DALLAS — If you are new to home shopping, you may be encountering some challenges: Increased home prices, credit score requirements and coming up with an acceptable down payment.

When I was getting my real estate license, I flagged things useful for all of us to know. So, installment No. 5 of my "Home Schooling" series is about alternative programs to help some buyers get the home.

‘My First Texas Home’

First up, ‘My First Texas Home.' An important note about the program’s name: This is for first-time buyers and for anyone who hasn’t owned a home in the last three years. There are income limits based on county and household size.

In Dallas County, for example, you can’t make more than $103,100 for a household of two people. And a home with three or more people has an income limit of $118,565.

There are also county-based home price limits under this program. In Harris County, for example, you can generally buy a home for up to $481,176.

You also must have a credit score of 620 or higher. You can have a higher debt-to-income ratio than some other loan programs will accept. And My First Texas Home offers below market mortgage rates, which can be especially important considering how much rates have risen this year.

The program also includes the possibility of assistance in getting extra money for your down payment and closing costs. For that extra money, you would basically take out a zero interest second loan that you don’t have to pay back until you’re done with the first loan for the house itself.

‘Home Sweet Texas Home’

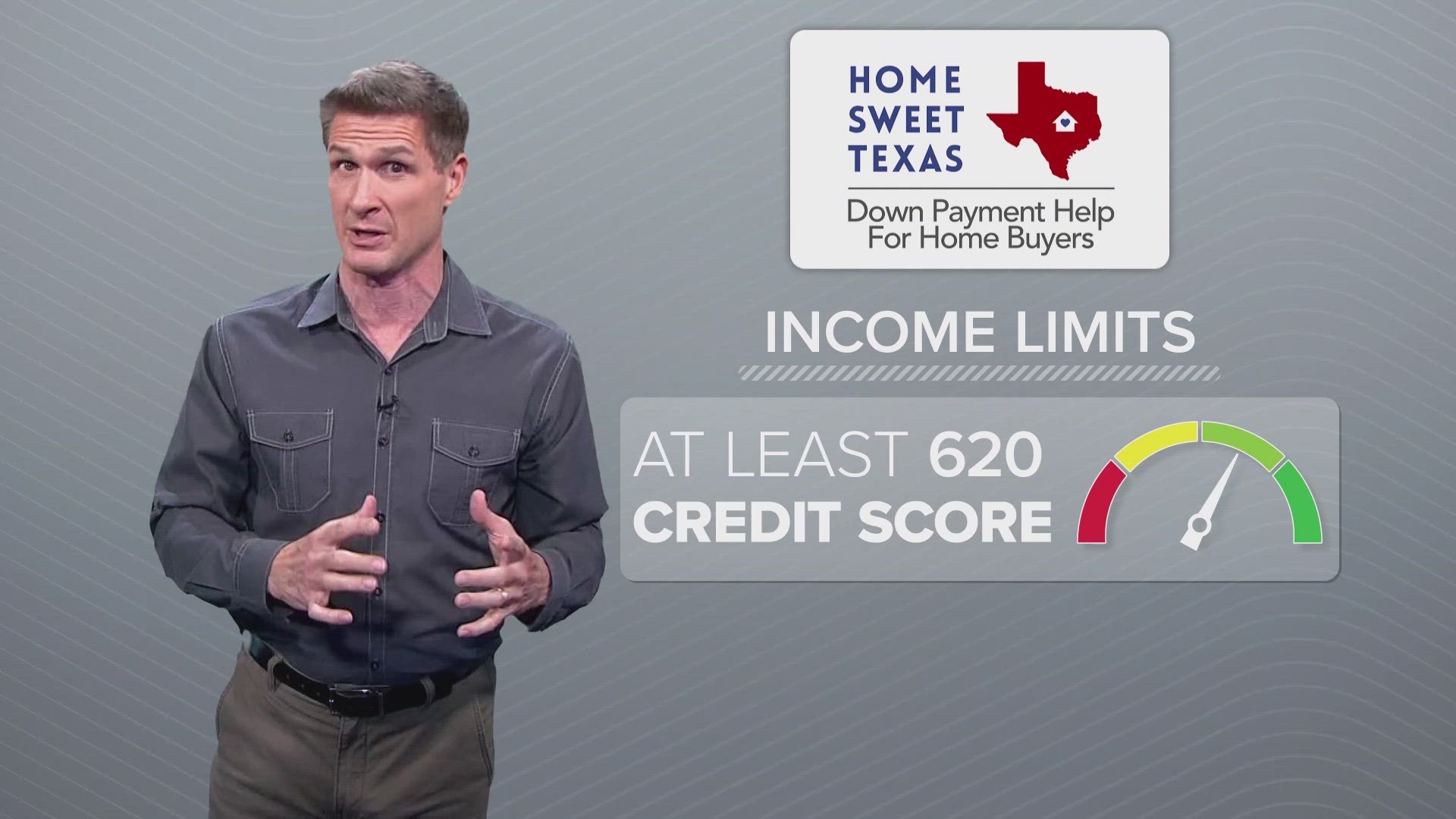

Another option: The ‘Home Sweet Texas Home’ loan program.

This also has income limits, and you must have at least a 620 credit score. This option offers down payment assistance that can be in the form of a grant that you don't have to repay, or a forgivable loan that you don’t have to repay if you don’t sell or refinance within three years.

‘Bootstrap Loans’

How about taking your loan interest rate all the way down to zero? The state has a program that does that. A 30-year loan for up to $45,000 at 0% interest.

The catch is: You have to work for this… like actually work. You and/or your family, friends or volunteers must provide at least 65% of the labor if you get this loan to help you build or rehab your home.

You can add this money to other types of loans you get for the property. It’s called the ‘Texas Bootstrap Loan Program’ and it is for people considered by the state to be in very low income households.

The exact income differs by county. In Tarrant County these would be the income limits by household size: (1 person) $40,200, (2 people) $45,960, (3 people) $51,720, (4 people) $57,420, (5 people) $62,040. Click here to see the maximum allowed incomes for each county.

You have to meet some other requirements, including completing an owner/builder education class. But in this era of increasing mortgage rates, this might be appealing, especially if you have construction skills or you know people who do and who are willing to contribute those skills for free.