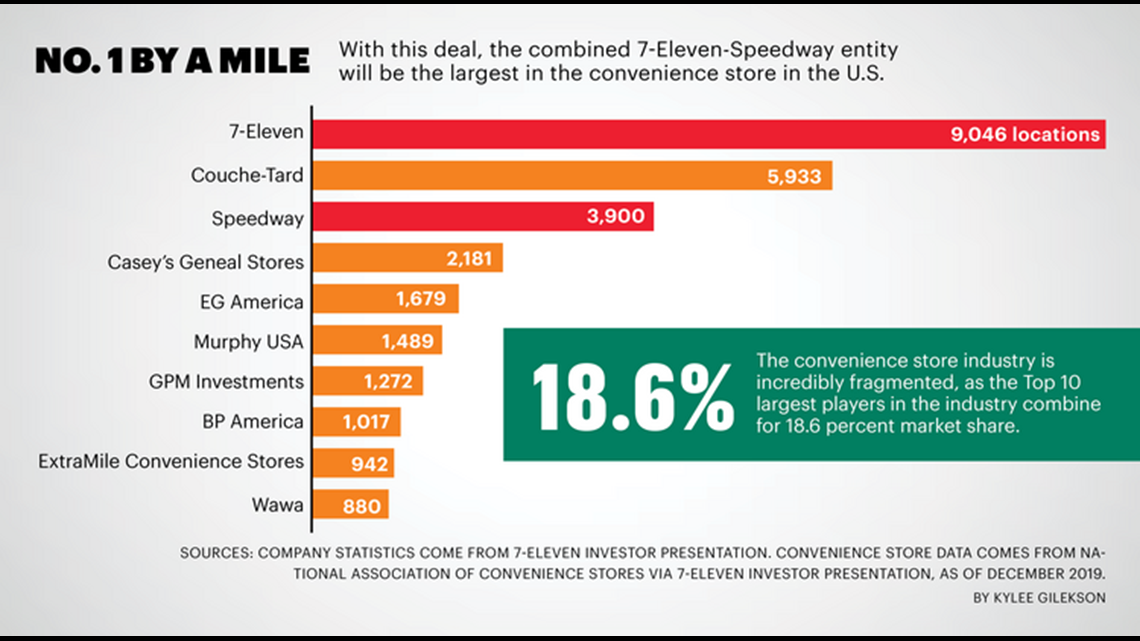

IRVING, Texas — 7-Eleven is already the largest player in the convenience store industry. If a blockbuster acquisition of Speedway goes through, it will be an even more dominant figure in the fragmented industry.

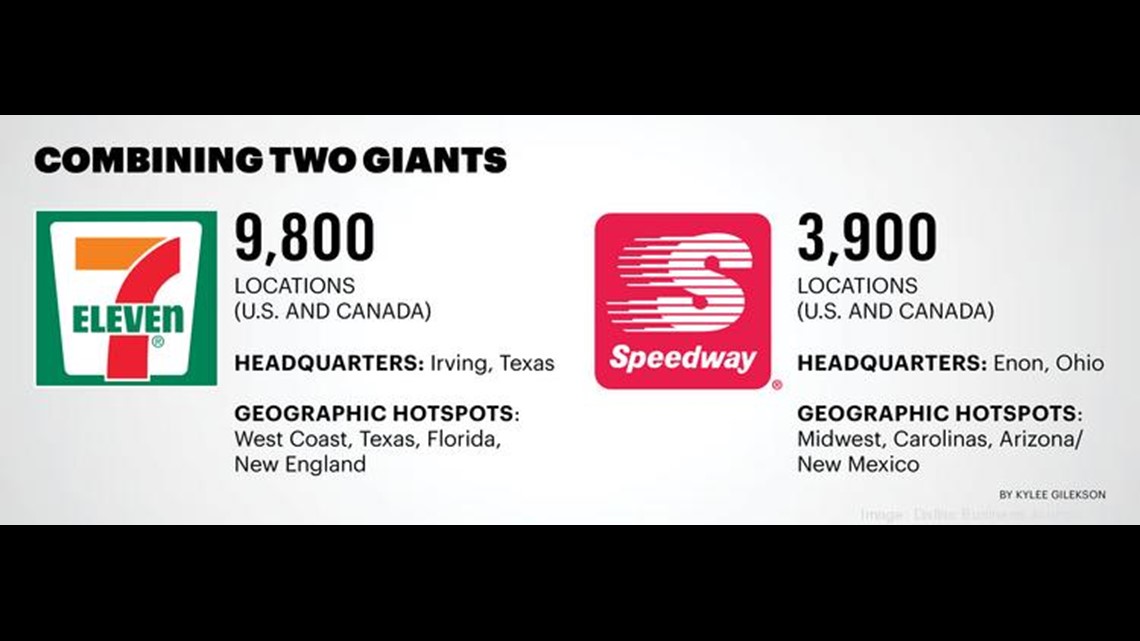

Earlier this week, Irving-based 7-Eleven, Inc. announced one the largest M&A deals of the year — a $21 billion purchase of Speedway from Marathon Petroleum Corp. (NYSE: MPC). 7-Eleven, part of Japan-based Seven & i Holdings Co., expects the deal to close in the first quarter next year.

"We'll have presence in 47 of the Top 50 most-populated metro areas," said Joe DePinto, president and CEO of 7-Eleven. "We really admire the (Speedway) brand and the business. They have some of the highest quality real estate facilities in the industry."

The deal will give 7-Eleven roughly 14,000 locations in the U.S. and Canada, extending its lead over the second-largest player in the industry, Canadian giant Alimentation Couche-Tard Inc.

For Speedway, if the deal goes through it ends a months-long saga that included an activist investor pressuring Marathon to spin off Speedway into its own entity, and previous negotiations between Marathon and 7-Eleven reportedly falling through in March as COVID-19 created economic uncertainty.

The $21 billion price tag surprised many considering the oil and gas sector's troubles this year, and Seven & i Holdings Co. shares dipped as low as 4.8 percent after the deal was announced. Some saw investor trepidation as unwarranted.

Click here for more on this story.