from the governor down to the man on the street, so to speak. They were all just fit to be tied about the lack of competition because a previous competitor went out of business, like a decade ago. And so, they really wanted more competition,” he added.

When Aloha Airlines went out of business in 2008, that left Hawaiian Airlines with a near-monopoly – flying locals and tourists to neighboring islands. Fares increased for a decade and Southwest saw an opportunity.

Hawaii’s lieutenant governor, Sylvia Luke, said this is more than a story of competition. It’s also one of social justice.

“A lot of these rural areas on a lot of the neighbor islands, they don’t have the type of healthcare services that urban Honolulu has. To have major surgery, you have to fly to Honolulu. It becomes a social justice issue,” said Lt. Gov. Sylvia Luke, D-Hawaii. “Airfare has dropped significantly from on average $150 to about $40.”

But are low fares enough to attract locals to Southwest Airlines over their hometown carrier that’s almost a century old?

“Low fares are enough for me. But the fact that they fly the right equipment. So. 737 vs. 717s, I'm down with that, but I don't want to be on a small four-seater, you know what I mean? If I can avoid it,” said Paul Brewbaker, economist.

Brewbaker and Frank Haas, a Hawaiian-based management consultant, have studied this state’s travel and tourism market for several decades.

“When we had two rival inter-island carriers, there was about 50% more inter-island travel than there is today,” Brewbaker explained, “and that was 20 years ago.”

What should Southwest Airlines prioritize for the next four years?

“Stay the course,” Haas advised. “I think they've entered the market the right way. They surveyed the market. I think they understand the market. They're getting more comfortable with the complexities of the market and the differences in this market and just over time, I think as long as they keep that mindset, they'll become entrenched.”

Brewbaker said Southwest’s near-term opportunity is to further increase inter-island travel.

“When I say grow volume, take passenger counts between the islands from [currently] 600,000 per month to 700 to 800. It was 900,000, 20 years ago,” Brewbaker said.

Southwest spent three years in Hawaii learning the culture before ever landing a plane here.

“For the consumer, it's probably all good. But it's important to remember there's always a tension between kama’aina and malihini – the locals versus the outsider guys, and Southwest is going to have to overcome that. It takes time. And everybody who's coming here has been a malihini at one point,” Brewbaker continued. “Be true to your brand. But yeah, try to fit in, bro.”

This month, the low-cost carrier returned to Hawaii with something it rarely does, a 737 with a special painted, Hawaiian themed livery.

“I'm very proud of it. It's the most complicated paint job we've ever done, by the way - 16 colors, 23 days to paint - but very beautiful,” said Bob Jordan, Southwest CEO.

The airline flies more than 800 aircraft but only 13 have special paint jobs, known as liveries. Imau One, the Hawaiian-themed 737, is now the 14th.

Still, the Dallas-based airline has 800 employees on the islands, a sliver of Hawaiian’s staff of 7,200.

But Southwest's presence in Hawaii has not only brought competition to inter-island travel, Watterson said, the Dallas-based carrier has also raised wages at the airports.

"The prevailing wage has gone up from, I believe it was $13 or $14 to [now] $20 is what we're offering for starting salaries, that [then] go up to $35 an hour, the top end of our scale," he said.

But what comes after Hawaii? Southwest is not yet revealing its plans.

Over the next 12-18 months, the airline said it will add more flights to destinations it already flies, restoring what it reduced during the pandemic, while still working to fit in, in the most remote destination it has ever flown.