This week, oil has taken a spill like we have never before seen…oil futures contracts for May even trading in negative prices on Monday. There’s no demand for oil right now because economies are shut down and storage tanks are brimming.

There are 160 million barrels of crude are floating around on tankers in the ocean right now. Especially if weak demand and low prices continue, this will have an impact on all of Texas. The current Texas budget was banking on an average oil price of $58 per barrel. Prices were hovering around that mark a few months ago, but even contracts for June have dropped this week to single digits.

The state was projecting over $3.8 million in oil tax revenue this year. Current oil prices make that haul look very unlikely. Texas is somewhat protected because much of that money goes into the state’s "rainy day" fund. But the loss of oil revenue also further contributes to a tremendous drop-off in sales tax receipts being collected by the state.

Sales taxes account for almost 10-times the amount of revenue as oil taxes. The Comptroller’s Office will release new data on tax collection in a few weeks. The numbers are expected to be dismal because much of the Texas economy has been closed to limit the spread of COVID-19.

Q&A with the Texas Workforce Commission

The governor said Tuesday that out of all the Texans who have qualified for unemployment, 80% have received payments. Many who have filed say they have repeatedly requested payments, as required by the Texas Workforce Commission, yet they say they are not receiving any benefits.

That was one of several commonly raised issues we sent to Texas Workforce Commission. Below are the agency’s responses to our questions.

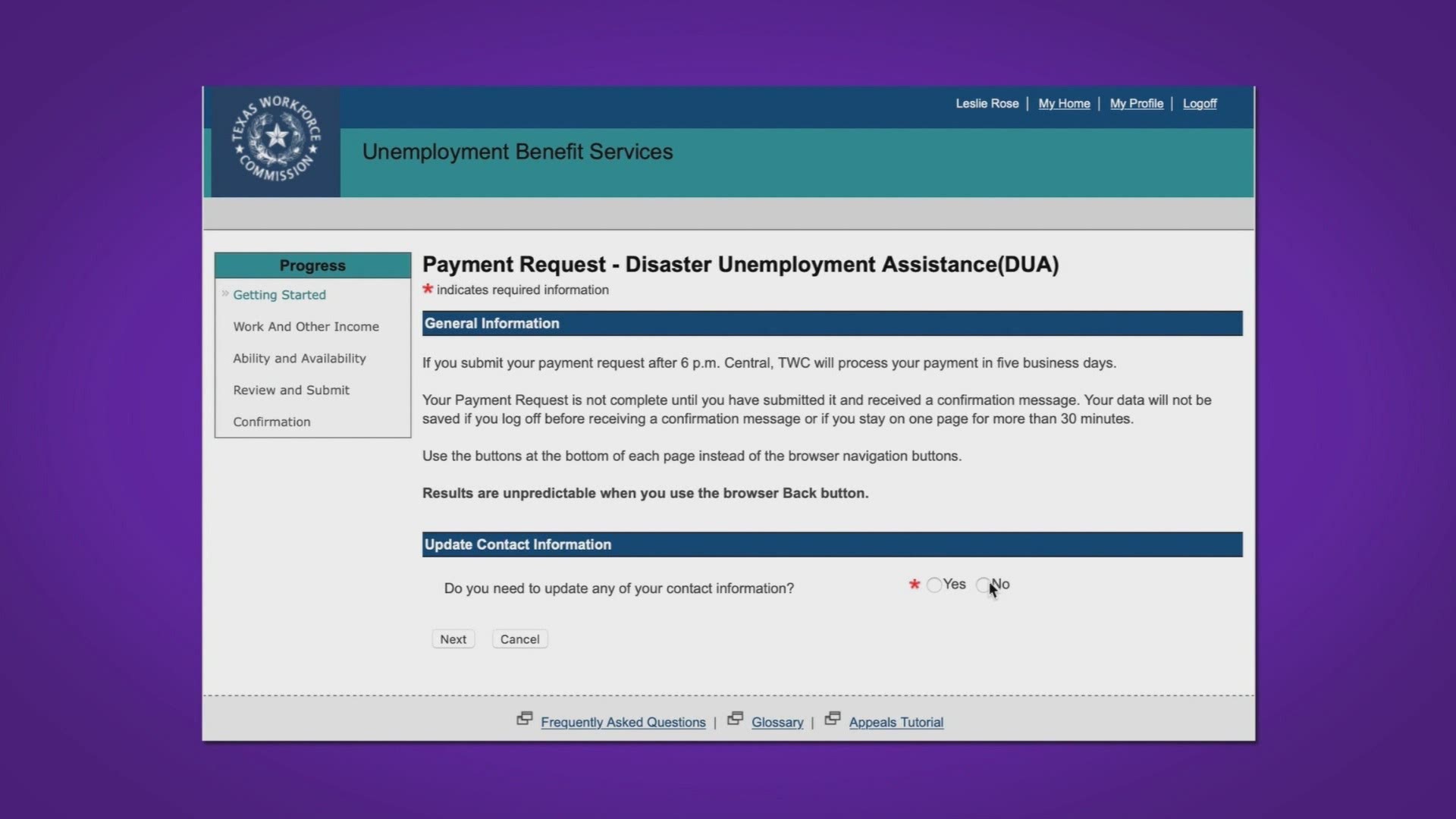

- Is disaster unemployment assistance now available for self-employed, contractors, etc.?

Programming for our Unemployment Benefit System is complete for Pandemic Unemployment Assistance (PUA) which means that people that are self-employed or independent contractors that are not working or have reduced hours due to COVID-19 can apply now.

Your viewers may apply for benefits or check the status of their existing claim online at ui.texasworkforce.org any time 24/7 which will allow us to more quickly handle their claim needs. If they do not have internet access, they may call 1-800-939-6631 M-F 8 am to 6 pm CST and Saturday 8 a.m. to 5 p.m. CST.

If you are already signed up and qualified for Texas unemployment benefits, no action is needed from you. We will determine if you qualify and notify you by mail or electronic correspondence of your eligibility.

If you applied for unemployment benefits but lacked the necessary wages to qualify, no action is needed. We will determine if you qualify under the new stimulus bill and notify you by mail or electronic correspondence of your eligibility.

2. Since federal benefits of $600 per week were actually put into effect for the week ending April 4th, but weren't yet being applied by TWC, will those payments also be made retroactive (to the week of April 4th)?

Yes. Texans may be eligible to receive FPUC benefits as far back as April 4 depending on when they were impacted by COVID-19.

3. Is there a target date for when TWC will begin checking eligibility for the federal benefits of an additional 13 weeks of unemployment insurance?

We are currently upgrading our system to adapt to the new legislation and will begin paying PEUC extended benefits as soon as possible.

4. I have heard from many people saying they have requested payments multiple times but haven’t gotten anything. How far behind is TWC on payments if the usual turnaround is about 21 days, what is typical now?

Texans are asked to request payment on their designated filing day, which is listed on their filing instructions, and then every two weeks after that, even if TWC has not yet informed them of their eligibility. That way, TWC can pay them faster if they qualify. On average it takes about 21 days to receive benefits. For some people, it will be faster and other will take a little longer.

5. Many people have reduced hours or wage reductions, but they say it is hard to figure out how to express that on the application--which seems more designed for loss of job. What is your advice for them?

When they are asked why they are not working, they should select reduced hours as their separation reason. If the reduction is a result of the COVID-19 then they should also mark COVID-19 under disaster impacted section.

With so many people out of work, we have launched a page called Yes, We Are Open. You can submit a business that is open or let the community know about a business that is hiring. For instance, Milestone has jobs available, including office staff positions, as well as HVAC, plumbing, and electrical techs. They’re even offering a $2,500 Essential Worker Hiring Bonus for licensed technicians. There is a searchable jobs database on the page that includes many employers that are hiring.