DALLAS — After much anticipation, mortgage rates dipped lower in late September, dropping to their lowest levels in two years after the Federal Reserve finally cut the benchmark interest rate.

But with the economy still running strong, mortgage rates quickly rebounded. If you didn’t grab one of those falling rates right away, the opportunity to lock in a money-saving refinance may have disappeared - for now.

Many homeowners who bought their properties in the past couple of years– especially when rates peaked in late 2023 and spiked again earlier in 2024— may have ample incentive to refinance when rates tick down again from current levels.

How many Texas homeowners might have saved when mortgage rates recently dropped?

Intercontinental Exchange, or ICE, ran two sets of numbers that are specific to Texas.

When the 30-year fixed rate dropped to 6.08% in late September, they found 401,910 Texans who were ‘in the money’, which ICE defines as: "Current 30-year mortgage holders that could reduce their interest rate by at least 75 bps through refinancing at the prevailing rate”.

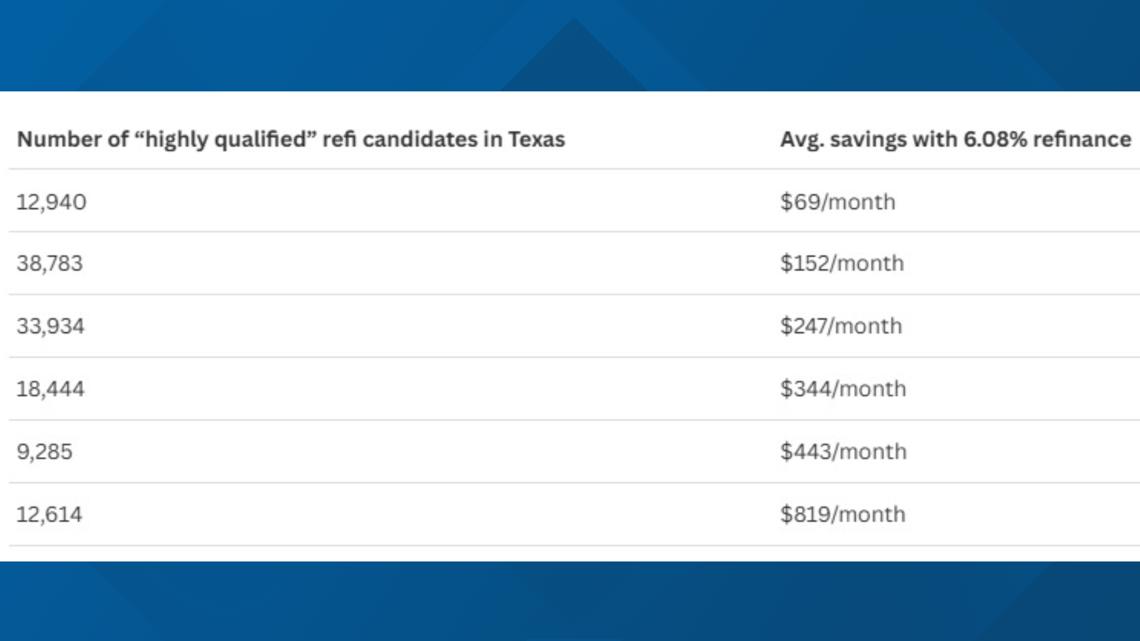

ICE calculated the following rough savings for Texas homeowners ‘in the money’ for a refi at 6.08%:

The firm found 126,000 of those homeowners had the right credit scores and loan details to be considered "highly qualified candidates" for a refi.

Here are the parameters they use to identify those borrowers: “Current 30-year mortgage holders with 720+ credit scores and 80% currently CLTVs (that stands for Combined Loan-to-Value ratios) that could reduce their interest rate by at least 75 bps through refinancing at the prevailing rate”.

Here is the breakdown of potential savings for those highly qualified candidates in Texas at 6.08%:

But then rates rose again…

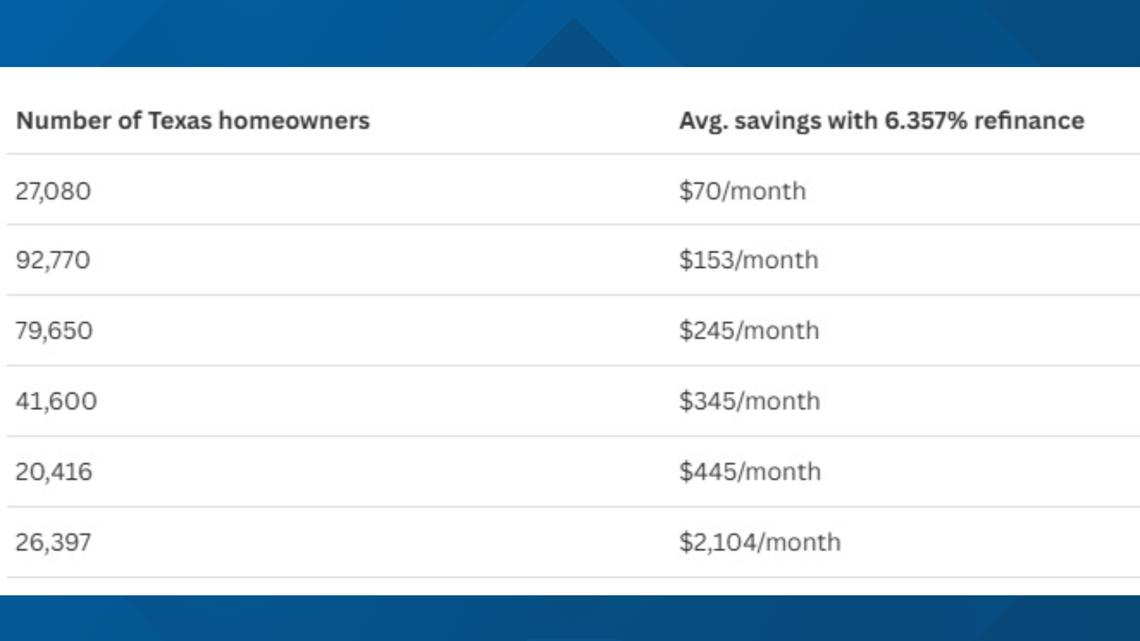

Just two weeks after mortgage rates took a dive, in early October rates jumped back up. ICE re-ran the refinancing numbers at a mortgage rate of 6.357% and found just 287,914 Texas mortgagors who could save by refinancing.

Here are ICE’s breakdowns for Texas homeowners ‘in the money’ for a refi at 6.357%:

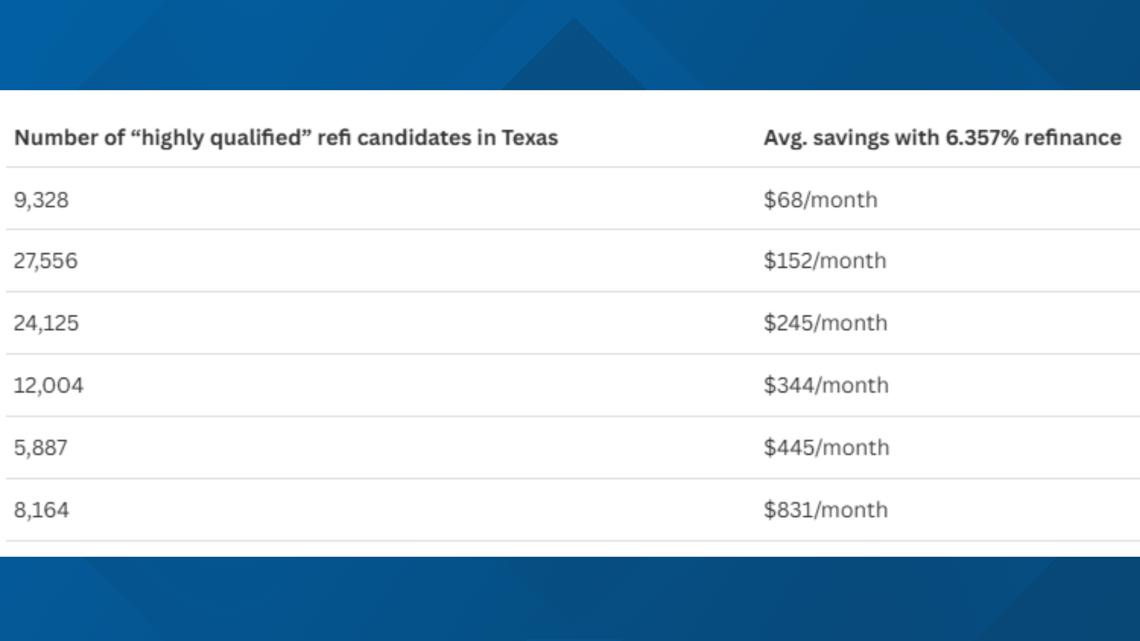

And these are ICE’s figures for ‘highly qualified’ Texas homeowners if they refinanced at 6.357%:

Ice also said that when mortgage rates hit that two-year low in September and even when rates crept back up in October, in both cases, D-FW had the highest number of mortgages in Texas that looked possibly ripe for a refi. But also in both cases, the Houston-area refinancing candidates might have saved more money on average than refinancers in other big Texas cities.

Assuming a 30-year fixed rate at 6.08%:

Assuming a 30-year fixed rate at 6.357%:

Why you may want to consider more than just the refi rate

Finally, it’s not all about the mortgage rate. It also matters what your closing costs on a refinance are and how long you plan to stay in the home. You can sketch the numbers on your own using a calculator, like this one from Zillow.

I ran the numbers of a hypothetical refinance that produced savings of more than $400 per month. If the refinancing closing costs were $6,000, they figure you wouldn’t really start saving money until your $400 monthly savings chips away all of that $6,000 in closing costs.

So, they show you don’t break even and truly start saving until you’ve paid 14 months on that refinanced loan. If you plan to move before that break-even point, that refinance might not be worth your while.

Maybe work the numbers as you wait for mortgage rates to tick back down.