FORT WORTH, Texas — A new legal battle could play a major role in deciding if businesses losses from the COVID-19 pandemic are covered by insurance.

Louisiana-based attorney John Houghtaling has filed possible precedent setting legal actions for restaurants in California and Louisiana, claiming that losses from coronavirus closures are covered by insurance.

“You need to look at your policies,” Houghtaling said. “They’re all getting the same message from the insurance companies, ‘we’re not going to pay you.'”

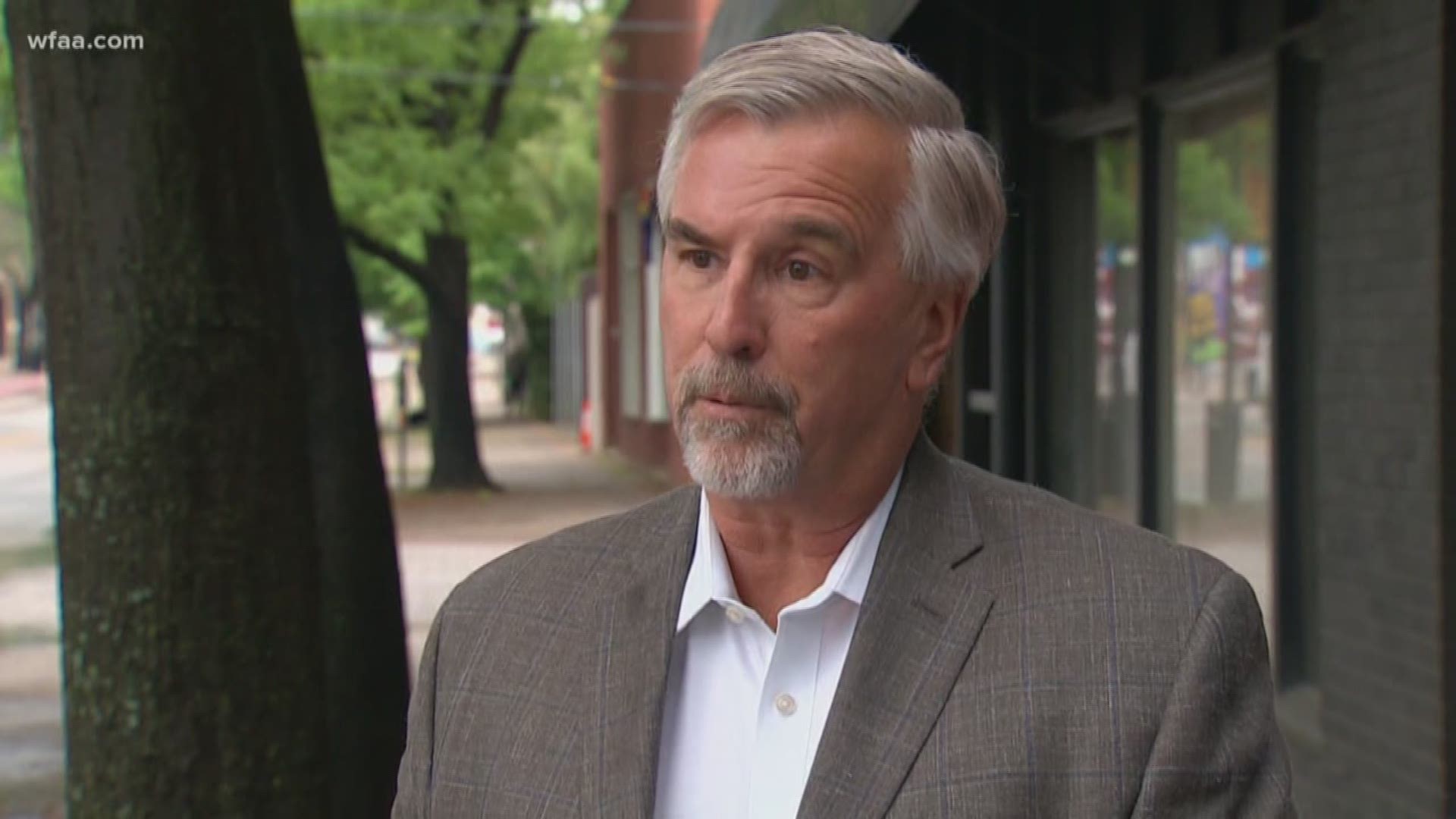

Steven Badger is on the other side of the issue as a Dallas-based attorney for Zelle LLP, representing many major insurance companies across the US. He says they’ve received many calls from insurance companies and are already getting dozens of claims locally.

“It depends upon the policy language,” Badger said. “A policy is a contract. There are terms that provide what the coverage is.”

Badger says most policies have virus exclusions added in 2003 after SARS, but Houghtaling disagrees and believes some insurers may be misleading policy holders.

“Without any question they have deceptively put out propaganda intentionally to trick policy holders,” he said.

“John is a policyholder advocate, so it’s not surprising that he’s taking that position, but what needs to happen is that the policies need to be interpreted,” Badger said.

Even if a policy has a virus exclusion, the real battle will be over what’s known as the civil authority clause. That would kick in if a business is forced to shut down due to physical damage like a fire or a broken water pipe not at their location but nearby and they lose business as a result. The question is if coronavirus counts the same way, and that has yet to be tested.

“That will be a key question addressed by the courts when these disputes go through the court system,” Badger said.

“The insurance companies are denying that the coronavirus triggers a dangerous property condition,” Houghtaling said. “I do hold hope that the insurance companies will stop this and they’ll do the right thing.”

Badger points out that there are variations to insurance policies and there can be thousands of different ones. Insurance publications have stated this makes class-action suits less likely.

“After every disaster there are insurance claims and with insurance claims come litigation,” he said.

While insurance companies are built for single disasters, Badger believes coronavirus claims could be on par with a hurricane hitting every city in the U.S. and has potential to bankrupt the industry if they’re forced by courts or governments to pay all of them.

"If they didn’t expect under their policy language to pay for coronavirus claims but he government tells them they have to, that’s a problem,” Badger said. “Are we sympathetic, am I sympathetic, you bet, but that’s not the solution.”

Houghtaling says he’s not against possible subsides or bailouts for insurance companies if they do lack the money to pay claims. Some insurance lobbying has already begun in Washington.

The real issue may be how long the legal battle takes, and that could decide how many shuttered stores survive.

“They’re withholding the funds,” Houghtaling said. “They’re withholding the life preservers we paid for.”