DALLAS — If you have waited, time is almost up to file your Income taxes. Because of the pandemic and the February winter storm, the deadline for Texans to file was pushed to June 15.

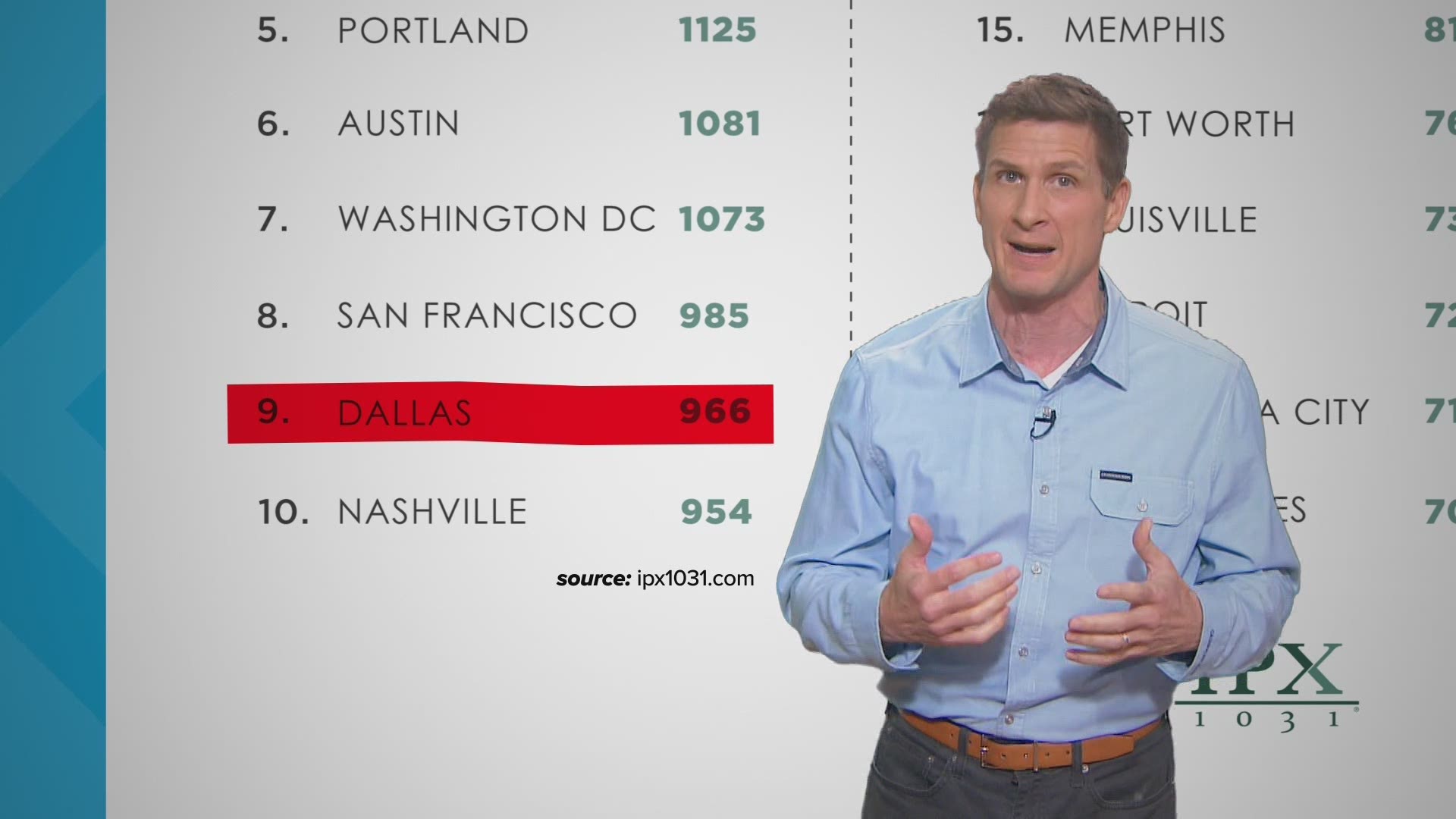

A recent survey named Dallasites as the ninth biggest tax procrastinators in the country. You might think most last minute filers hold off because they’re not getting refunds, but that excuse was the fourth most cited.

The number one reason respondents put off filing: It’s too time consuming.

Get them done, though. If you are late, you could face a monthly penalty of 5% of what you owe, to an eventual maximum of 47.5% of the amount of tax you owe.

Miss filing by more than 60 days, and the IRS warns the penalties can soar to “100% of the tax required to be shown on the return.” Additionally, the IRS charges interest (federal short-term rate + 3%).

Instead of filing late, consider setting up a payment plan or filing for an extension.