North Texans report that it will take a long time to recover financially from COVID-19.

More than any other metro surveyed by Edward Jones, people in Dallas said they are planning to work longer because of the pandemic, with 32% of Dallas respondents saying they will have to push back retirement.

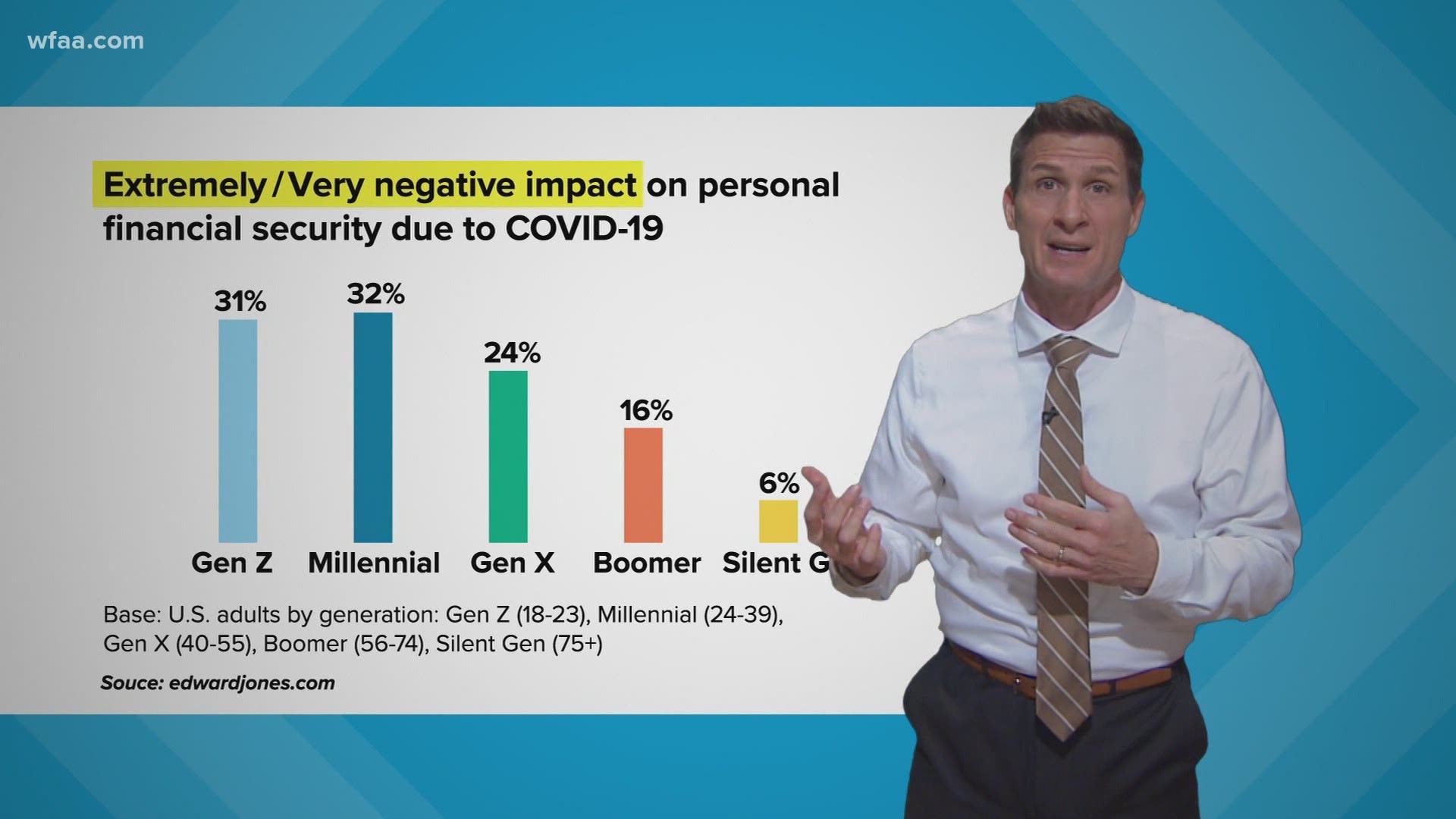

Understandably, people in the Generation Z, millennial and Generation X age groups were more likely to report the pandemic has had an extremely or very negative impact on personal financial security. Those are people who are just getting started in their careers or who are in their prime earning years.

Is your 401(k) OK?

Another poll by TD Ameritrade found 16% of Americans have increased retirement contributions recently. But almost three times as many Americans say we have either reduced retirement savings or withdrawn or taken out loans from our retirement nest egg.

And your employer may not be helping. Willis Towers Watson asked around and found that 12% of companies have suspended matching contributions to 401(k) plans because of the COVID-19 crunch. Another 23% in the survey are planning to cut their match this year or are at least considering doing so.

Calculating the cost of raiding your retirement account

If you need to take money out of a retirement account early, the CARES Act has waived penalties for COVID-19 related withdrawals.

To help you make a decision about whether such a withdrawal is your best option, click this calculator that can help you estimate how much money your nest egg could lose in the long term is you take money out early.

The below video is from Oct. 23, 2018.