DALLAS — A full year after the devastating winter storm of February 2021, the costs are still adding up.

The biggest insurance payouts (page 16 here) were in Harris County (about $1.74 billion), followed by Dallas County ($1.28 billion) and Tarrant County ($771.3 million). Travis County claims accounted for the fourth largest insurance payout total ($751.4 million), followed by Collin County ($576.2 million) and Denton County ($392.4 million).

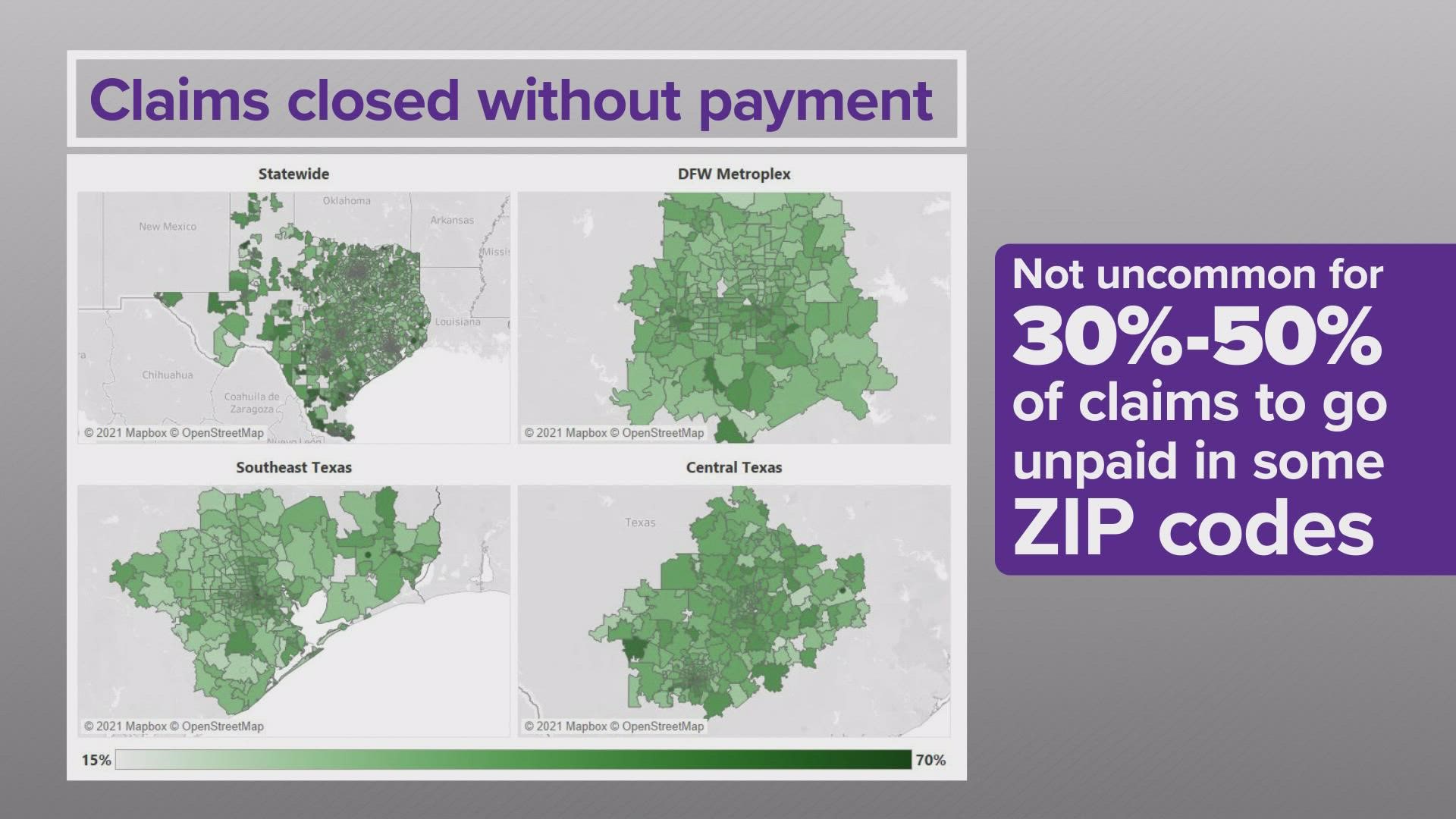

In total, insurance companies in Texas doled out $10.3 billion to cover their customers’ damages from that storm. That’s a lot of money, but look at these maps on page 44 here. Ironically, the darker shades of green on those maps don’t indicate more money. Those are the places where insurance companies closed more claims without paying.

In some instances, between 60% and 70% of claims in a particular area were closed without insurance payment. And it looks fairly common that 30% to 50% of claims went unpaid in many ZIP codes.

The bottom line there is that many people who had damage and had coverage had to pay for it themselves.

Even if your claim was paid – or if you didn’t make a claim (and that includes most of us) – you may still pay for that storm in the form of higher home and auto insurance rates. This is especially true depending on where you live.

You know how real estate is about location, location, location? Insurance is, too.

Part of how insurers evaluate how risky you are – and therefore how expensive your premium should be – is by looking at your ZIP code and tallying up how many claims have been filed by the people around you.

On page 38 here, there are more maps from the 2021 winter storm. The darker the shade of green, the more claims. And on page 40 here, the darker the shade of green, the more money insurance companies paid.

People with the high-dollar homes are getting it the worst, according to locally based MarketScout. They examined insurance rates after last year’s storm and found that homeowners premiums are up 5% to 12% for people in houses valued at $1.5 million and up.

The reason: A lot of those homes have fire sprinklers – in some cases that’s required – and we know how well water pipes fared in that deep freeze.

MarketScout found post-storm premium increases of 3% to 5% for homes valued $200,000 to $400,000. And that doesn’t even address what might have happened with your auto insurance rates because of that storm.

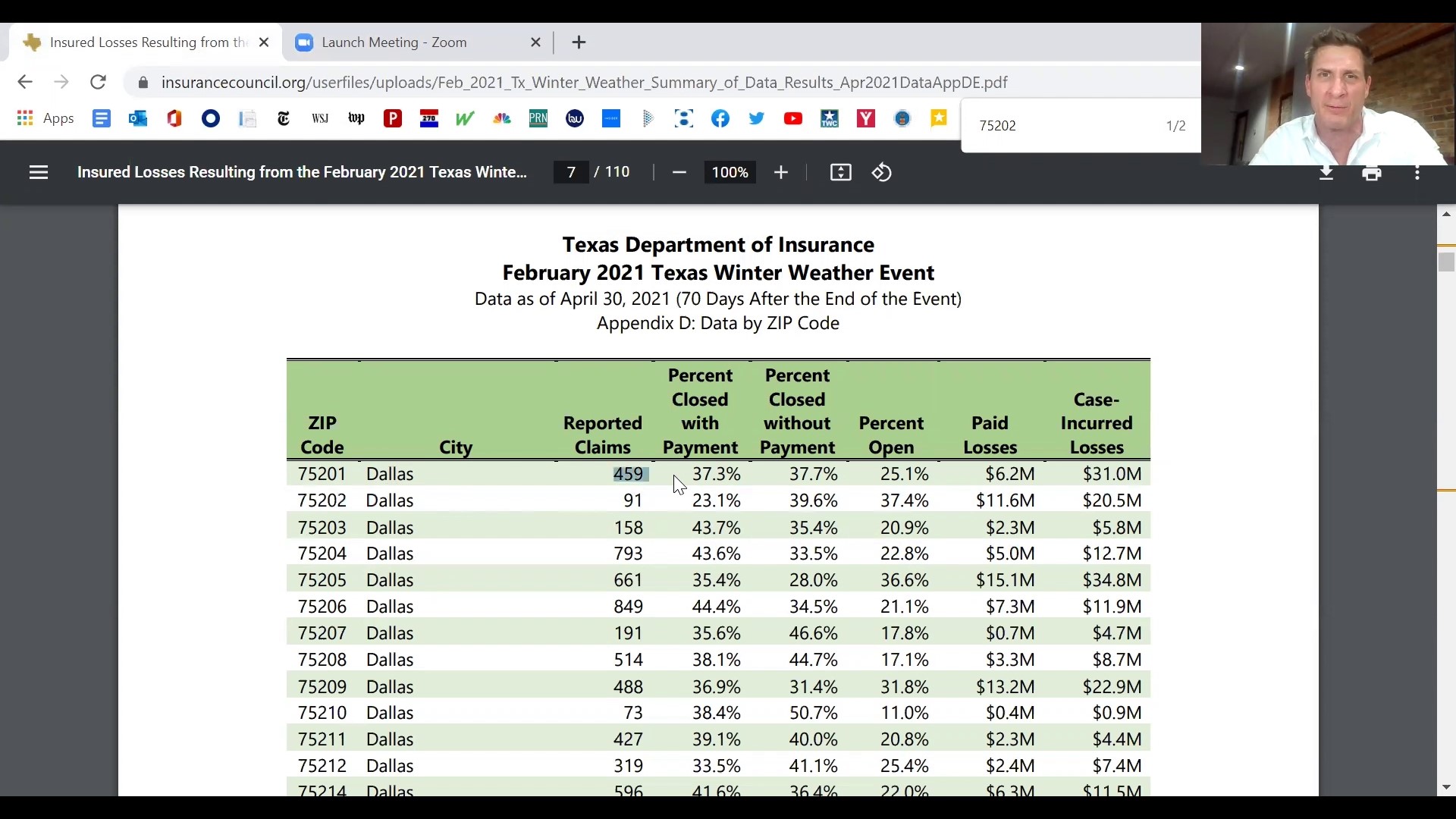

If you want to check the claim numbers and the damage losses from the 2021 winter storm for your ZIP code, this is the link… and below is a short tutorial for how to find the numbers for your ZIP code. Depending on the claims for your area, it could affect your insurance rates.