DALLAS — As much as we always complain about traffic, other drivers, and the cost of gasoline, it can actually be worse: not being able to complain about them because a pile of glass on the pavement is all that is left of your vehicle.

Someone I know just experienced the shocking and confusing “where’s my car” moment when they walked outside to get into it. That was followed by several moments of wondering “What do I do now”?

One of the first things on her to-do list was to call the Right on the Money guy and ask how quickly she might be able to get her insurance company to pay her so she could get another car. Right away I knew that the Q-word she used was going to be a problem.

Getting an insurance payout for a stolen or totaled car may not be "quick"

Unfortunately, what was taken so quickly is replaced so much more slowly. The insurance company has to process your claim and do an investigation. They also want to give some time to see if your car is found. Generally, in Texas, the rules are that once you tell them your vehicle was stolen, the insurer has 15 calendar days to acknowledge they received the claim and ask you for any additional information.

Then they have 15 more business days to collect any info they need and give you a written approval or denial of your claim–and they can extend that to 45 days if they inform you that more time is needed and tell you why.

Even If they approve the claim, they get 5 more business days to actually pay you. Now, if the insurance company doesn’t meet the processing and payment deadlines, you have a right to be paid your claim amount plus 18% interest and attorney's fees if you have those.

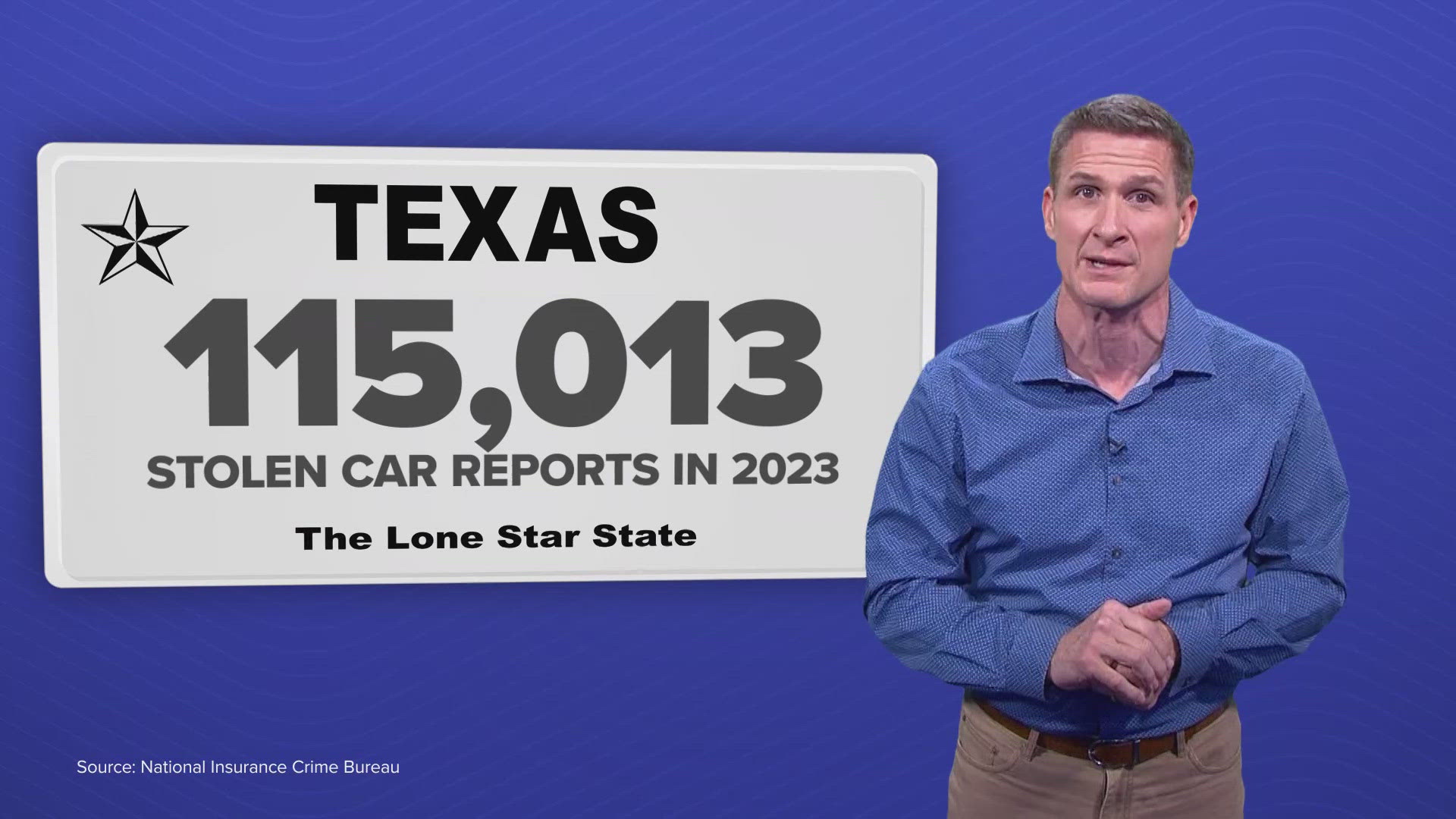

Just know that insurers are busy. Texas had 115,013 stolen car reports last year. Houston and Dallas are in the top 5 metros in the country for this problem.

Disagreements with the insurance company over the valuation of your totaled vehicle?

But how do insurers determine the value of your stolen (or totaled) automobile? Many of them use special software to come up with a number. What could possibly go wrong? Even just this year there have been headlines about big settlements and big lawsuits over alleged lowball insurance valuations for totaled cars based on software suggestions.

Anyone who experiences this should ask for the insurer’s documentation on how they determined your vehicle’s value, and make sure their info is correct. Also, the state recommends you do your own valuation from used car dealers or get online quotes from sites that offer to buy used cars.

Just make sure you are using known sites such as Carvana, AutoNation, or Carmax. Make sure you compare your vehicle to a vehicle that is the same year and model in about the same condition with roughly the same number of miles on it.

If you and the insurance company still can’t agree on the value of your totaled car, you have more options: It can be more complicated with a vehicle that has been stolen, but generally, in a case where you and the insurance company are far apart on the amount of loss, you can hire your own expert to give an opinion of value or you can hire an attorney. You can also file a complaint with the Texas Department of Insurance.

The plot thickens

The person who reached out to me about their stolen car owned a Kia, one of the models that we have previously reported has been a potential target of thieves following a menacing social media craze a few years ago that showed thieves how to exploit a weakness and quickly steal certain Kia and Hyundai models using just a screwdriver and a USB cable.

The automakers came up with a fix for the problem. For vehicles that haven’t been repaired in time, there is a legal fix that has been in the works: a settlement worth hundreds of millions of dollars to reimburse qualifying owners for theft or attempted theft of their vehicles. Under the settlement, they would be able to possibly get money for part of the value of their vehicle, the contents inside, some of their insurance costs and some of their transportation costs among other things.

This has been slowly making its way through the courts, but applications for reimbursement for affected Kia owners and affected Hyundai owners under that settlement are open now.

Several large law firms have been working on this case. This one has been posting answers to many questions. I have also corresponded and spoken off the record with some attorneys representing potentially affected vehicle owners.

They explain that they are still awaiting a crucial hearing that hasn’t yet been scheduled, but one told me they “hope that occurs in August.” Another suggested it could be September, and that even if the judge makes a final ruling then, the case could still be appealed after that.

They explained, though, that if there is no appeal, or after appeals have been exhausted, there would then be a 6-month window for potentially affected drivers to get their claims in. Only then, they say, would the settlement administrator determine which claims are approved and how much money each approved claim would fetch.

That said, potentially affected vehicle owners can file claims now by clicking here for Kia and here for Hyundai. Just know, it will be a while before you know whether the claim has been approved, and even longer before you could receive money for that claim.

More Right on the Money content: