DALLAS — When your investments, your IRA, or your 401(k) or 403(b) get squished like they probably have this year, it can feel like you are the one getting squeezed. Maybe this will help ease the pressure just a bit.

A lot of the reason the stock market has been so volatile is that the Federal Reserve has been raising interest rates in order to pour cold water on an economy that has gotten too hot and is causing inflation (higher prices).

We always hear that the stock market doesn’t like rising interest rates. And there have been some steep declines in stocks in recent months as the Fed has been aggressively increasing rates. But there have also been some days of explosive growth in the stock market.

What does history say about how the stock market fares during periods of ascending interest rates? Several analyses about that, including this one and this one, have come out this year. Historically speaking, they show that during and right after the Federal Reserve started raising interest rates, stocks rebounded.

If you are looking for specifics, one analysis found that stocks in the technology, real estate, and energy sectors fared the best following Fed rate increases.

These various looks back all use different time periods and data. But they consistently show that with the exception of a few of the past eras of interest rate increases, the market was almost always up—often significantly—during the periods when rate hikes were happening…and a year after rate increases began.

But…before you get too excited, it doesn’t always work out

The Bloomberg comparison looked at the S&P 500 Index's Future Returns after periods of rate hikes over the past four decades. Out of eight rate-rising eras, it found that there was just one occasion when the market had sunk lower six months after interest rates started going up.

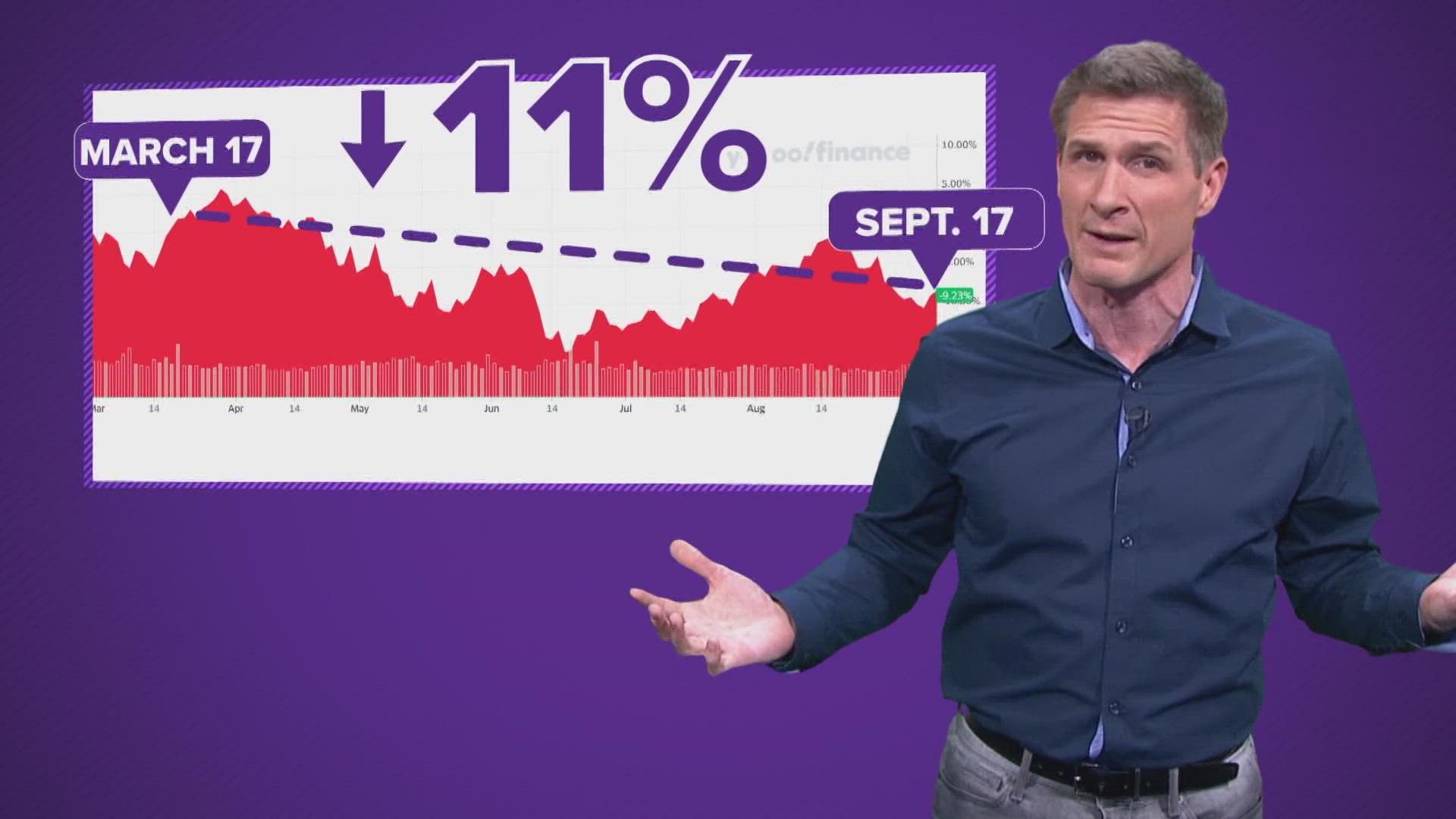

This year, rates started rising on March 17, and six months later — in mid-September — the market was down about 11%.

We could be experiencing one of those rare negative market outcomes after rate increases. But again, if the historical trends noted in the above reviews hold up again this time, we would see positive returns between now and next spring.

And the Bloomberg report notes that electoral history bolsters that outlook. They report that in midterm election years–like this year–going all the way back to the 1950s, some of the worst months for stocks are some of the months we have already been through this year.

If we stay on trend, they report that history shows that in the last three months of this election year…and in the first three months of next year, we should see big market gains that might help un-squish your investments and retirement accounts.

Despite volatile market, retirement savers have put more money in

Fidelity, which manages a huge number of retirement accounts, reported earlier this year that 401(k) savings rates are still at record levels.

Fidelity says that, on average, the employee contribution plus the employer’s match is coming out to 13.9% of the employee’s salary being invested into their retirement fund.

The money you put into a retirement account is potentially buying shares of stock at relatively low prices. So, when the market goes up sharply again, those share prices and your account balance would ideally also shoot up.

Even before the markets significantly improve, Fidelity says younger investors in Generation Z have been investing their 401(k) money heavily in target date funds. Those are based on your target date for retirement. The further out your retirement is, the riskier the investment mix might be.

But risk can bring reward. Fidelity found that Gen Z target fund investors only lost 8% from the first quarter of this year to the second quarter, compared to 401(k) balances overall which were down 15% in that time period.