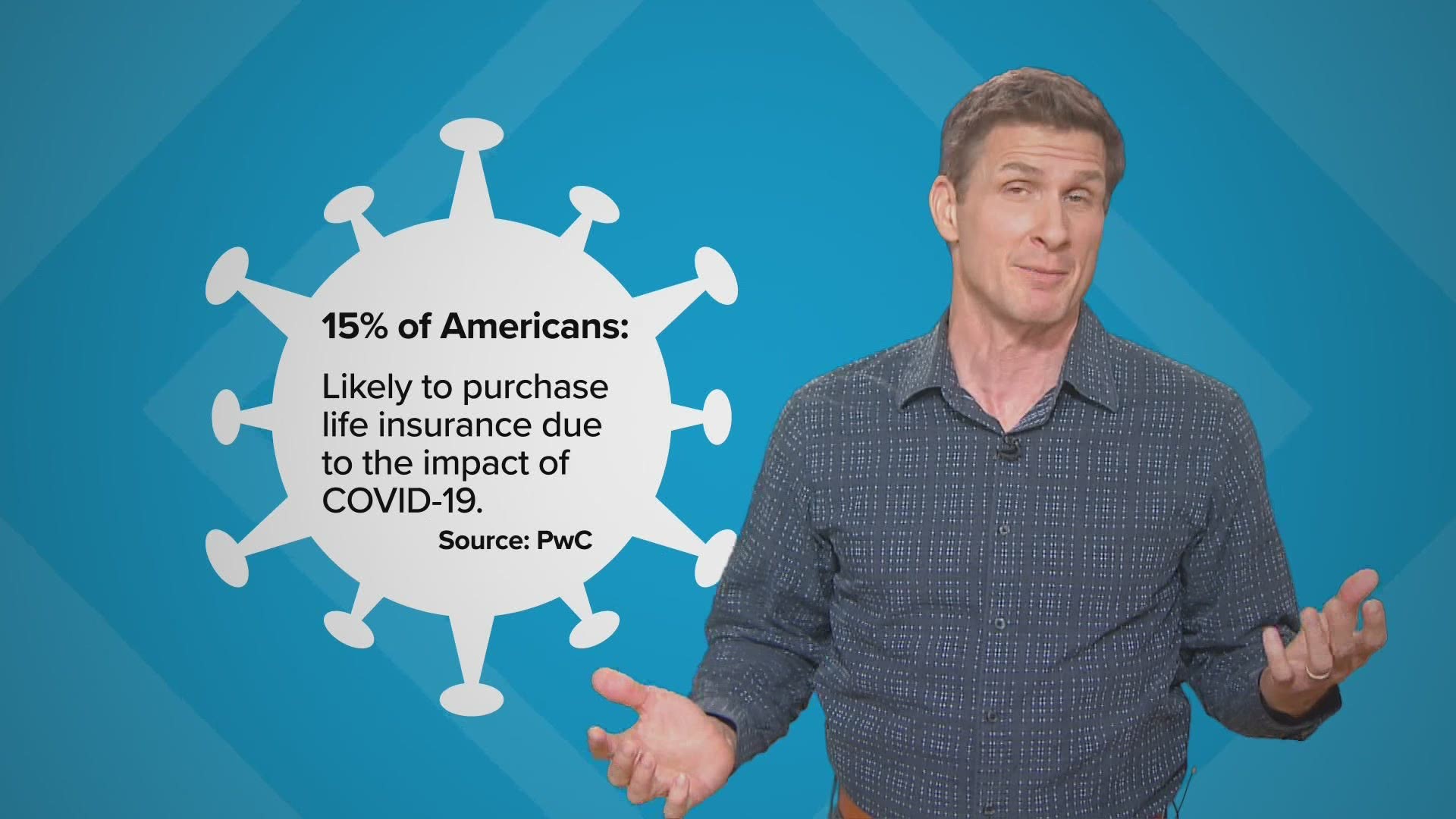

TEXAS, USA — Just when we would like to be carefree again, the pandemic is weighing on our thoughts. Recently, 15% of people surveyed said they’re likely to purchase life insurance due to the impact of COVID-19.

Maybe this will be the reminder many people need. Stats say almost half of us have put off getting coverage that we know we need. One survey showed that more than half of us think a life policy is going to cost three times as much as it really does. And women are far less likely to have coverage than men.

“Today life insurance ownership for women is 47%, much lower than the 58% of men who have coverage," according to a 2021 Insurance Barometer Study from LIMRA.

If you are considering getting life insurance coverage, now might be a good time

During the worst of the health crisis, many insurers restricted new policies, like not offering them to the oldest applicants, changing which underlying conditions they would accept and delaying approval if you had traveled internationally or been exposed to someone who had COVID-19.

Well, the majority of insurers have reportedly lifted those special restrictions. And maybe the insurance companies missed all of us applicants. Lifequotes.com reports that life insurance rates have now fallen to an all-time low.

So, if you still need to get it done, do it. And even if you have life insurance, many who have policies are considered underinsured. Now might be a good time to make sure your coverage is adequate.

How do you know how much life insurance you need?

Each person’s situation is different, but there are some generally accepted suggestions for determining your life insurance needs. NerdWallet published this article that answers the question of how much you might need. It also includes a life insurance calculator.

Once you know how much you might require, you can find out how much that coverage might cost. You can shop with individual insurance companies, or you can use one of several life insurance comparison sites including Policy Genius and Quote Wizard.