TEXAS, USA — It’s getting closer. After being pushed off multiple times since March of 2020, the resumption of federal student loan payments is about to begin.

This will affect more than 45 million people in this country. Here in Texas, Lending Tree estimates there are 3,759,300 people carrying educational debt (which includes federal and private student loans) and that their average balance is $41,299.

Those who owe probably know by now that the sweeping student loan forgiveness granted by President Biden was struck down by the U.S. Supreme Court.

What to know about payments restarting

Payments restart on Oct. 1, which is getting uncomfortably close, especially for people struggling with their other bills. Recent data from the Consumer Financial Protection Bureau shows that even with the suspension of payments, more student loan borrowers than usual are 60 or more days delinquent with another form of credit.

So, what will it look like when they have to take on that student loan payment again? There are now several income based options for repayment. And there is a tool that helps borrowers explore which one might work best for them.

Also, you can talk with your loan servicer. That might be a good idea anyway, because in this crazy past three years, an estimated 30 million accounts have gotten a new servicer or a new payment platform. That means the majority of borrowers will be resuming payments on their old loans on a new system.

Make sure you are all set up with your servicer before October, when it might start to become much harder to get through to them. Go here to confirm who is servicing your loan.

A potentially important benefit for people repaying student loans!

One more note on this subject: This isn’t the first time or the second time we have reported this. For the third time (because this is really important), Jan. 1 could be a key date as well for many who owe on student loans.

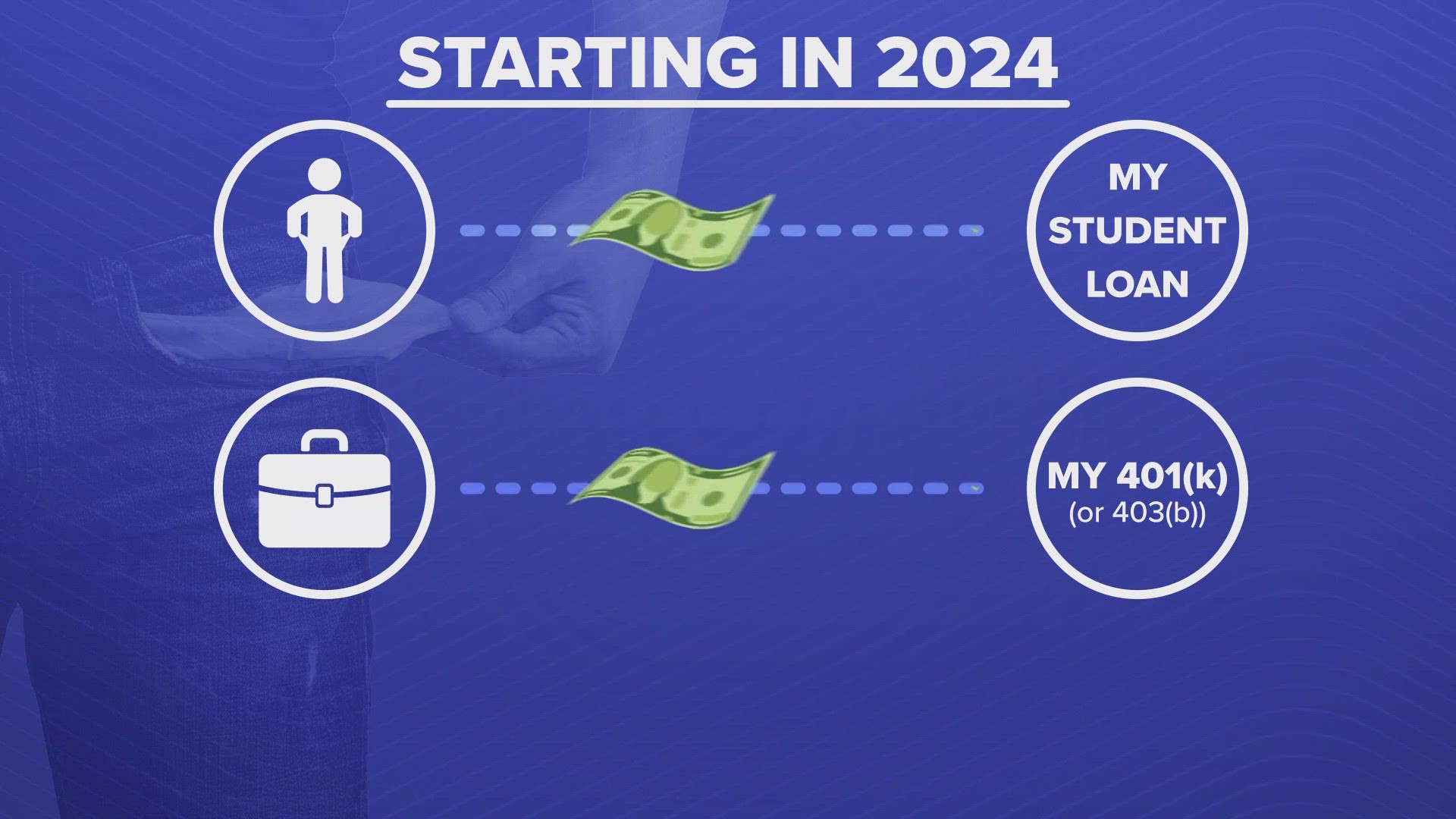

Starting in 2024, even if you are not able to make contributions to your 401(k) or similar retirement plan, if you are making payments on your student loan, your employer can consider those payments as though they are contributions to your workplace retirement plan. They can also make matching contributions to your retirement account based on that. Ask your employer about this.

A 'major' problem for women in higher education

On the topic of money and higher education, we have a "major" problem. Most women who are attending colleges and universities are not majoring in the Bankrate’s list of the 20 highest paying fields of study, shown here.

Bankrate highlighted that these are all STEM-related majors. They also figured that degrees in these top tier areas of study result in average salaries between $85,000 and $110,000 a year. And then they noted that men hold 78% of the degrees in these fields. Women account for just 22%. And they found that women “tend to dominate in degrees that lead to lower pay."

That is a weighty reminder to parents and educators to keep guiding young girls toward this kind of education, especially if they have interests or inclinations related to science, technology, engineering, and math.

There is also an initiative called the Texas Girls Collaborative Project that aims to get more girls and young women into these areas of study, and hopefully get them more of those sought after degrees and those bigger paychecks.