DALLAS — Managing your retirement accounts or other stock investments may be making your head spin in 2022. It may make you feel better (or a lot worse) to know that very smart people who manage a lot more money than most of us do, regularly disagree on what is best to invest in going forward.

But they have some educated guesses. And occasionally they share them with Barron’s, as they recently did once again for that publication’s latest Big Money Poll. According to the report, almost three-quarters of the 107 respondents boasted their personal picks and their professional investments have done better this year than the S&P 500 overall.

What do they like?

Of those polled, the largest group, 42% of them, think stocks are still the best bet. These sectors (in order) were their top choices when they were surveyed on which kinds of investments they favor the most: energy, healthcare, information technology, financials, and consumer staples.

But before the poll closed in early October, the brain trust was asked whether the current S&P 500 bear market had bottomed yet. A huge percentage of them, 84%, said no. That said, when asked if they felt neutral, bearish (pessimistic), or bullish (optimistic) about the market in the next 12 months, the largest share of them (40%) expected positive things compared to those who were neutral (30%) and bearish (30%).

What lies ahead?

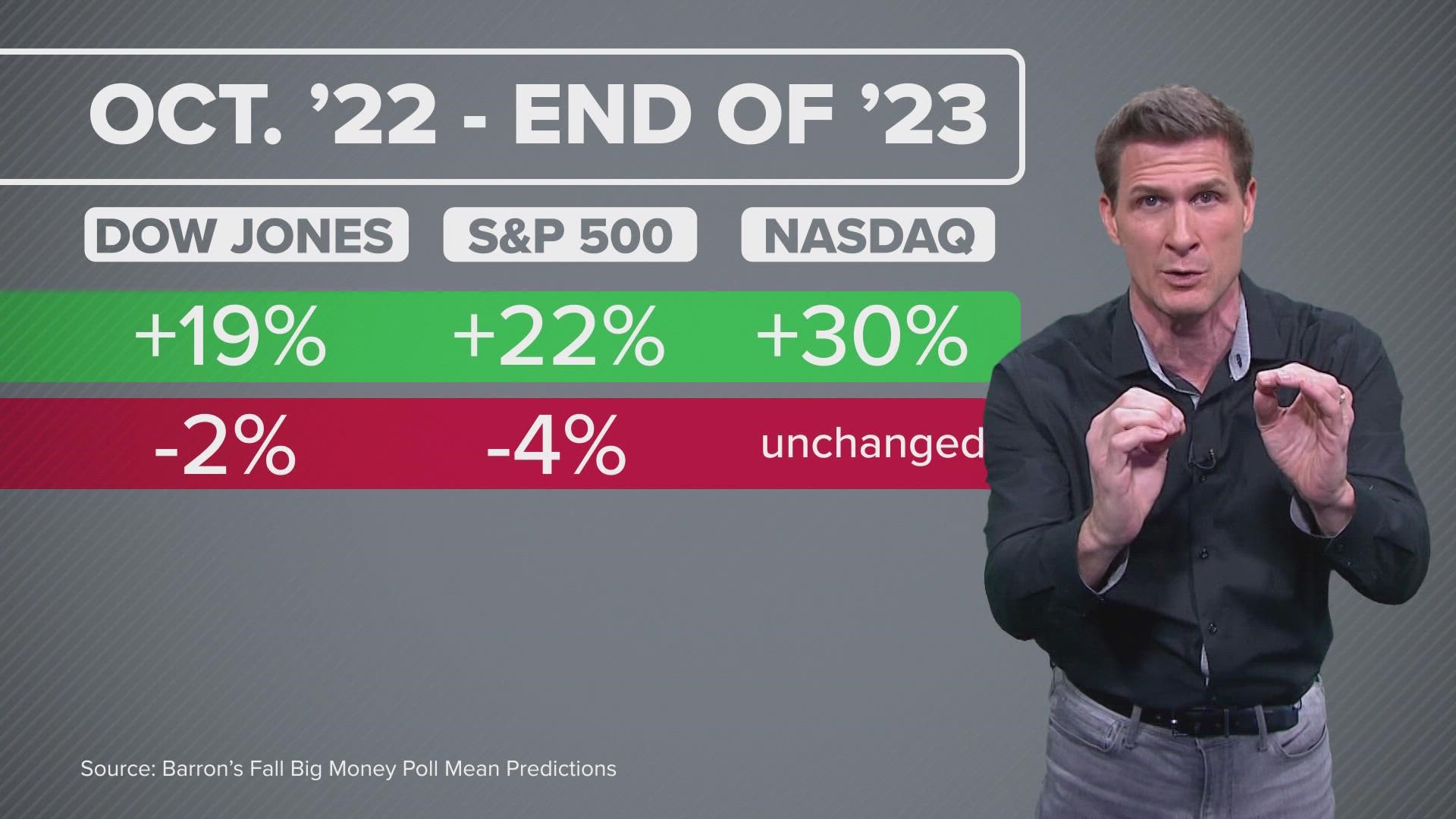

When the Barron’s poll was published in October, they reported the mean prediction from the bulls in the survey was that, by the end of 2023, the Dow will rise 19%, the S&P 500 will gain 22%, and the NASDAQ will rocket 30% higher.

The bears expect all three indices to be down slightly or stay about the same by the end of 2023. Their mean prediction was for the S&P 500 to slip 4% from recent levels, the Dow to shed 2%, and the NASDAQ to end up about the same as it was in October 2022 by the time we get to the end of 2023.

That is significant; even the pessimists who are managing a lot of money are suggesting some of the worst pain in the markets may be behind us now, especially if you are a long term investor and don’t need to get your money out right away.

Indeed, the article concludes that quality stocks might be bargains right now, and that, if you don’t need your invested money for well beyond a year, “The current environment looks to be a gift”.

We’ll see as we slowly unwrap it over the next year or more.